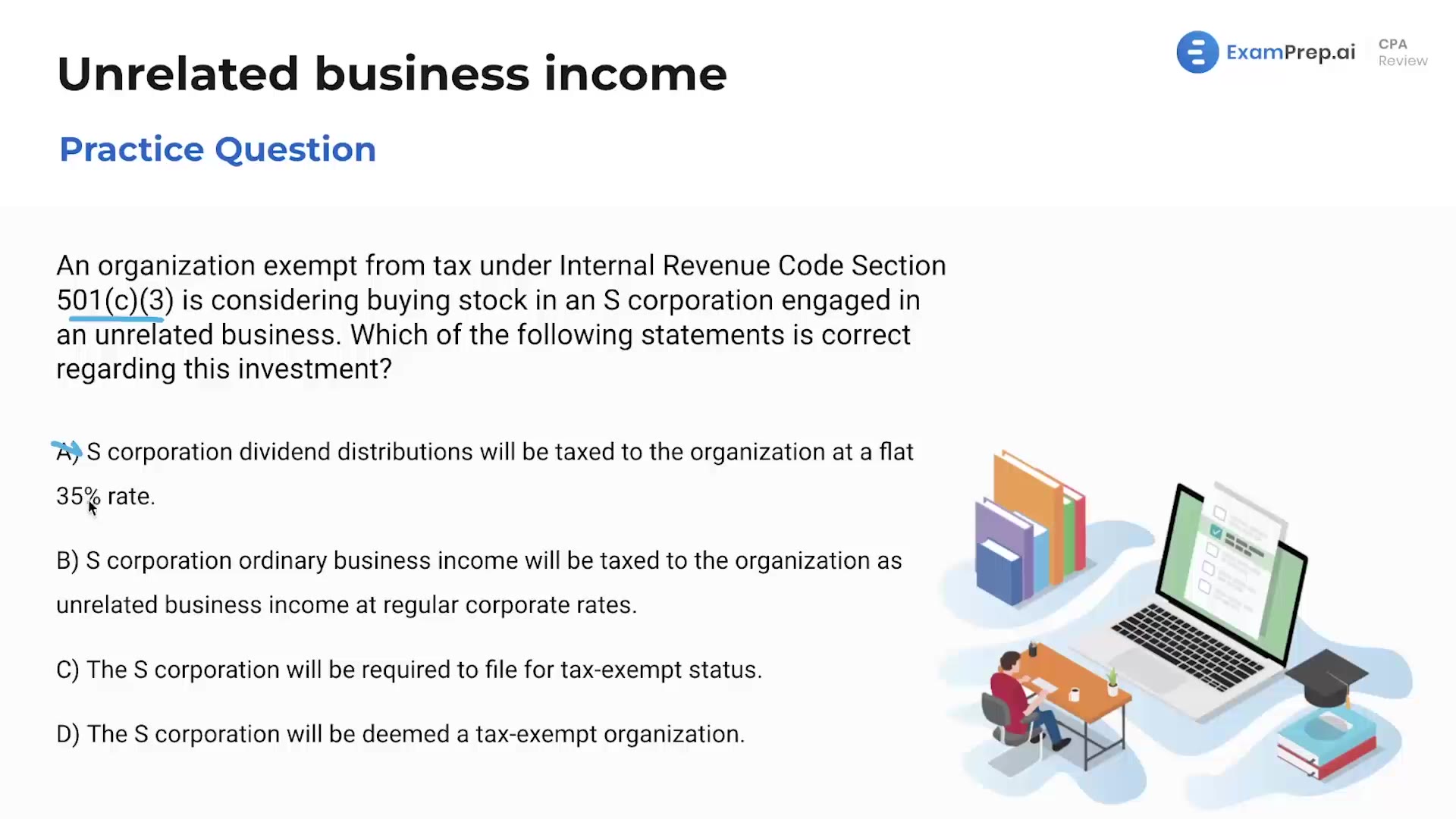

In this lesson, Nick Palazzolo, CPA, breaks down the complexities of unrelated business income (UBI) through a practical, question-based approach. He dives right into a scenario where a tax-exempt organization is considering an investment in an S-Corporation, immediately setting the stage for a discussion on what constitutes UBI. Nick skillfully debunks common misconceptions and distractors, shedding light on the taxation of S-corporation dividend distributions and ordinary business income. Through his explanation, viewers gain clarity on how different forms of income are taxed for tax-exempt entities, reinforcing their understanding with a focus on why certain answers are incorrect. With encouraging final words, Nick wraps up the lesson, motivating continued practice on such nuanced topics.

This video and the rest on this topic are available with any paid plan.

See Pricing