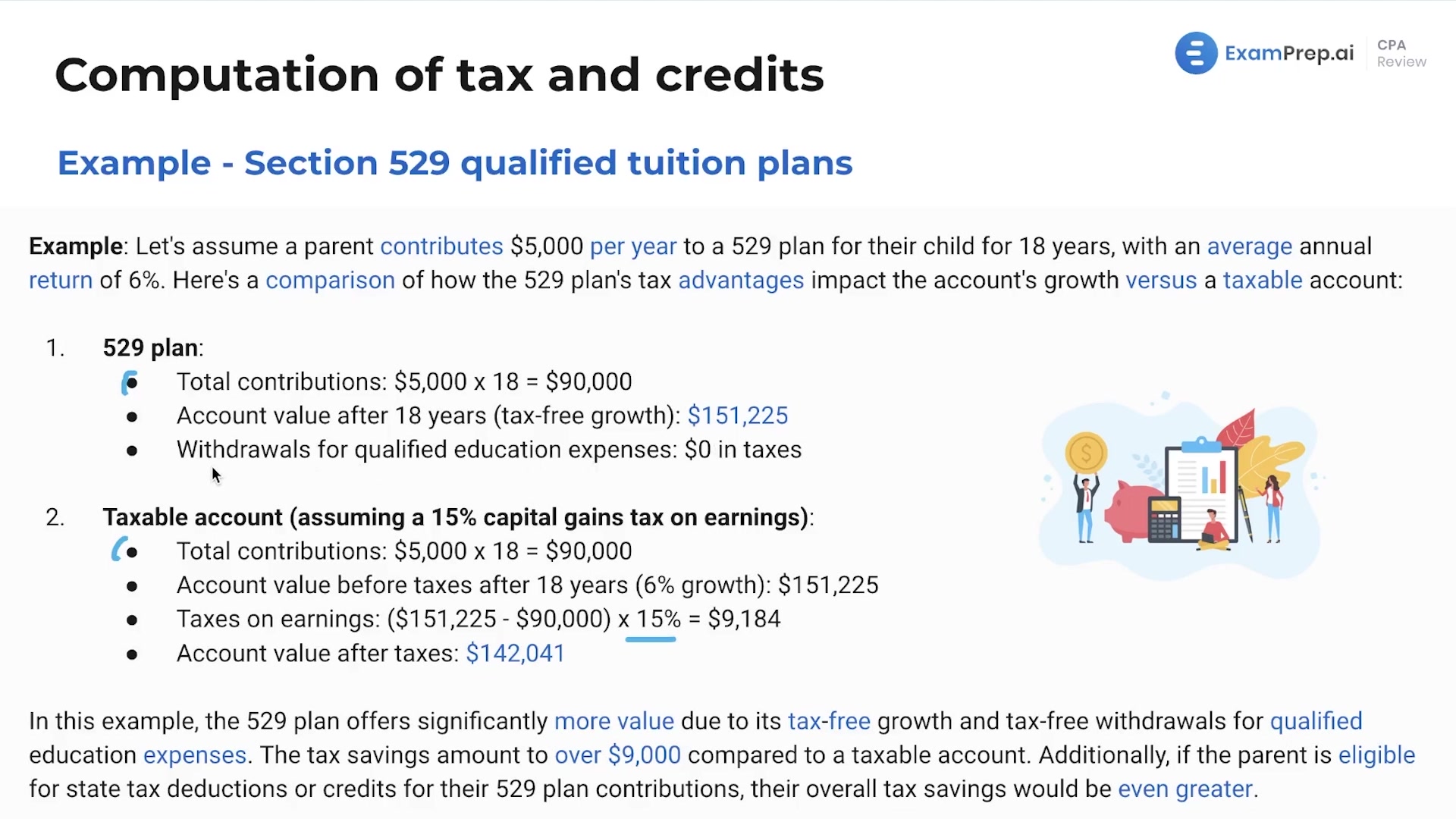

In this lesson, explore the intricacies of education savings plans such as the 529 and Coverdell plans with Nick Palazzolo, CPA, to understand how these tax-advantaged plans assist in saving for future educational expenses. Nick breaks down the differences between the two types of 529 plans, the prepaid tuition plan and the college savings plan, and covers the tax-free growth and withdrawals associated with these plans when used for qualified education costs. Moreover, he illustrates through clear examples, the tax benefits and potential savings when comparing both 529 and Coverdell plans to a normal taxable account, emphasizing the substantial value these plans can provide in reducing the financial burden of educational expenses. The lesson also delves into contribution limits, eligibility requirements, and the consequences of non-qualified withdrawals. Through Nick's guidance, gain valuable insights into how to strategically utilize these savings vehicles for educational funding.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free