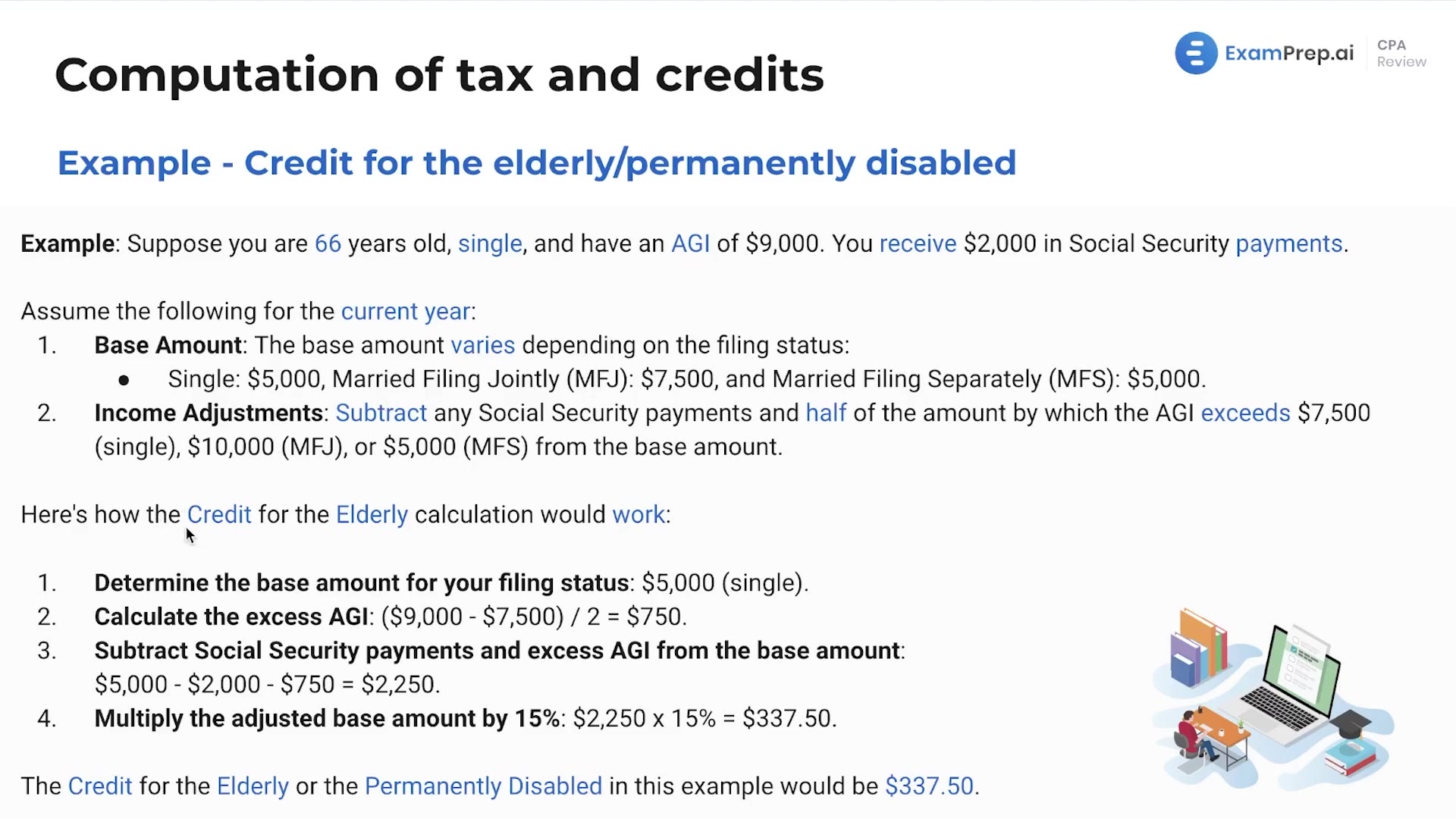

In this lesson, Nick Palazzolo, CPA, breaks down the intricate details of the credit for the elderly or permanently disabled, providing insight into its purpose to offer financial relief to qualifying individuals. This tax credit is particularly applicable to those aged 65 and older or those with permanent disabilities. Nick methodically explains how to calculate this credit, emphasizing the 15% limit on eligible income and walking through each step required to determine the applicable credit amount. The lesson includes a practical example that illustrates how to calculate the credit, starting from identifying the correct base amount related to filing status, all the way to adjusting for social security payments and excess adjusted gross income (AGI). Finally, Nick concludes by contrasting the relative importance of this credit with others, such as the child tax credit, ensuring a well-rounded understanding of its place in the tax code.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free