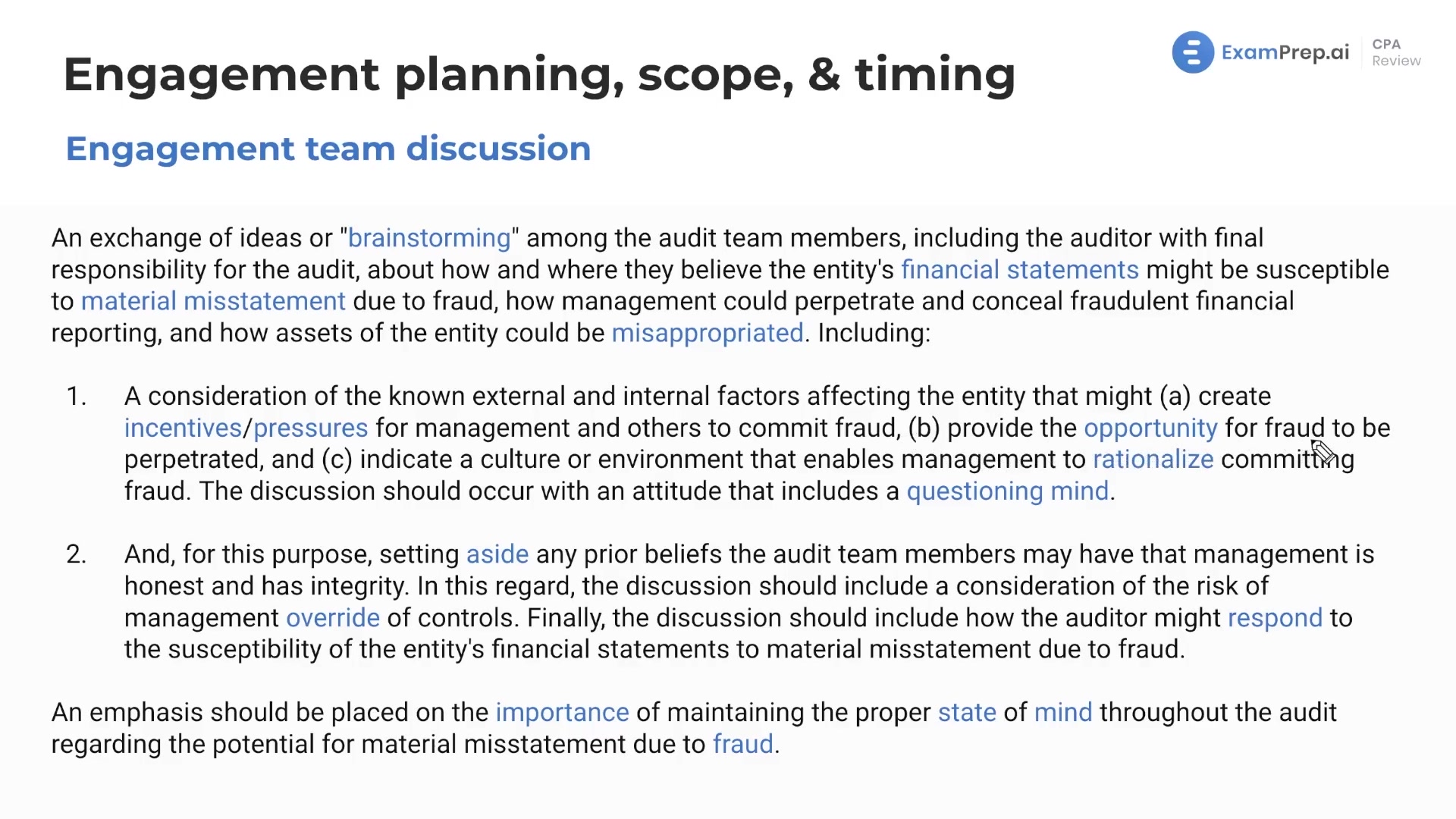

This lesson covers the engagement team discussion during the planning stage of an audit, which focuses on brainstorming the potential risks of material misstatement due to fraud. Nick Palazzolo, CPA, discusses the importance of including senior staff and the auditor with final responsibility in this initial meeting, where the team considers factors such as potential asset misappropriation and how management could conceal fraudulent financial reporting. The lesson emphasizes maintaining professional skepticism, assessing external and internal factors that may increase the risk of fraud, and understanding the importance of recognizing the potential for management override of controls. Additionally, the team will discuss how to respond if fraud is discovered and the importance of maintaining a questioning mindset throughout the audit process.

This video and the rest on this topic are available with any paid plan.

See Pricing