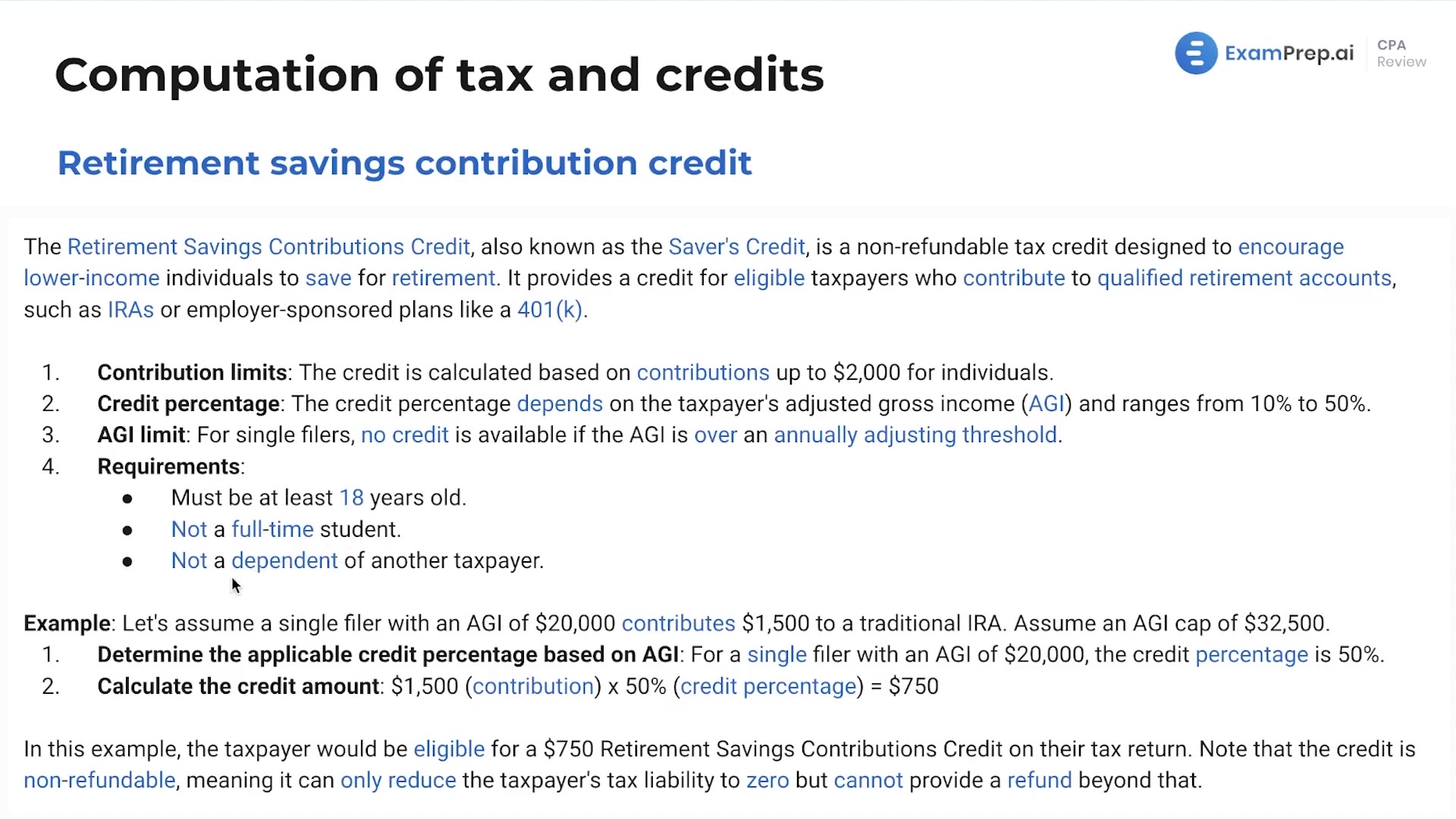

In this lesson, Nick Palazzolo, CPA, unravels the intricacies of the Retirement Savings Contribution Credit—affectionately known as the Savers Credit. As a non-refundable tax credit, it is specifically designed to encourage individuals on the lower end of the income scale to invest in their retirement savings. Nick clearly outlines the qualifying criteria, such as age, student status, and dependency, required to utilize this credit. Illustrating with an example, he demonstrates how to calculate the credit amount based on maximum contributions and adjusted gross income (AGI) levels. Furthermore, Nick details why the credit cannot result in a refund beyond reducing the tax liability to zero, emphasizing the credit's specific aim to aid taxpayers with lower incomes in bolstering their retirement funds.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free