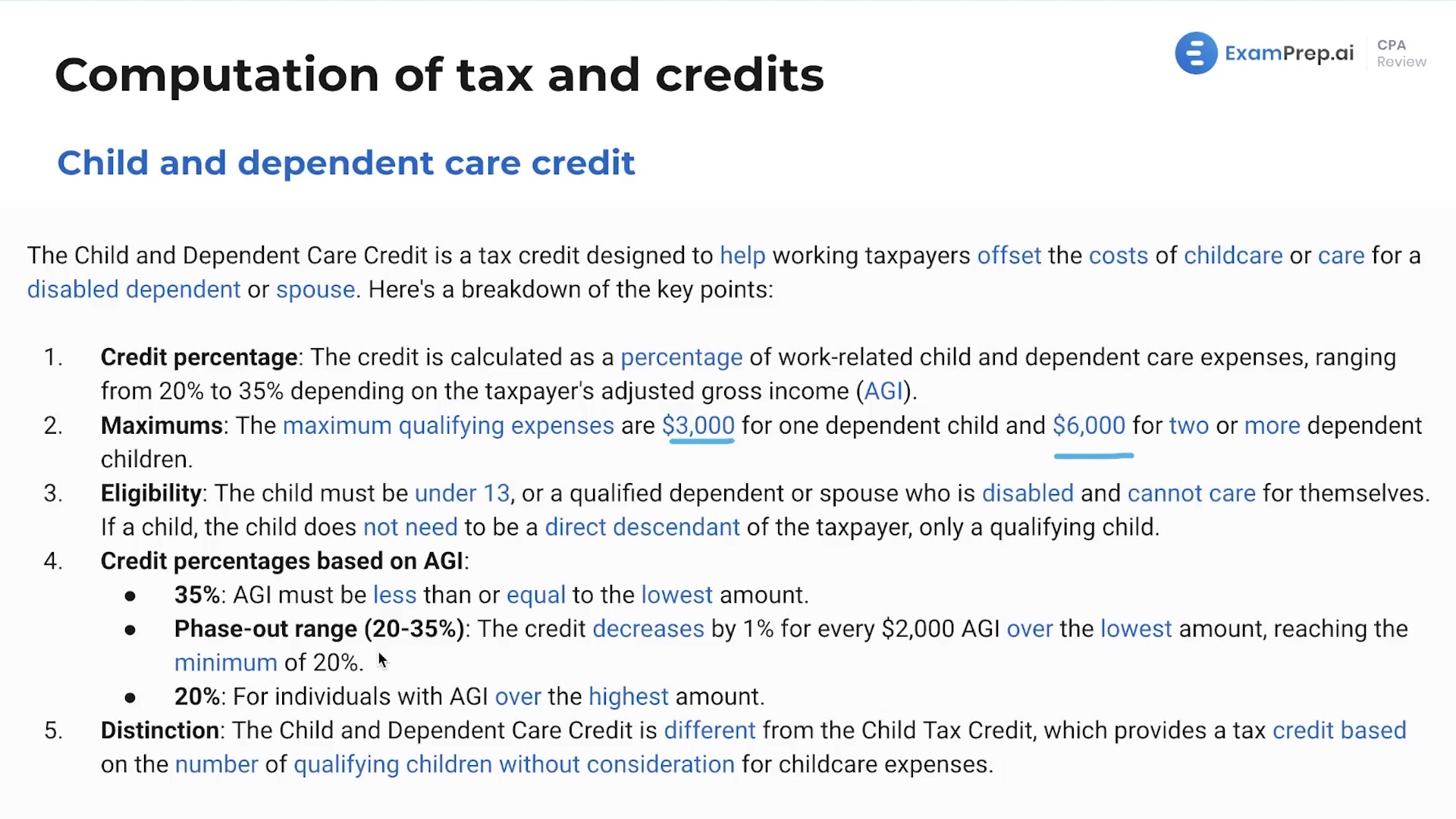

In this lesson, Nick Palazzolo, CPA, unpacks the intricacies of the Child and Dependent Care Credit, elaborating on how it provides financial relief for those with child care expenses. He describes critical elements such as the credit percentage, maximum qualifying expenses, and the influence of the taxpayer's adjusted gross income (AGI) on the credit calculation. Nick simplifies the daunting task of managing the varying credit amounts and phase-outs, offering practical strategies for anticipating those changes on the exam. By laying out clear examples, he makes the calculation of the credit both understandable and accessible. Nick also underscores the distinction between this credit and the Child Tax Credit, candidly navigating through the details with a dash of humor to lighten the learning experience.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free