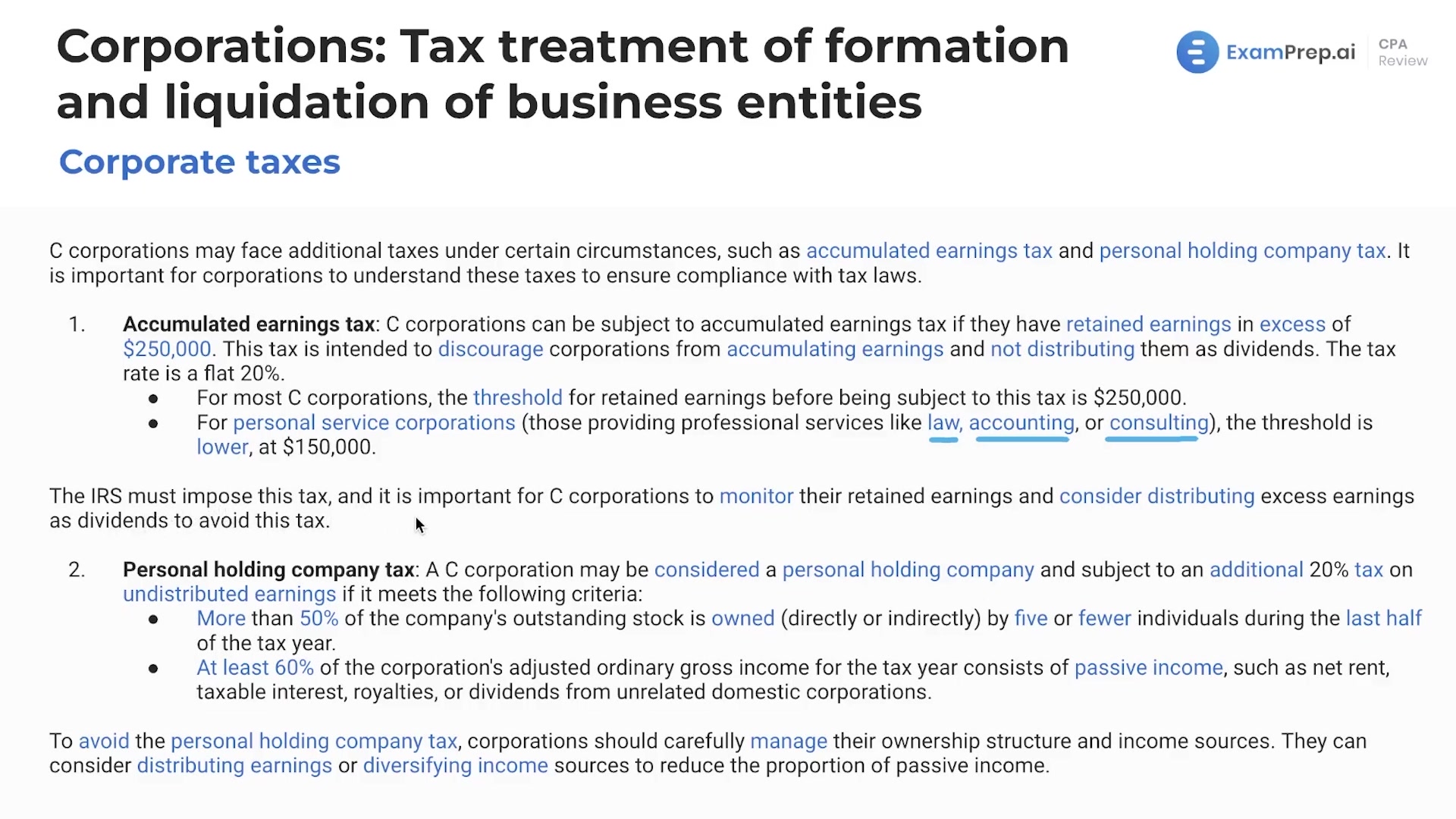

In this lesson, Nick Palazzolo, CPA, breaks down additional taxes that C-Corporations may encounter such as the accumulated earnings tax and the personal holding company tax. He explains the conditions under which C-Corporations face these taxes, including the importance of retained earnings thresholds and the implications for personal service corporations. Nick simplifies these complex concepts by discussing the rationale behind the tax rules and how corporations can navigate these additional tax burdens by managing retentions and distributions of earnings. He also demystifies the criteria that define a personal holding company and its tax repercussions, providing practical insights into tax planning and corporate structure optimization.

This video and the rest on this topic are available with any paid plan.

See Pricing