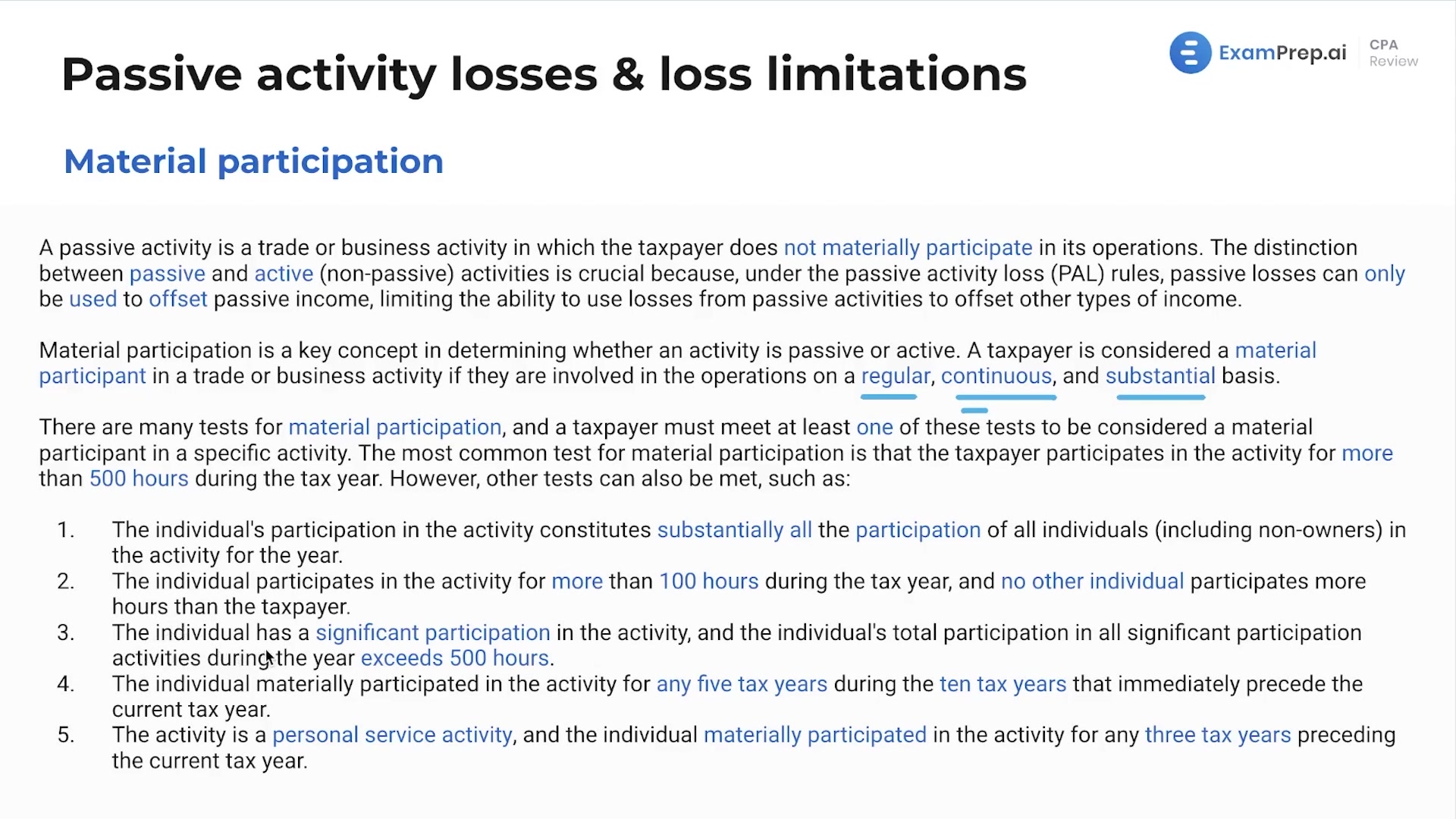

Nick Palazzolo, CPA, delves into the complexities of passive activity losses and limitations, providing a thorough breakdown of what constitutes a passive activity and how the IRS limits loss deductions. He brings clarity to the mom and pop exception, a vital piece of knowledge for understanding how small businesses can circumvent typical passive activity loss rules. Further, Nick lays out the criteria necessary for qualifying as a real estate professional, showing how this designation can transform rental losses into opportunities for offsetting income in other areas. Throughout the lesson, real-life scenarios and examples help demystify the rules, ensuring a solid grasp of how to handle rental real estate and passive income on taxes.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free