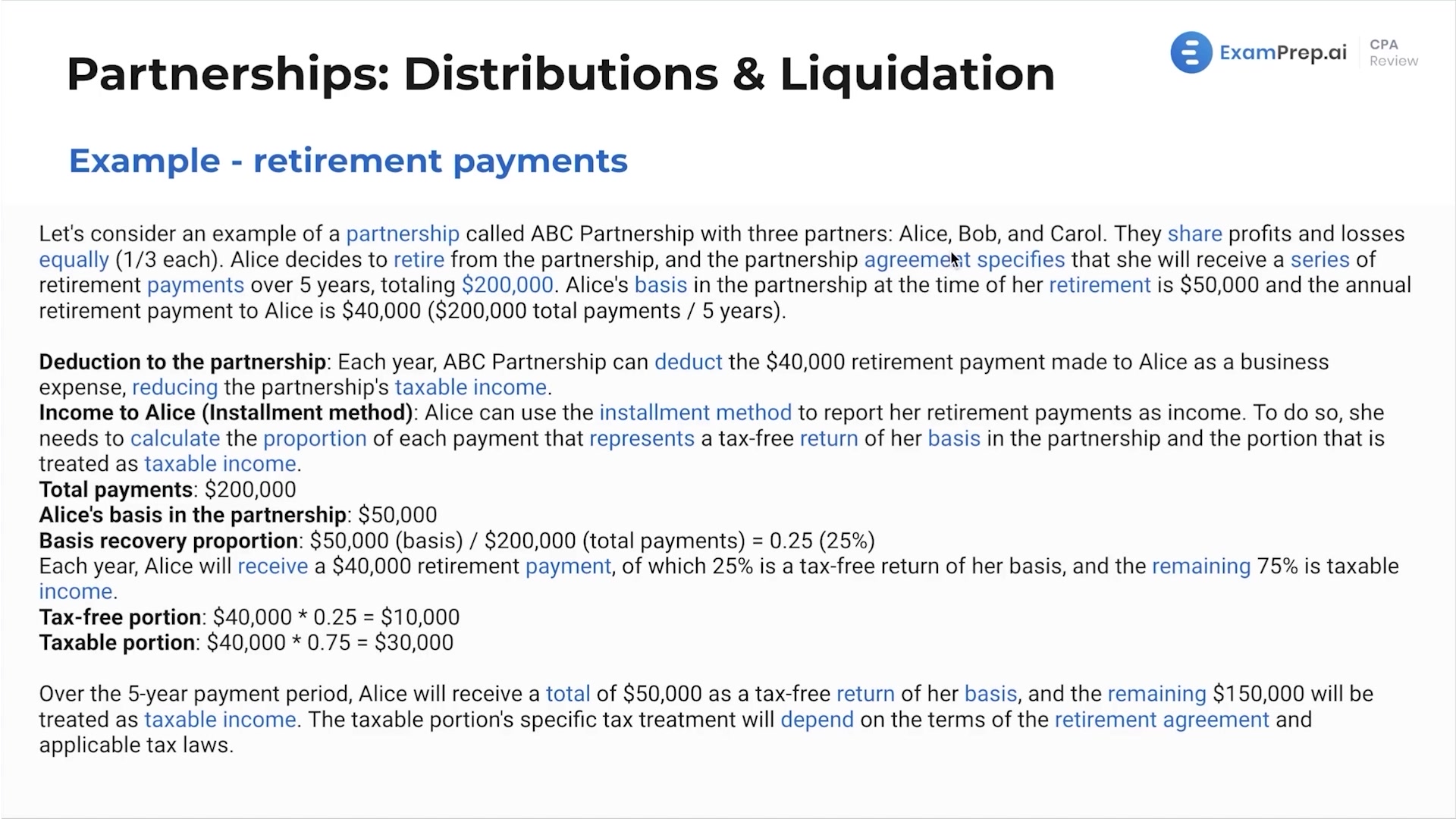

In this lesson, Nick Palazzolo, CPA, breaks down the intricacies of retirement payments within a partnership context, emphasizing their tax implications and deductibility. By exploring various payment structures such as lump sums and installment methods, Nick clarifies how these options affect the retirement income reported on a partner's individual tax return. The discussion includes an example with a logical step-by-step explanation, distinctly showing how the partnership deducts these payments and how the retiring partner calculates the taxable and non-taxable portions of the income received. Nick instills a sense of confidence, assuring you that understanding these retirement payment concepts is completely manageable with the help of his clear and practical examples.

This video and the rest on this topic are available with any paid plan.

See Pricing