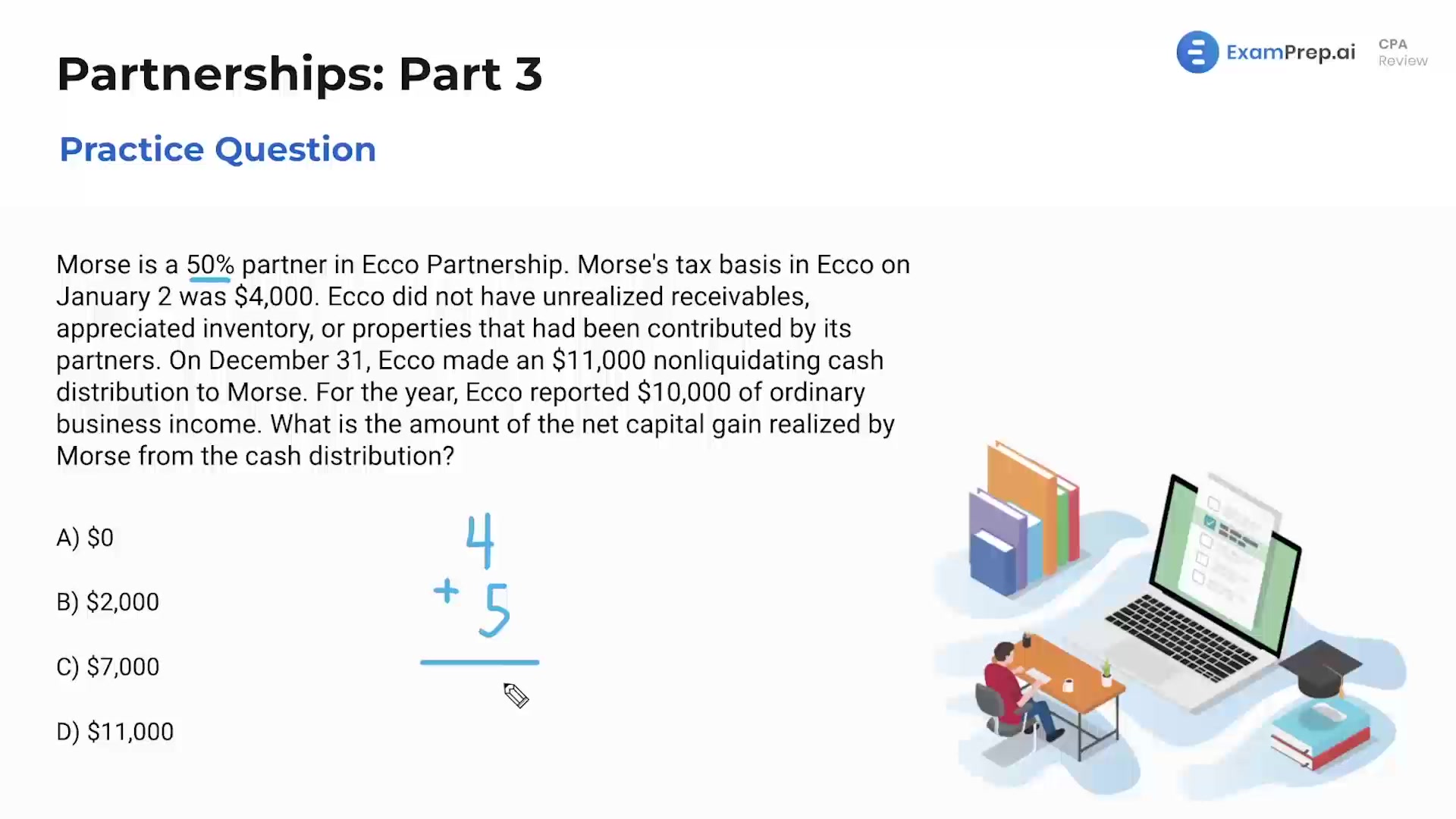

In this lesson, Nick Palazzolo, CPA, walks through a selection of multiple-choice questions on partnerships, specifically focusing on distributions and the tax implications of liquidating and non-liquidating distributions. He methodically breaks down the calculation of a partner's basis in the partnership before and after distributions, including how to determine the tax impact of cash and property distributions. Through examples, Nick demonstrates how the distributed amount exceeding a partner's basis can result in a capital gain. He also demystifies the process of determining a partner's basis in the property received after a distribution. Engaging with the lesson's detailed scenarios will solidify your understanding of these key partnership concepts, which Nick emphasizes as essential for the exam.

This video and the rest on this topic are available with any paid plan.

See Pricing