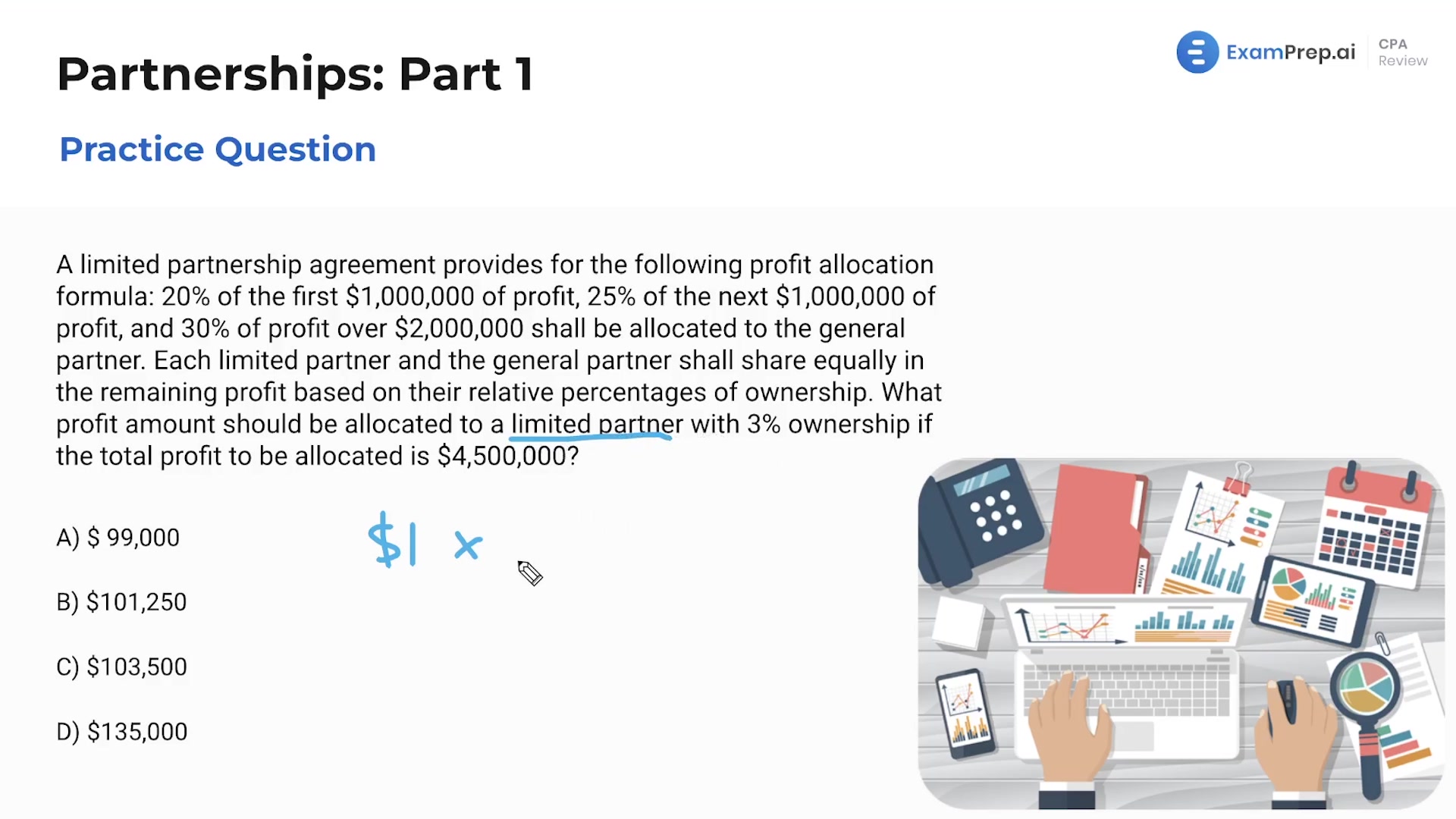

In this lesson, ease into the intricacies of partnership formations with Nick Palazzolo, CPA, as he tackles practice questions that shed light on how partner contributions impact basis calculations. Nick breaks down a partner's basis by examining different forms of contributions—from cash to services—and how these are valued within the partnership structure. He also demystifies the allocation of profits within a limited partnership agreement, guiding you through computations that determine a limited partner's share based on ownership percentage and profit tiers. Through these examples, you'll gain clarity on essential concepts like basis determination and profit allocation, honing skills that are integral to mastering partnership taxation and solidifying the foundation for a variety of exam scenarios.

This video and the rest on this topic are available with any paid plan.

See Pricing