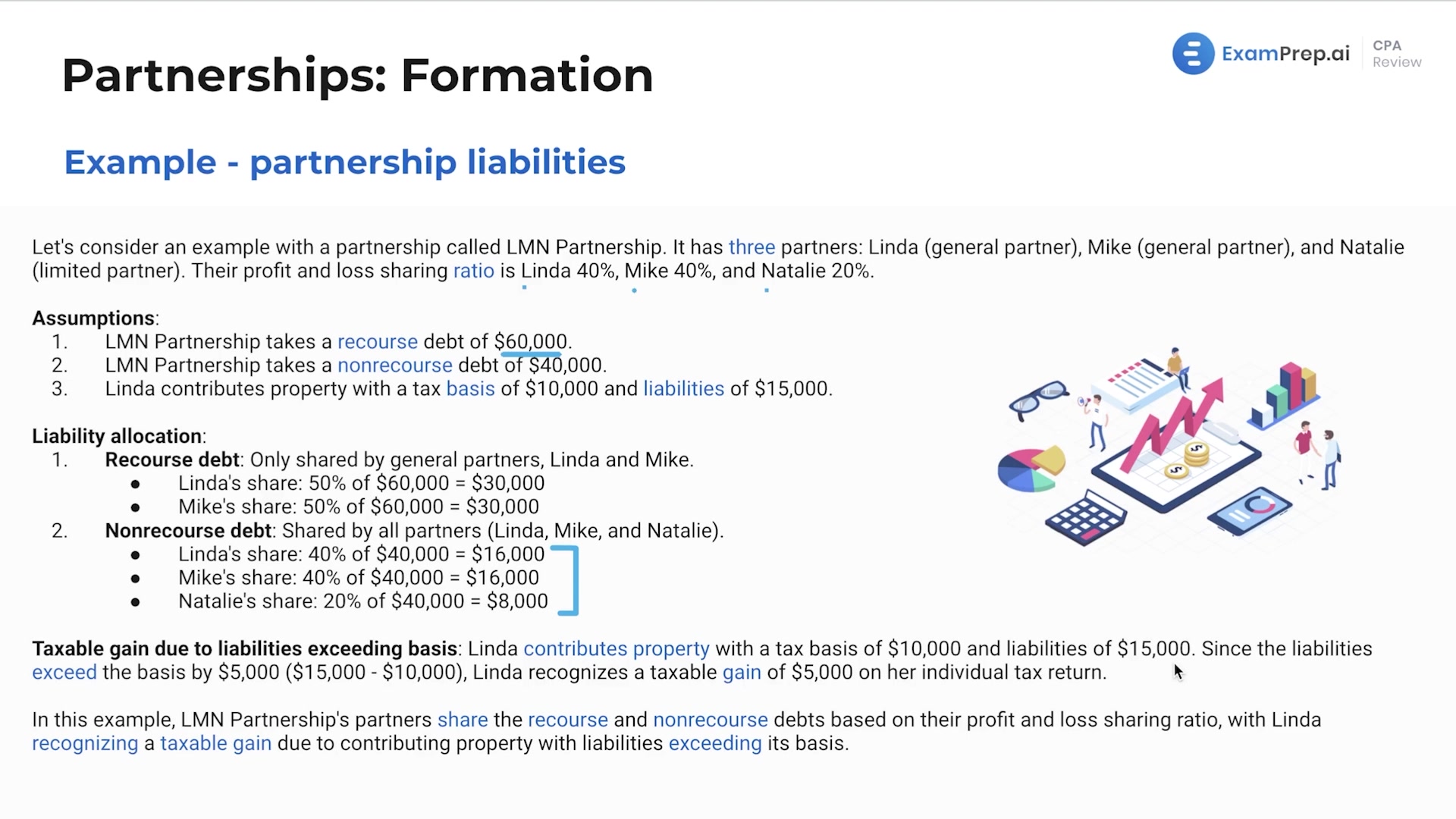

In this lesson, Nick Palazzolo, CPA, tackles the complex topic of partnership liabilities, illuminating how they impact a partner’s basis in the partnership. Engaging with a variety of scenarios, he demystifies the treatment of recourse and non-recourse debts, explaining the differences and the conditions under which partners may be held personally liable. As Nick delves into examples, he highlights how debts can benefit partners by increasing their basis—leading to potential tax advantages—yet also how these same liabilities can trigger taxable gains if they exceed the basis of contributed property. Throughout the lesson, Nick simplifies the allocation of liabilities among general and limited partners, providing clear mathematical breakdowns and emphasizing key points to remember for the exam.

This video and the rest on this topic are available with any paid plan.

See Pricing