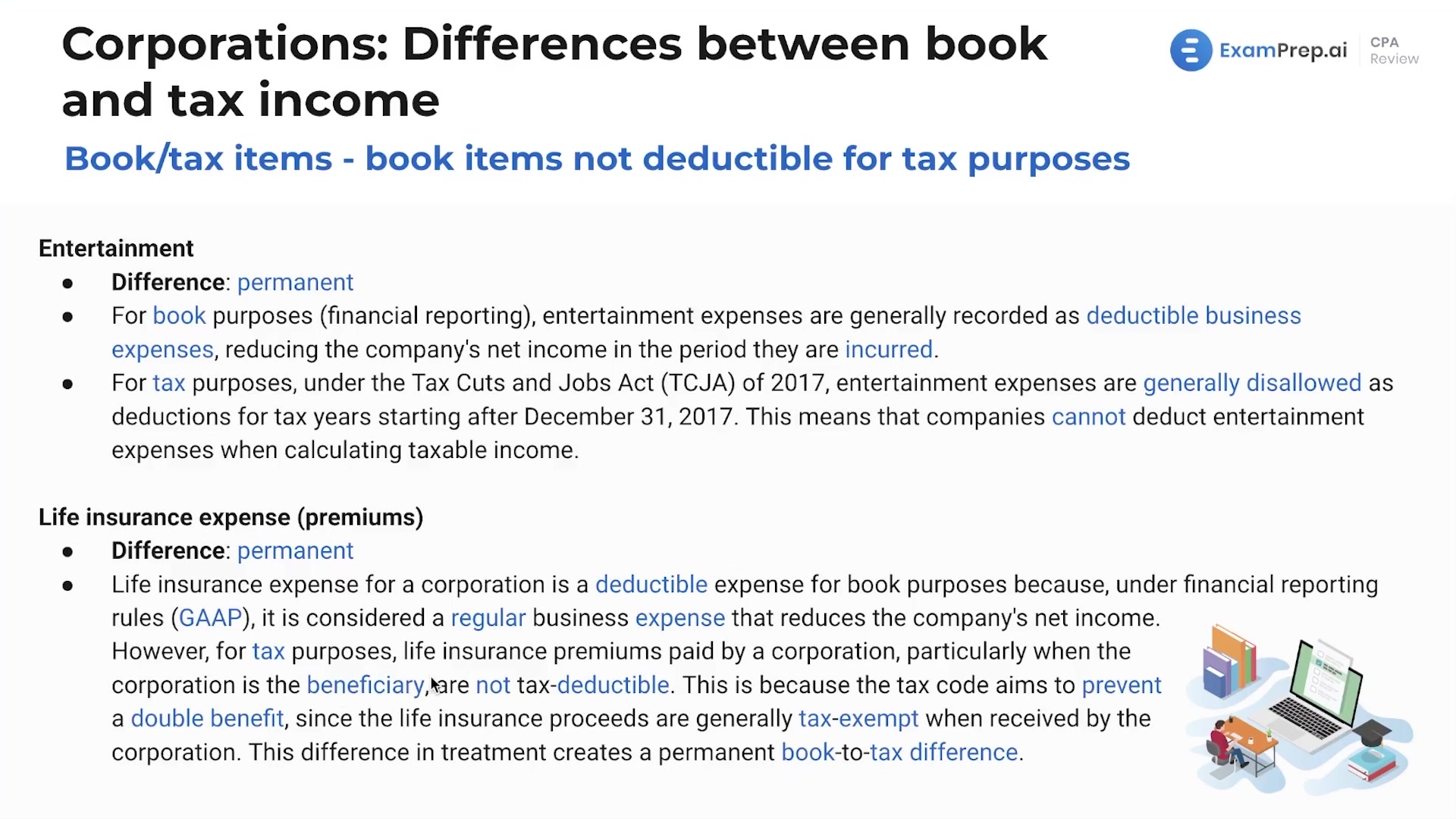

In this lesson, Nick Palazzolo, CPA, dives into the nuances of tax accounting by explaining the differences between book and tax deductible items. He walks through specific cases such as penalties, fines, lobbying expenses, and political contributions, which may be recognized differently on financial statements versus tax filings, leading to permanent differences. Nick also breaks down the complexities of entertainment expenses post-Tax Cuts and Jobs Act of 2017, life insurance expense premiums, net capital losses, net operating losses, and the variable treatments of R&D costs to clarify how each can create permanent or temporary differences in book versus tax financials. Throughout the lesson, he underscores the importance of understanding these distinctions for accurate tax reporting and emphasizes the rationale behind why certain expenses are handled differently in financial reporting compared to tax filings.

This video and the rest on this topic are available with any paid plan.

See Pricing