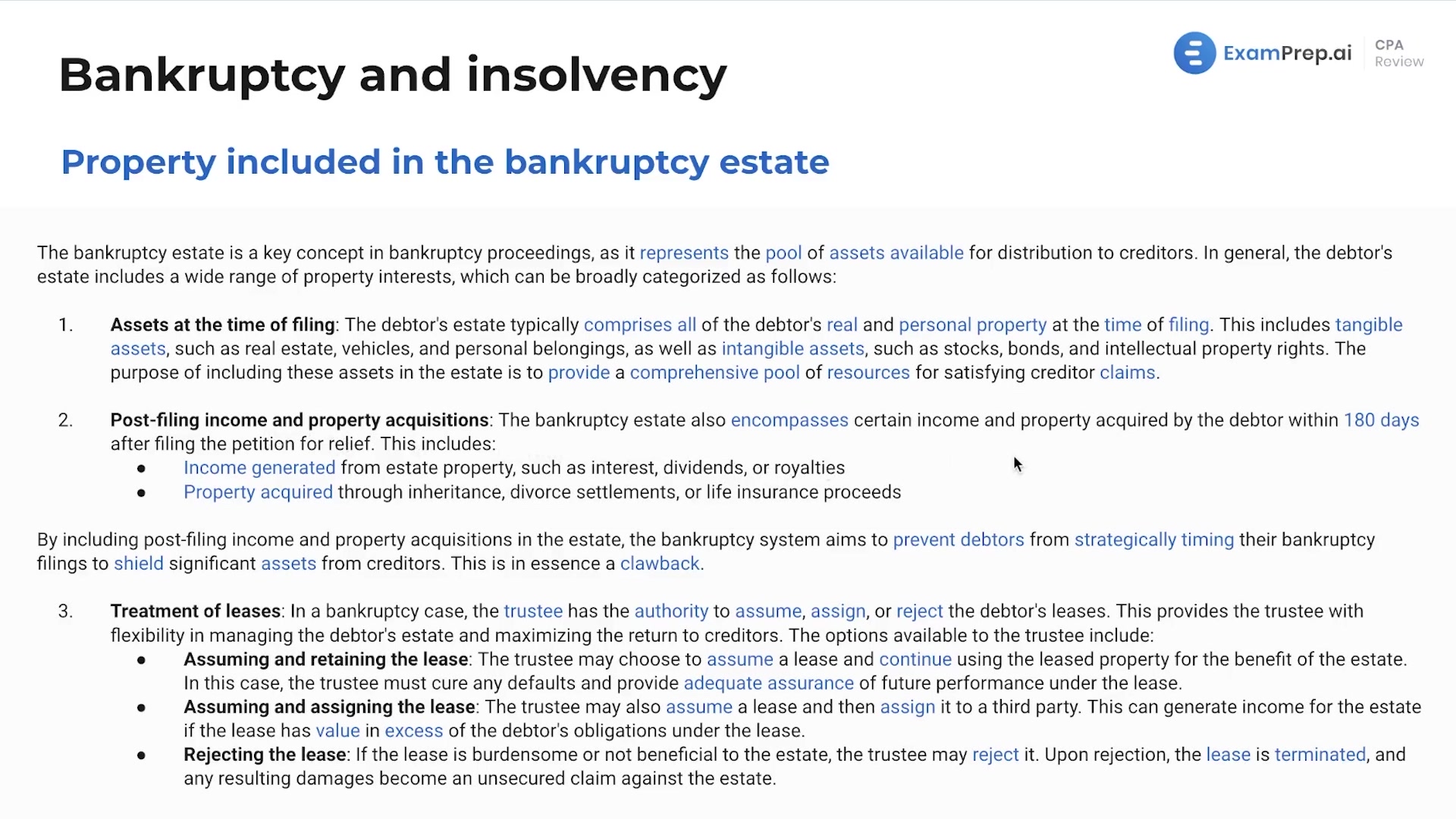

In this lesson, navigate the complexities of the bankruptcy estate under the expert guidance of Nick Palazzolo, CPA. Nick breaks down the fundamental aspects of what constitutes a bankruptcy estate and explains the process of making claims against one. He emphasizes the importance of creditors and shareholders filing the correct proofs to ensure their right to payment from the estate, especially highlighting the consequences of missing these critical deadlines. Additionally, Nick examines the inclusion and exemption of specific types of assets and income in the bankruptcy estate, ranging from tangible and intangible belongings to post-filing income and inheritances. He also details the treatment of leases in bankruptcy and outlines the various kinds of property that are typically exempt, such as personal household items, certain benefits, and tools of the trade, ensuring a clear understanding of what assets can be protected during the bankruptcy process.

This video and the rest on this topic are available with any paid plan.

See Pricing