Gift Tax and Estates

Gift tax is a federal tax applied to an individual giving anything of value to another person without expecting something of equal value in return, while estate tax is levied on the transfer of the "taxable estate" of a deceased person, whether this transfer is to a beneficiary or otherwise. Both are integral parts of the United States transfer tax system and are subject to complex regulations, including exemptions and deductions that affect tax liability.

Lesson Videos

Gift Tax and Estates Overview

Gift Tax and Estates Overview

Introduction to Gift Tax and Estates

Introduction to Gift Tax and Estates

General Points Regarding Gift Tax

General Points Regarding Gift Tax

Complete and Incomplete Gifts

Complete and Incomplete Gifts

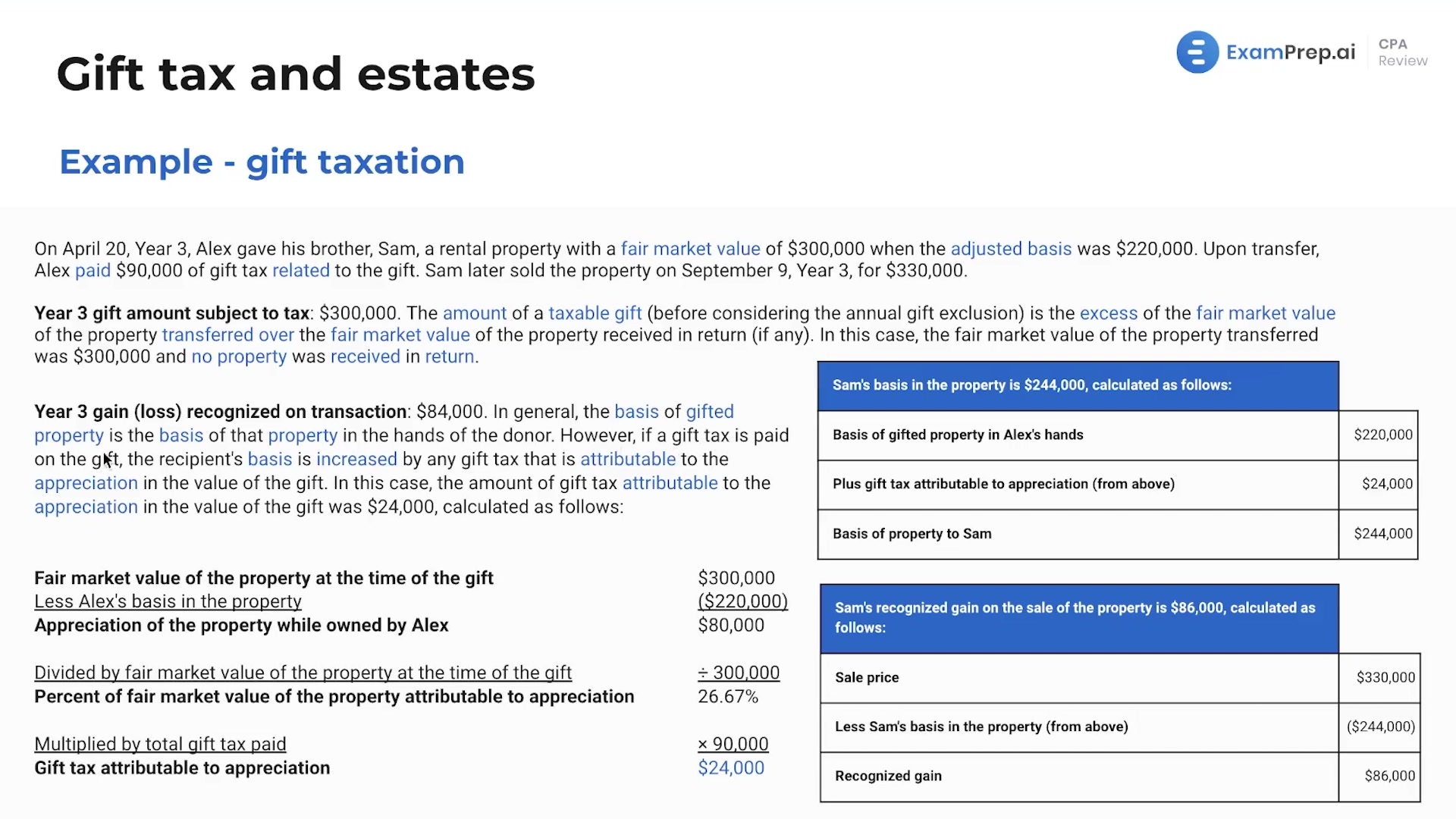

Examples of Gift Taxation

Examples of Gift Taxation

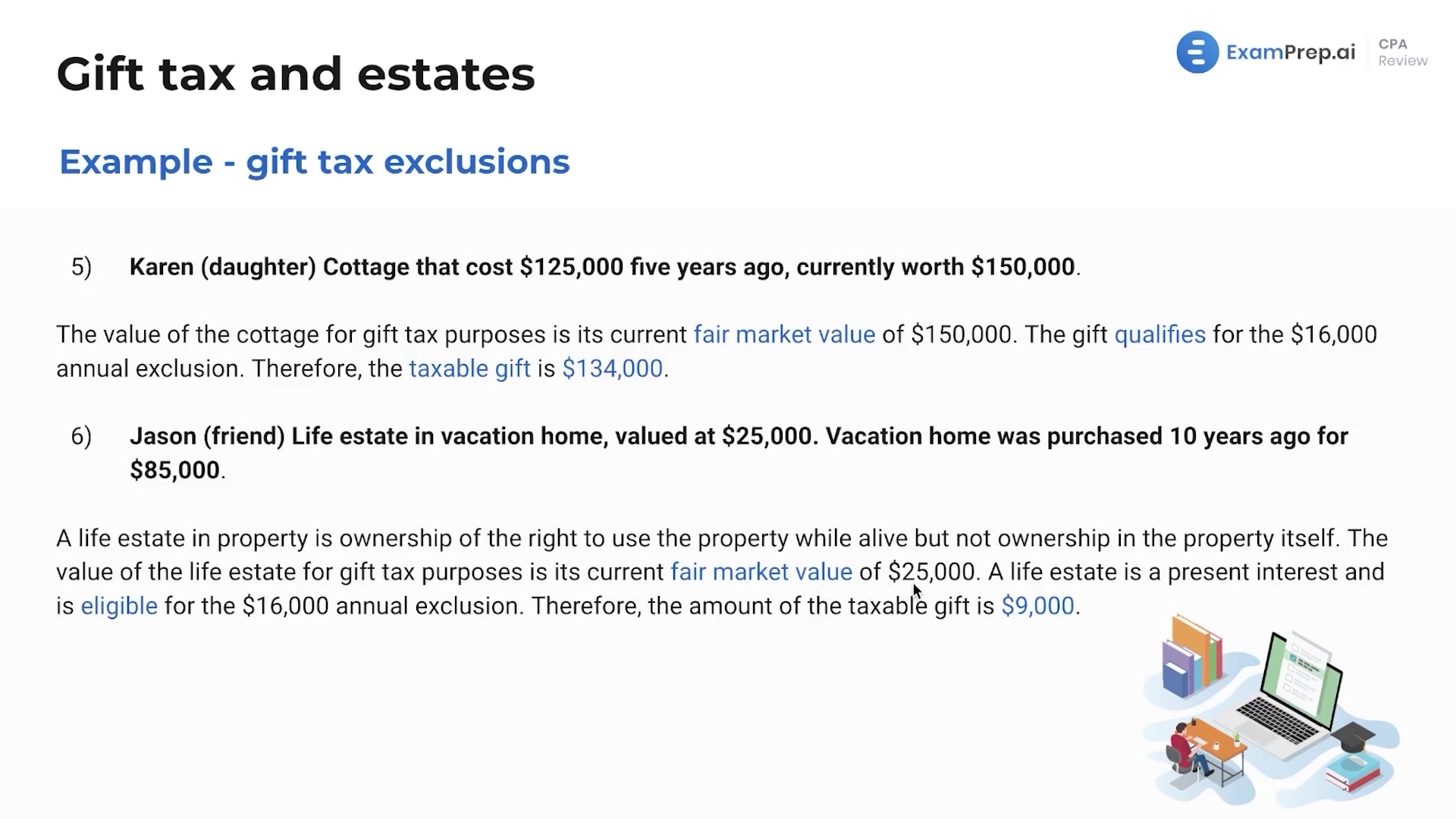

Gift Tax Exclusions

Gift Tax Exclusions

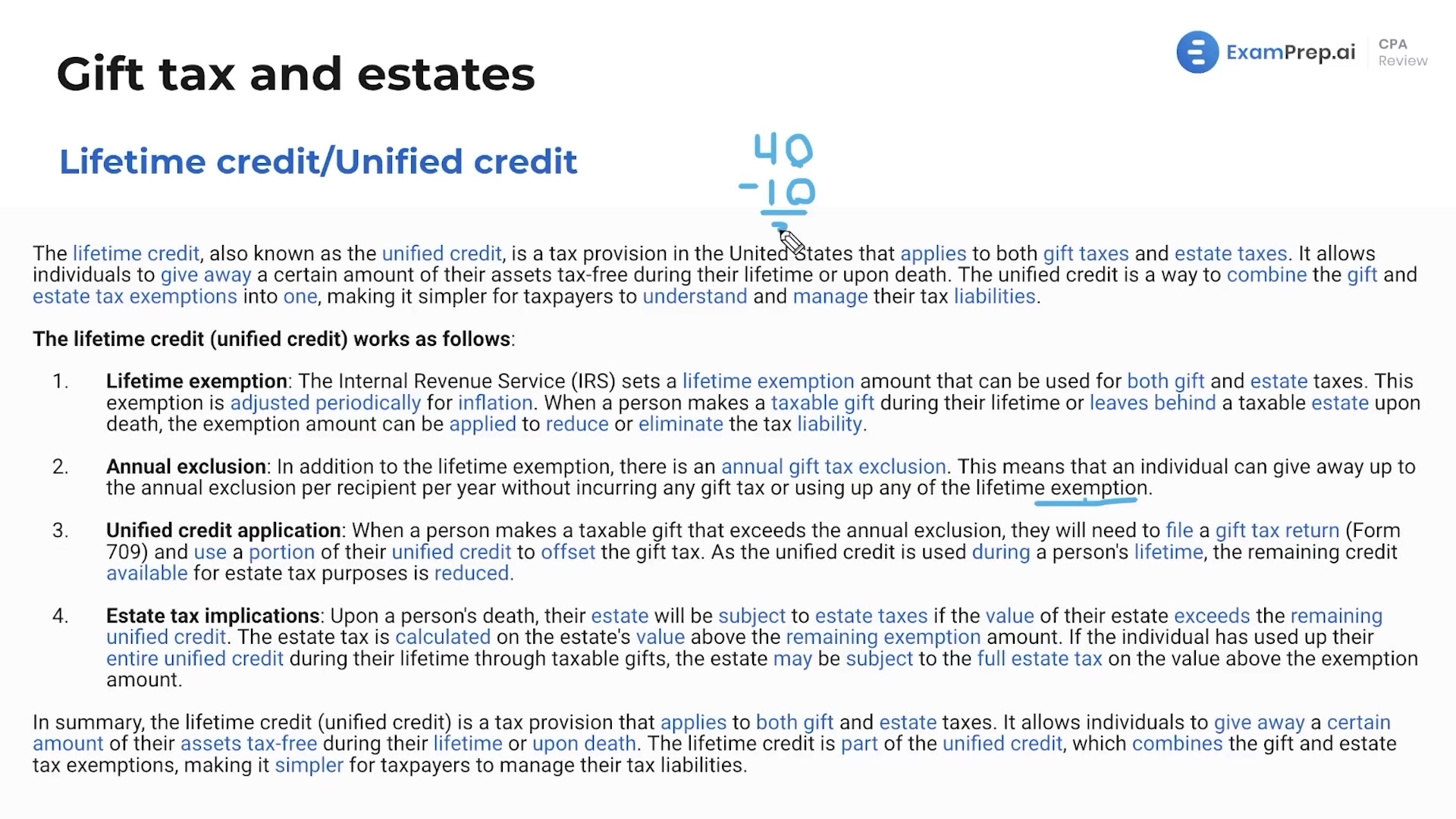

Lifetime/Unified Credit

Lifetime/Unified Credit

Gift Tax and Estates Summary

Gift Tax and Estates Summary

Gift Tax and Estates - Practice Questions

Gift Tax and Estates - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate