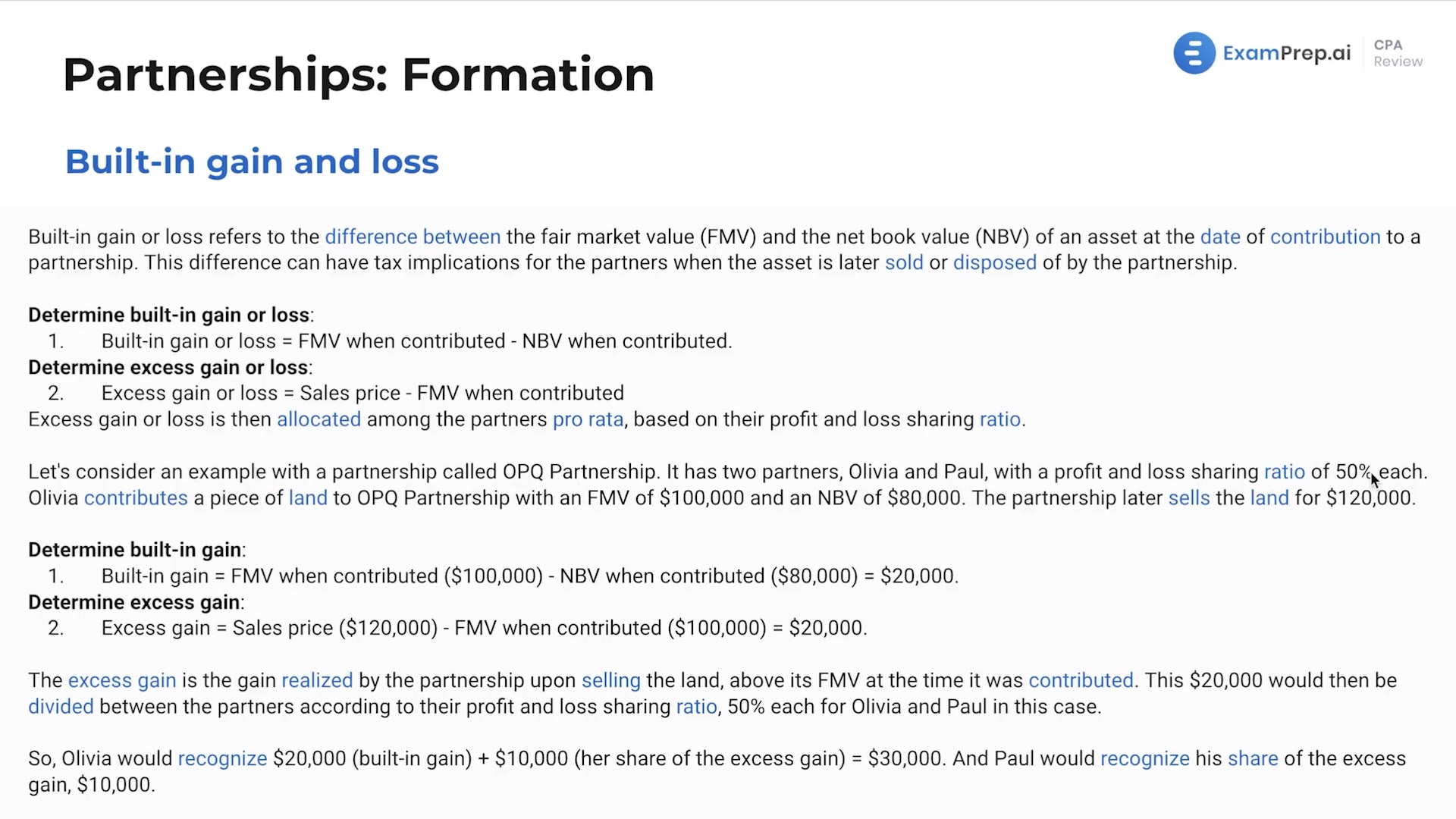

In this lesson, Nick Palazzolo, CPA, simplifies the concept of built-in gains and losses, a critical piece of understanding for handling partnership and S-corporation tax scenarios. He illustrates how the difference between the fair market value and the net book value of an asset at the date of contribution can affect taxable events upon disposition. Nick clarifies the process of calculating both the built-in and excess gains or losses and their allocation among partners. Through the use of a practical example involving a partnership called OPQ, Nick deconstructs the calculation method and demonstrates the impact on individual partners when assets are sold, offering an essential formula for breaking down this multifaceted tax concept.

This video and the rest on this topic are available with any paid plan.

See Pricing