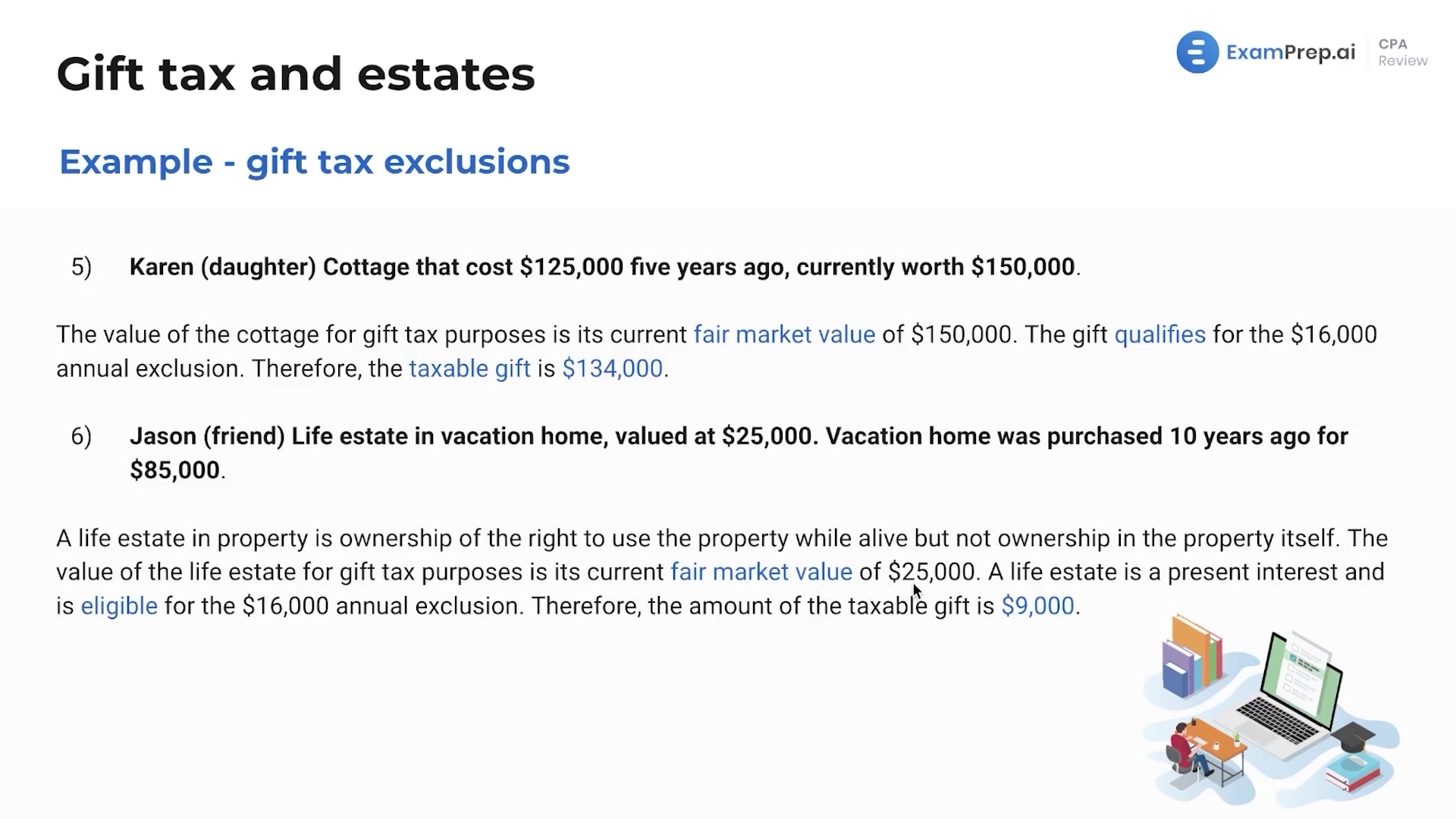

In this lesson, Nick Palazzolo, CPA, navigates the complexities of gift tax exclusions through a series of practical examples. He begins with a detailed explanation of how the gift tax applies to various scenarios, including cash gifts, investment shares, and payment of tuition and medical bills. By examining each case, he clarifies how the annual exclusion amount is used to determine the taxable portion of a gift and emphasizes the importance of understanding the exclusions for education and medical payments, which must be made directly to institutions to qualify. Nick further distinguishes between gifts to individuals and charitable donations, elucidating the rules for tax exemptions in each context. He wraps up the session by breaking down the process of calculating gift tax owed without a lifetime exemption, reinforcing the key takeaways with a focus on real-world applications and exam readiness.

This video and the rest on this topic are available with any paid plan.

See Pricing