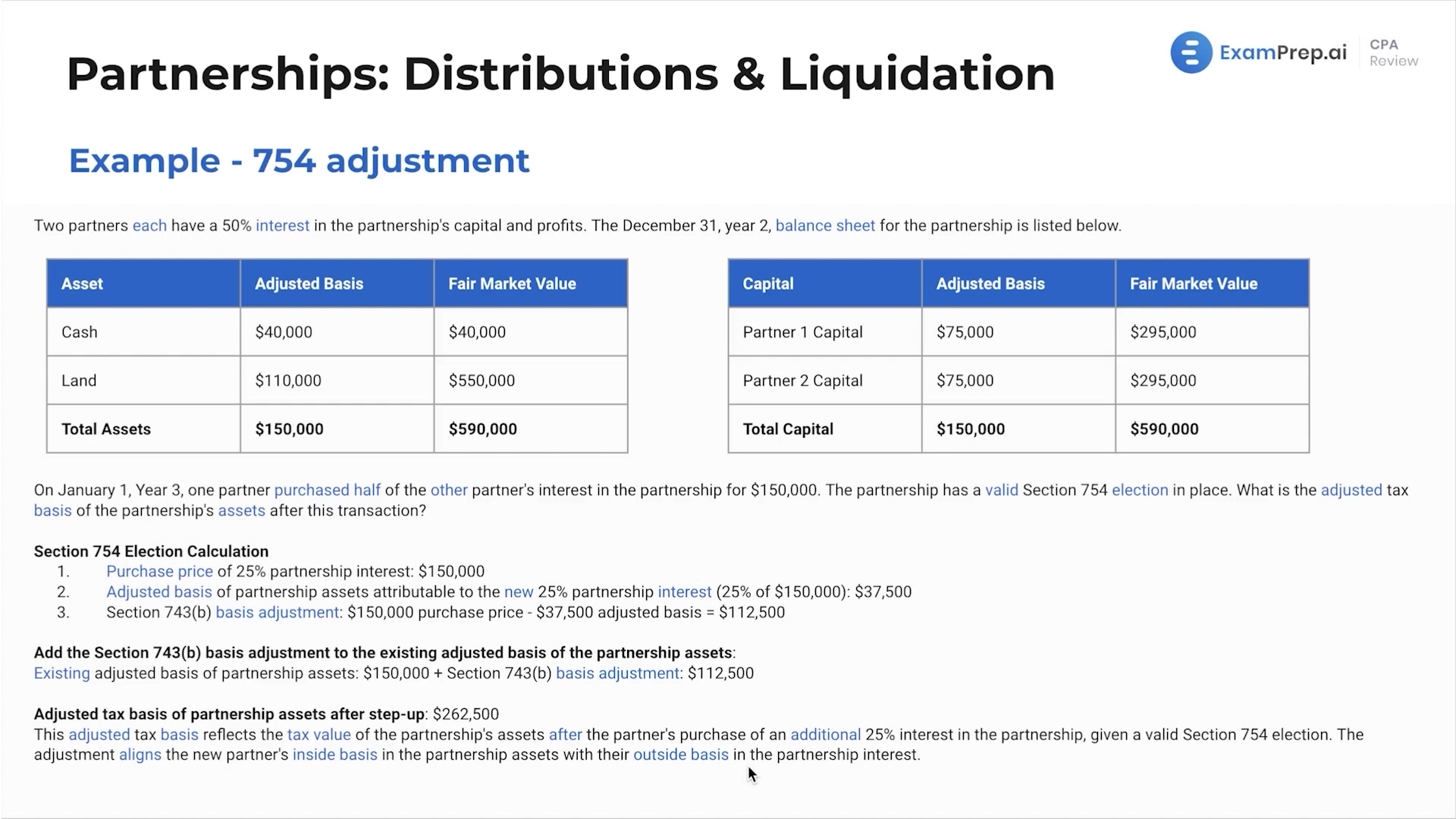

In this lesson, Nick Palazzolo, CPA, unpacks the intricacies of transferring and liquidating partnership interests, an area packed with tax implications and strategic decisions partners must navigate. Delve into the nitty-gritty of what happens when a partner retires or passes away, how the remaining partners adjust the capital accounts and profit-sharing agreements, and the practical impact of these changes on the partnership dynamics. Nick also sheds light on the mechanics of capital gains and losses during liquidation, the strategic considerations behind the Section 754 election, and how the 743B basis adjustment ensures fair tax treatment by aligning the inside and outside bases, safeguarding against double taxation and unwanted tax repercussions. With clear examples, including numeric calculations and key formulae, this lesson offers a thorough exploration of the tax and accounting treatments that affect day-to-day and long-term partnership operations.

This video and the rest on this topic are available with any paid plan.

See Pricing