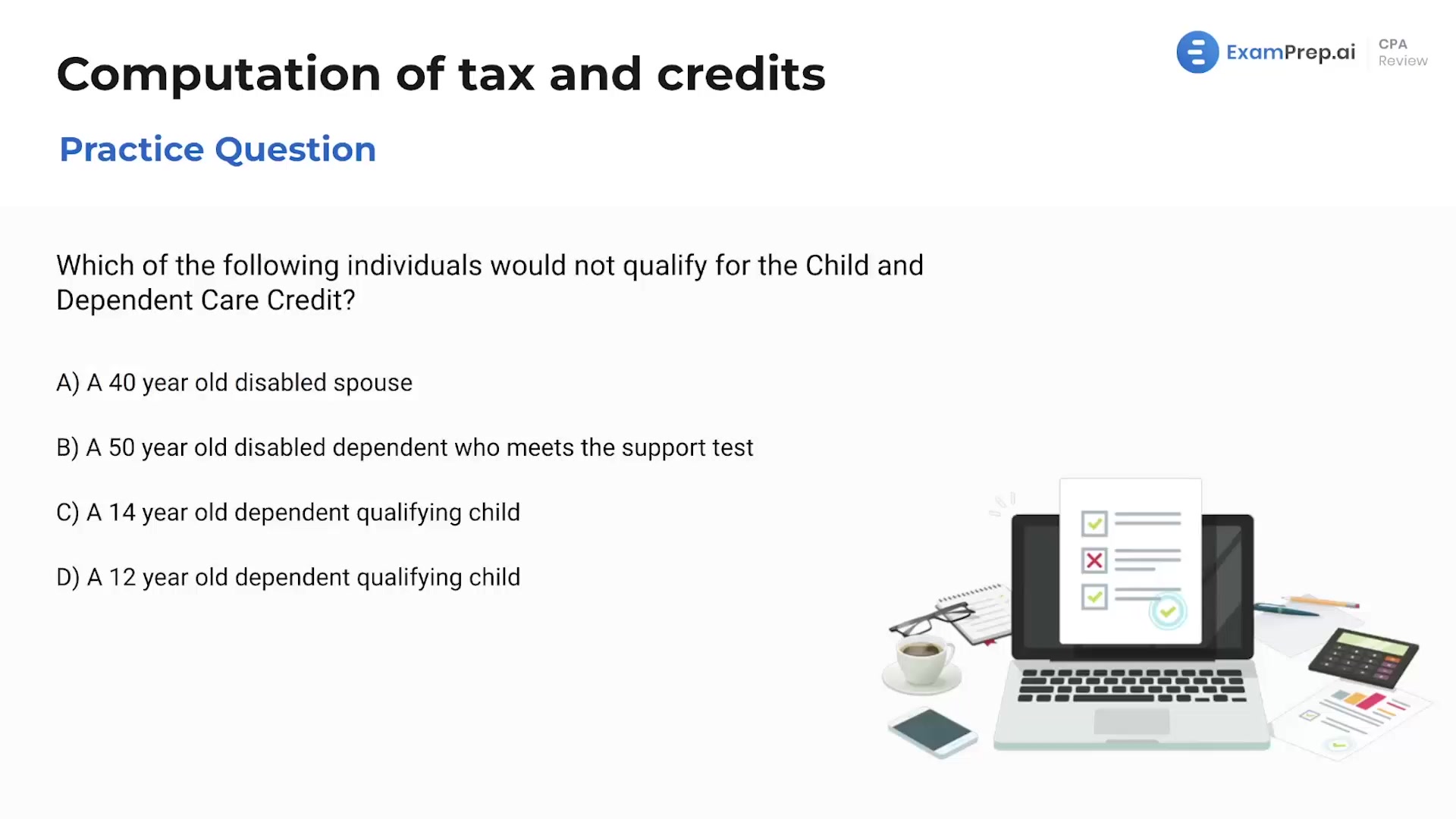

In this lesson, Nick Palazzolo, CPA, dives into nailing down the computation of taxes and credits, helping unravel the intricacies of calculating overpayments and qualifying for tax credits. Starting with a practical scenario, Nick breaks down each component of a tax return, from regular tax before credits to federal income tax withheld, and walks through an example to clarify how an overpayment is determined. He then shifts focus to the child and dependent care credit, explaining the specific criteria that determine eligibility. Clarifying these integral points with a real-world lens, Nick ensures a deeper understanding of key tax concepts.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free