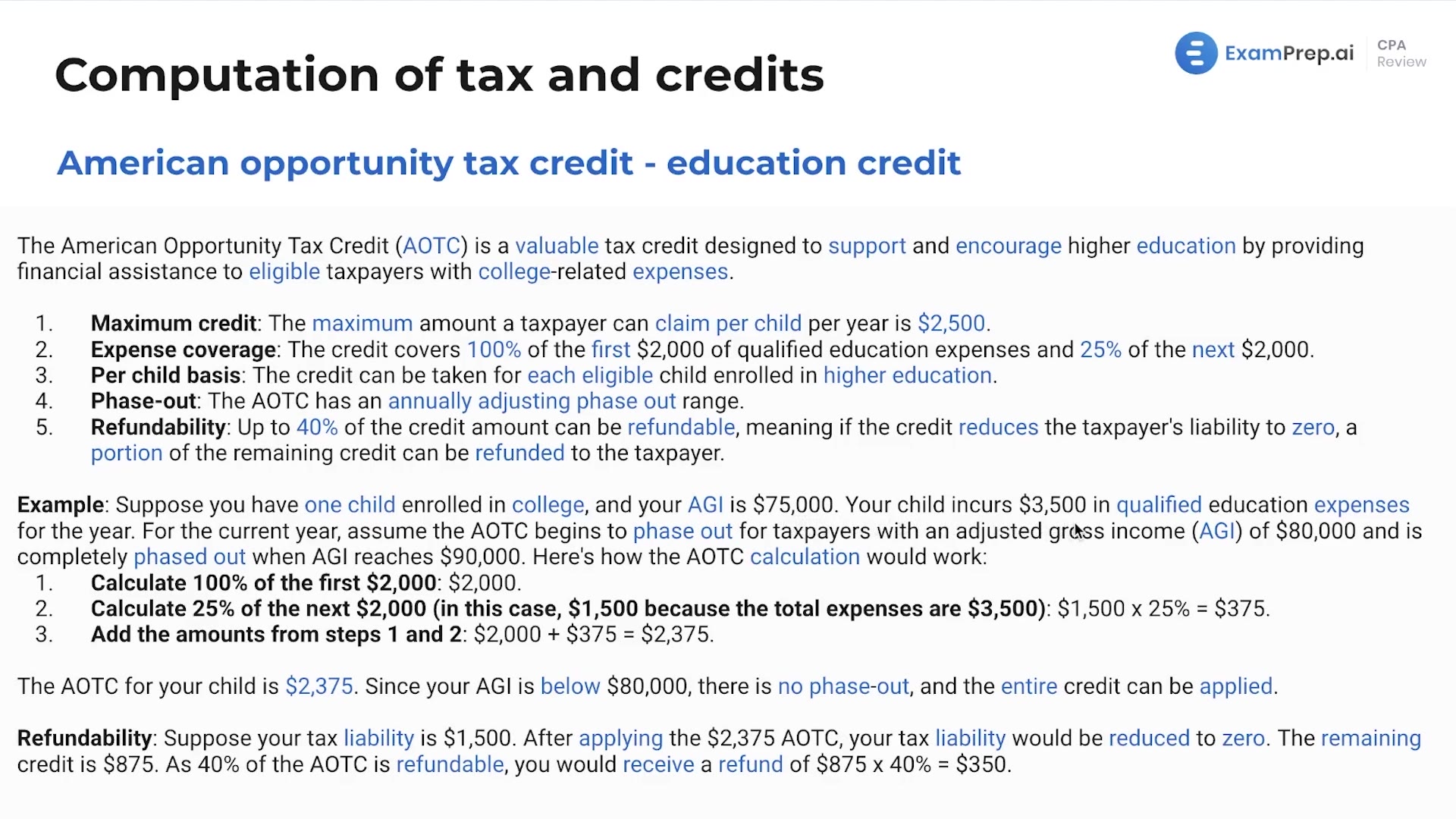

In this lesson, Nick Palazzolo, CPA, breaks down the American Opportunity Tax Credit (AOTC), a beneficial credit aimed at supporting higher education expenditures for qualifying taxpayers. With an engaging approach, he delves into how the credit works, explaining the ins and outs of calculating the maximum benefit of $2,500, how the credit applies on a per child basis, and the phase-out ranges based on adjusted gross income (AGI). He also illuminates the credit's refundability aspect, demonstrating through a practical example how up to 40% of the credit can be refundable. By elucidating the details, Nick ensures that grasping the AOTC's application in real-world tax scenarios is transparent and comprehensible.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free