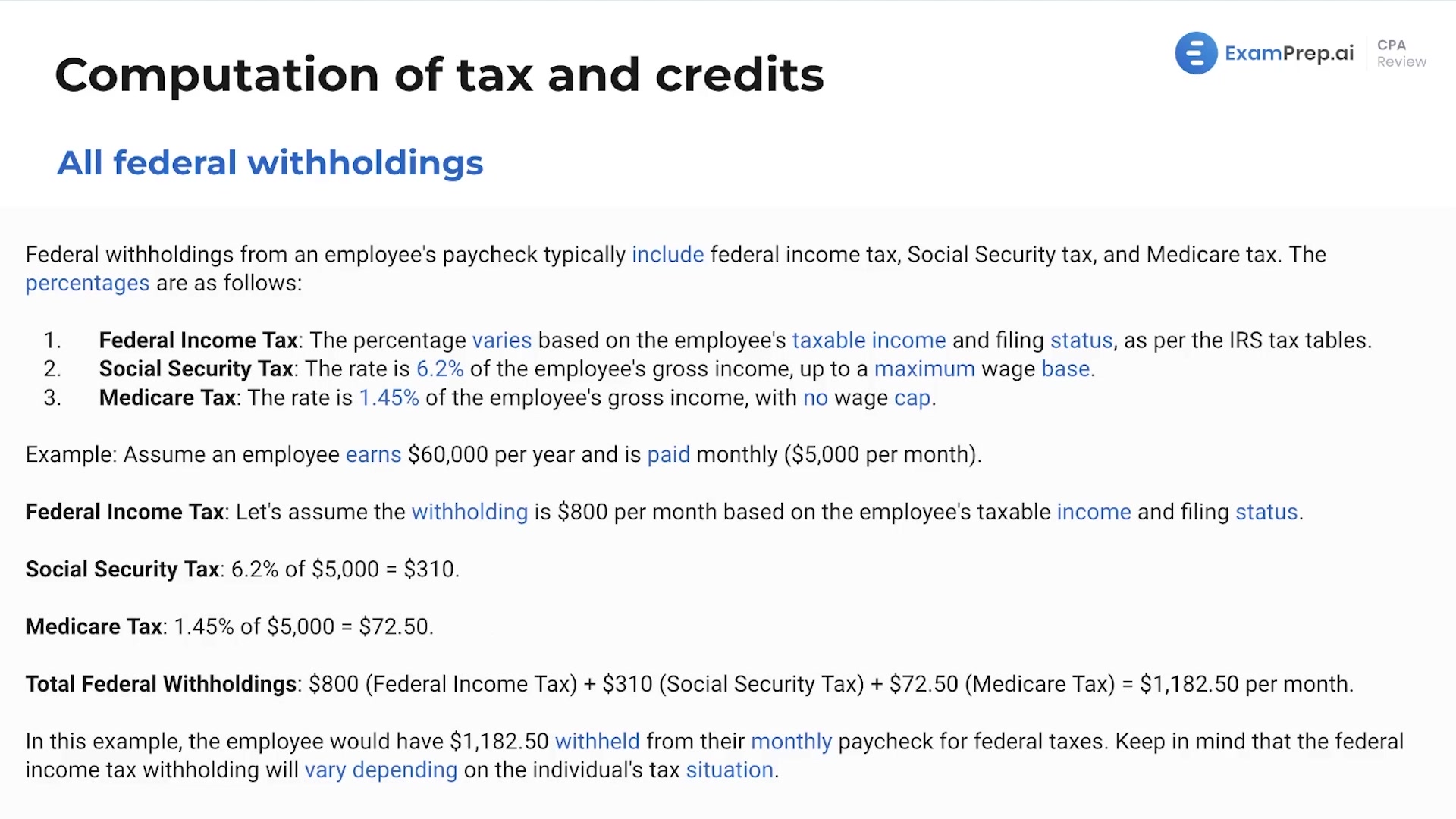

In this lesson, delve into the intricacies of federal tax withholdings as Nick Palazzolo, CPA, sheds light on the crucial deductions from employees' paychecks. Get a handle on the constant percentages of Social Security and Medicare tax—elements of the immutable FICA—and learn how these taxes, full of nuances and caps, impact take-home pay. Discover how federal income tax is a more variable tale, one that hinges on earnings and filing status. Moreover, Nick unpacks scenarios involving excess FICA withholdings, guiding through the mechanisms for reclaiming any overpayments—whether credited back by employers or reconciled during tax return filings. This foundational session equips with the essentials of navigating federal withholdings, setting the stage for mastering the payroll landscape encountered in the professional journey.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free