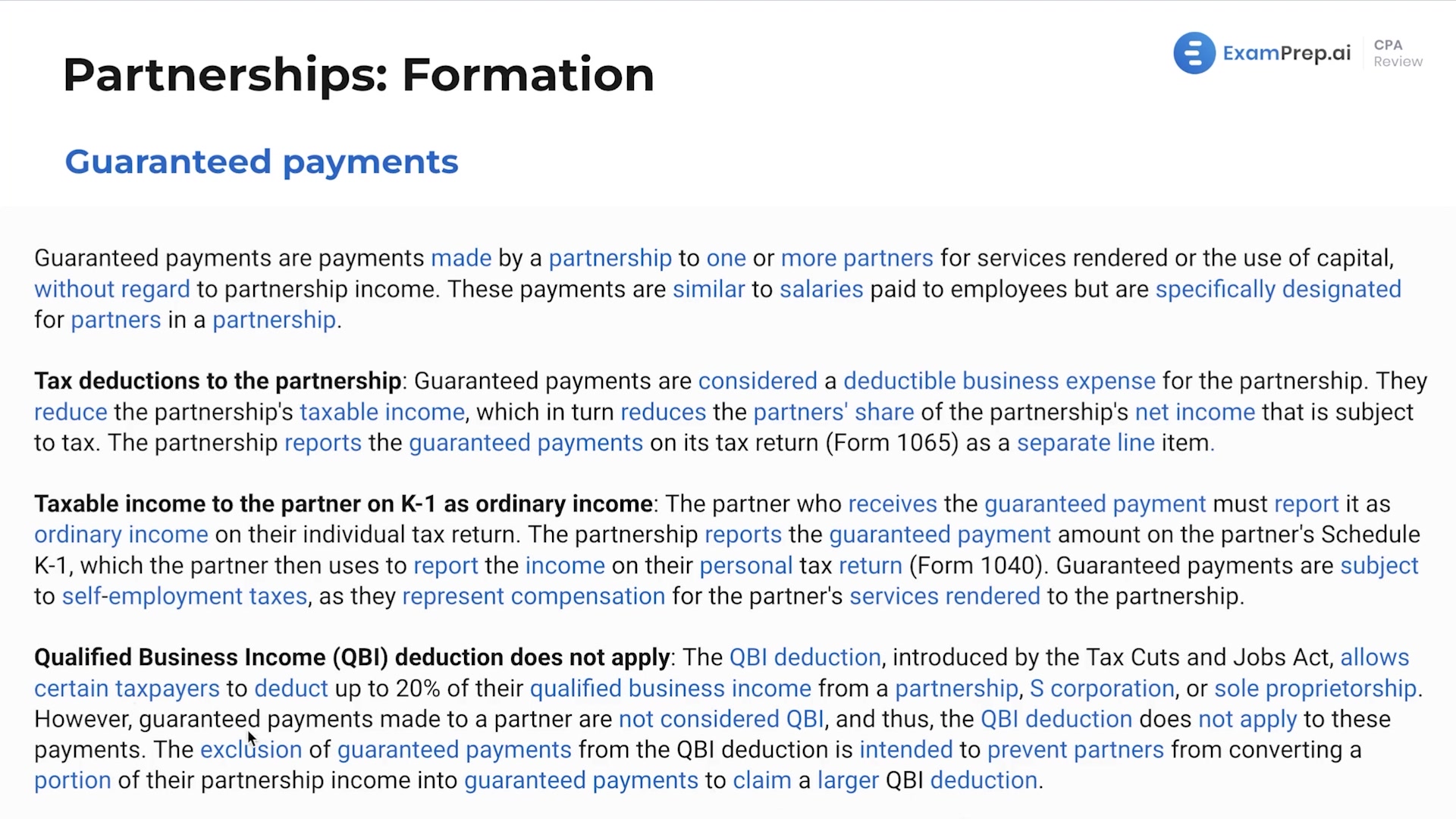

In this lesson, Nick Palazzolo, CPA, breaks down the concept of guaranteed payments in partnerships, clarifying their unique role as a form of compensation for partners. He keenly outlines the tax implications of these payments, including their deductibility as a business expense and impact on a partner's taxable income. With a helpful example, Nick illustrates how guaranteed payments affect the partnership's taxable income and how they're separately reported on IRS forms, such as Form 1065 and Schedule K-1. Additionally, Nick dives into the nuance of why guaranteed payments do not qualify for the QBI deduction introduced by the Tax Cuts and Jobs Act. Through his practical approach, the intricacies of allocating partnership income and the resulting tax responsibilities become clear, paving the way for a thorough understanding of this topic in the realm of partnership taxation.

This video and the rest on this topic are available with any paid plan.

See Pricing