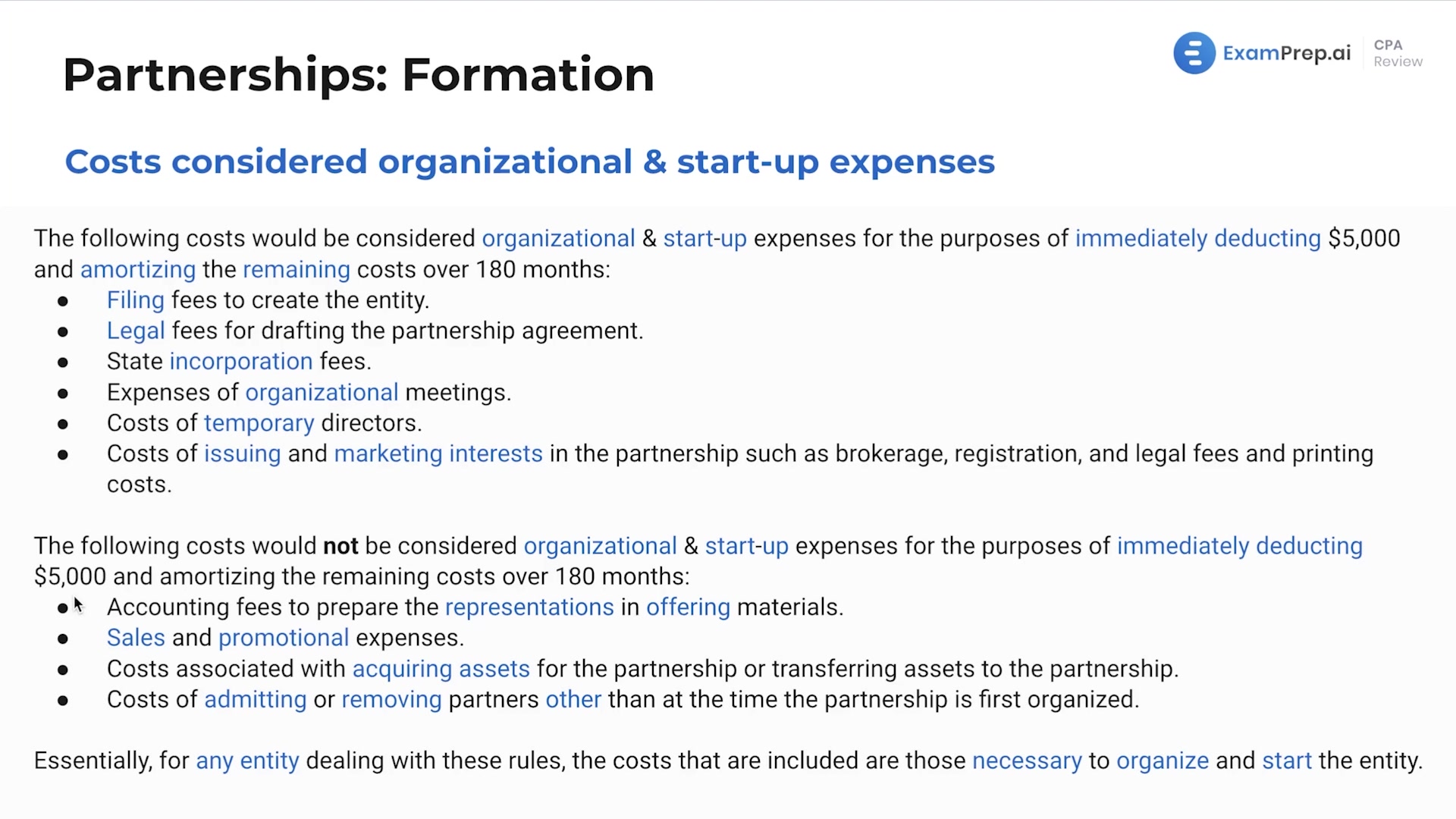

In this lesson, Nick Palazzolo dives into the world of tax deductions, focusing on organizational and startup expenses commonly encountered when forming partnerships and corporations. With his characteristic clarity, Nick breaks down the initial deduction of $5,000 allowable for both org expenses and startup expenses, highlighting the phase-out rules when these exceed $50,000. He goes on to explain the amortization of these expenses over 180 months, complete with practical examples to illustrate the concepts. Also, Nick makes sure to differentiate between what the IRS considers as valid organizational and startup costs versus those that are not permissible deductions, ensuring that every detail is clear for handling real-world fiscal scenarios.

This video and the rest on this topic are available with any paid plan.

See Pricing