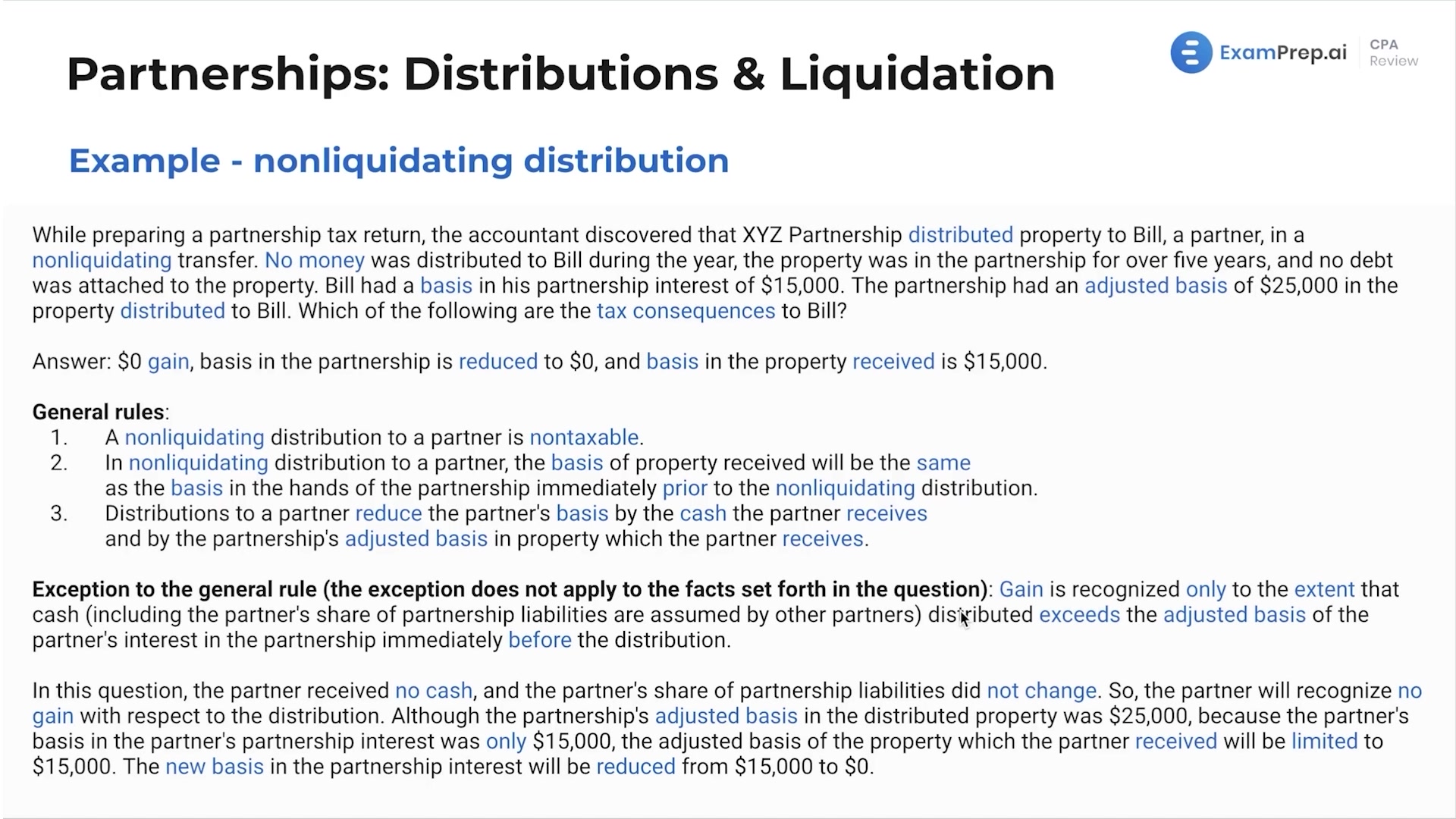

In this lesson, Nick Palazzolo, CPA, delves into the complexities of non-liquidating distributions within the realm of partnership taxation. He engages with a series of illustrative examples that shine a light on the tax implications and basis adjustments following such distributions. Nick meticulously walks through calculations showing how cash and property distributions affect a partner's tax basis while demystifying various scenarios and the critical rules that govern them. With a combination of in-depth explanations and practical examples, he ensures a thorough understanding of what to expect when dealing with these distributions, preparing for the potential curveballs that partnership-related questions can present on the exam.

This video and the rest on this topic are available with any paid plan.

See Pricing