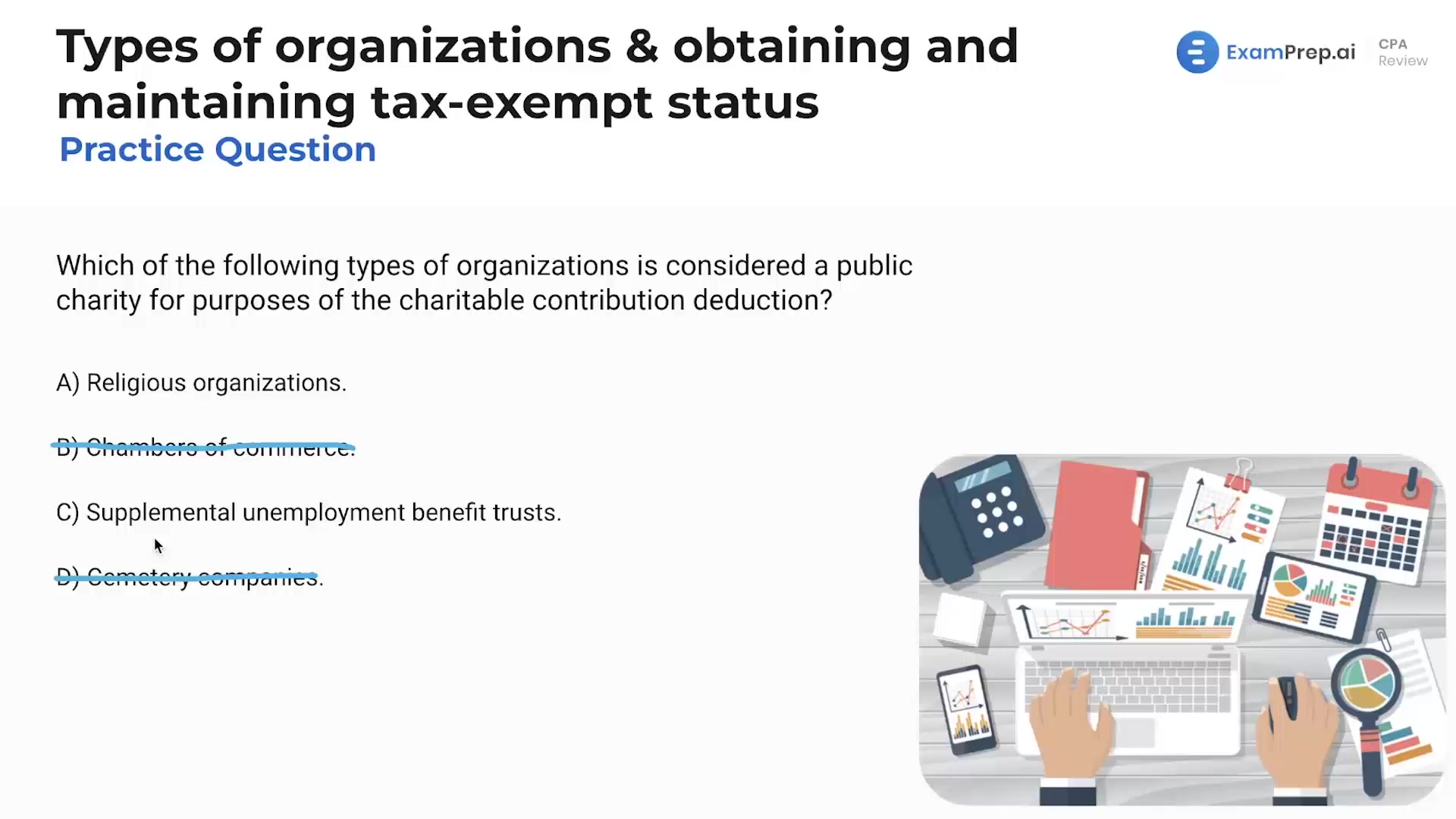

In this lesson, Nick Palazzolo, CPA, walks through a series of multiple-choice questions centered around nonprofit tax-exempt organizations, focusing on the characteristics that define a public charity. He offers strategies for tackling exam questions, such as identifying types of organizations typically regarded as ineligible for charitable contribution deduction due to political affiliations. Nick gives insight into common and less common entities you might encounter on the exam like Chambers of Commerce, cemetery companies, religious organizations, and Supplemental Unemployment Benefit Trusts, explaining which qualify as tax-exempt. He wraps up with a clear breakdown of the 501(c)(3) exemption, clarifying why entities like partnerships do not qualify for this exemption and encourages continued practice to master the concepts.

This video and the rest on this topic are available with any paid plan.

See Pricing