Unrelated Business Income

Unrelated Business Income refers to the revenue generated by a tax-exempt organization from activities not substantially related to the purposes for which the entity was granted tax exemption. This type of income is subject to unrelated business income tax (UBIT) to ensure that nonprofit entities do not unfairly compete with taxable businesses.

Lesson Videos

Unrelated Business Income Overview

Unrelated Business Income Overview

Introduction to Unrelated Business Income

Introduction to Unrelated Business Income

Criteria for Unrelated Business Income

Criteria for Unrelated Business Income

Characteristics of Unrelated Business Income

Characteristics of Unrelated Business Income

Activities and Income Sources Not Subject to UBI Tax

Activities and Income Sources Not Subject to UBI Tax

Unrelated Business Income Summary

Unrelated Business Income Summary

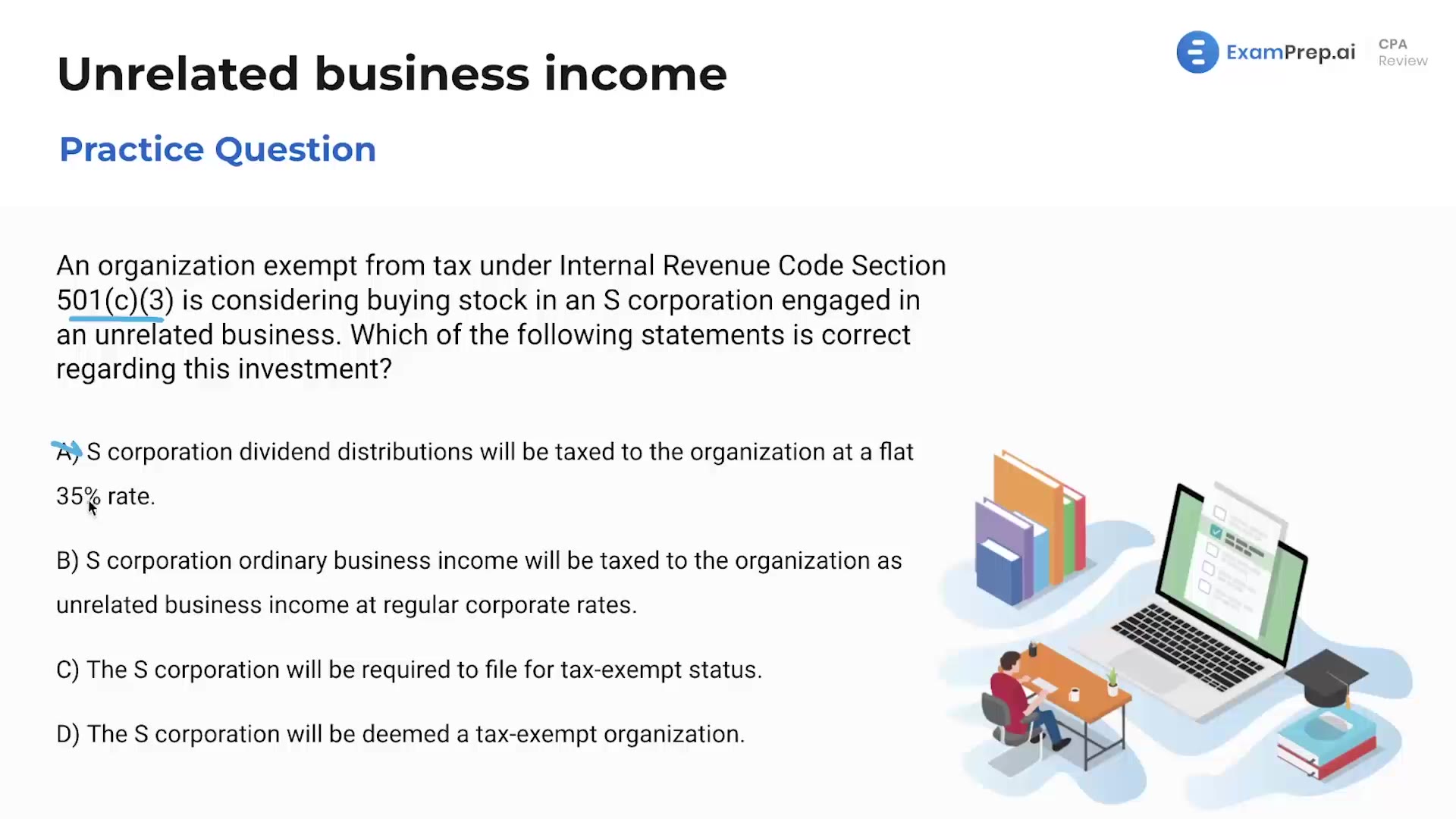

Unrelated Business Income - Practice Questions

Unrelated Business Income - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate