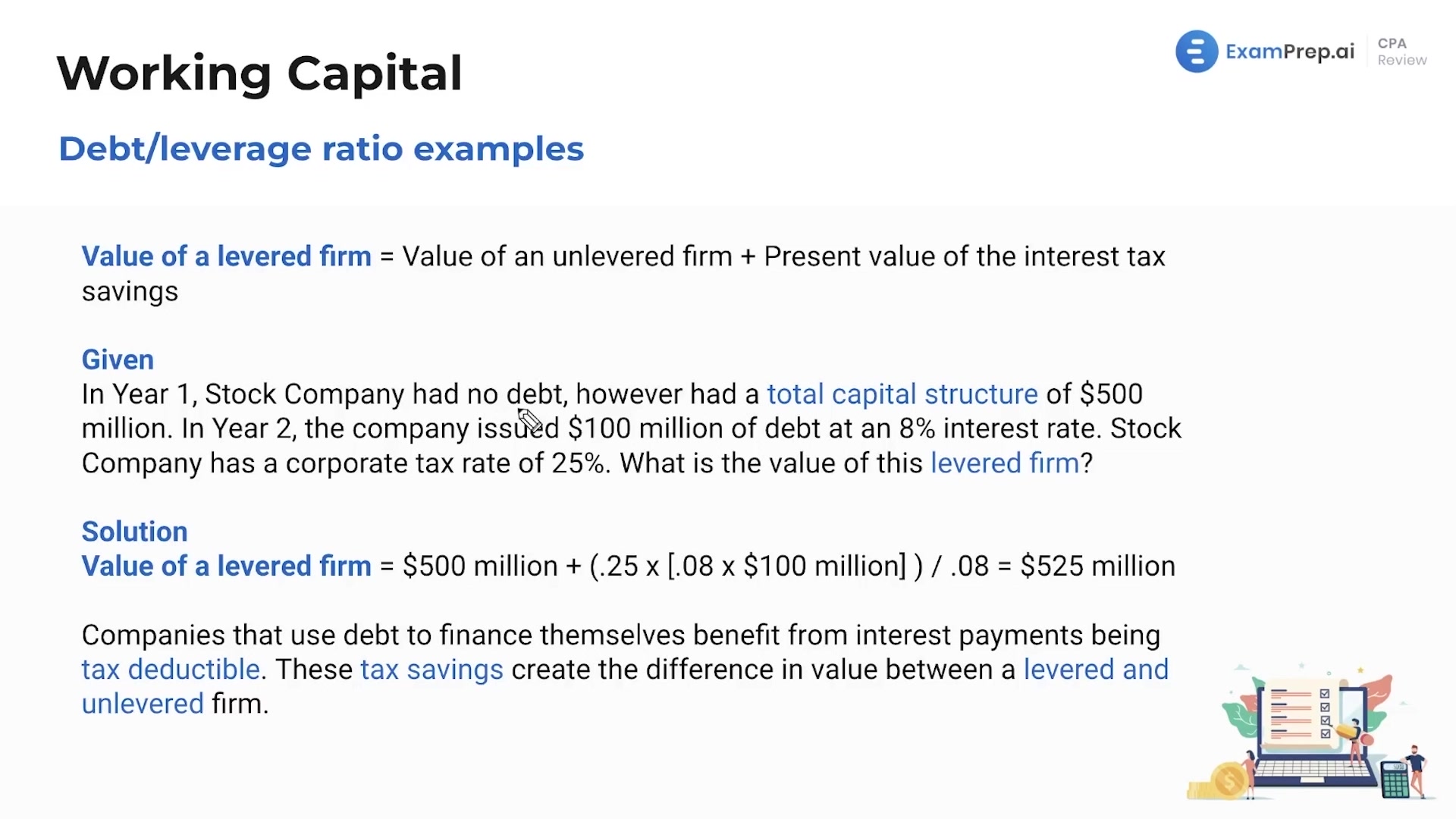

In this lesson, Nick Palazzolo, CPA, breaks down various debt and leverage ratios essential for evaluating a company's financial health and stability. Grasping how a business maintains and handles its debt is crucial for both management and potential investors, and equally important for banks when deciding on creditworthiness. Nick demystifies concepts like the value of a levered firm and provides easy-to-understand explanations of key formulas, such as total debt ratio (debt divided by assets) and debt-to-equity ratio (debt divided by equity). He underscores the significance of the times interest earned ratio, a key indicator of how well a company is doing in terms of its earnings relative to its interest obligations. The lesson is rounded off with a practical example showcasing how to calculate the value of a leveraged firm, emphasizing the added complexity and benefit of tax savings from interest payments.

This video and the rest on this topic are available with any paid plan.

See Pricing