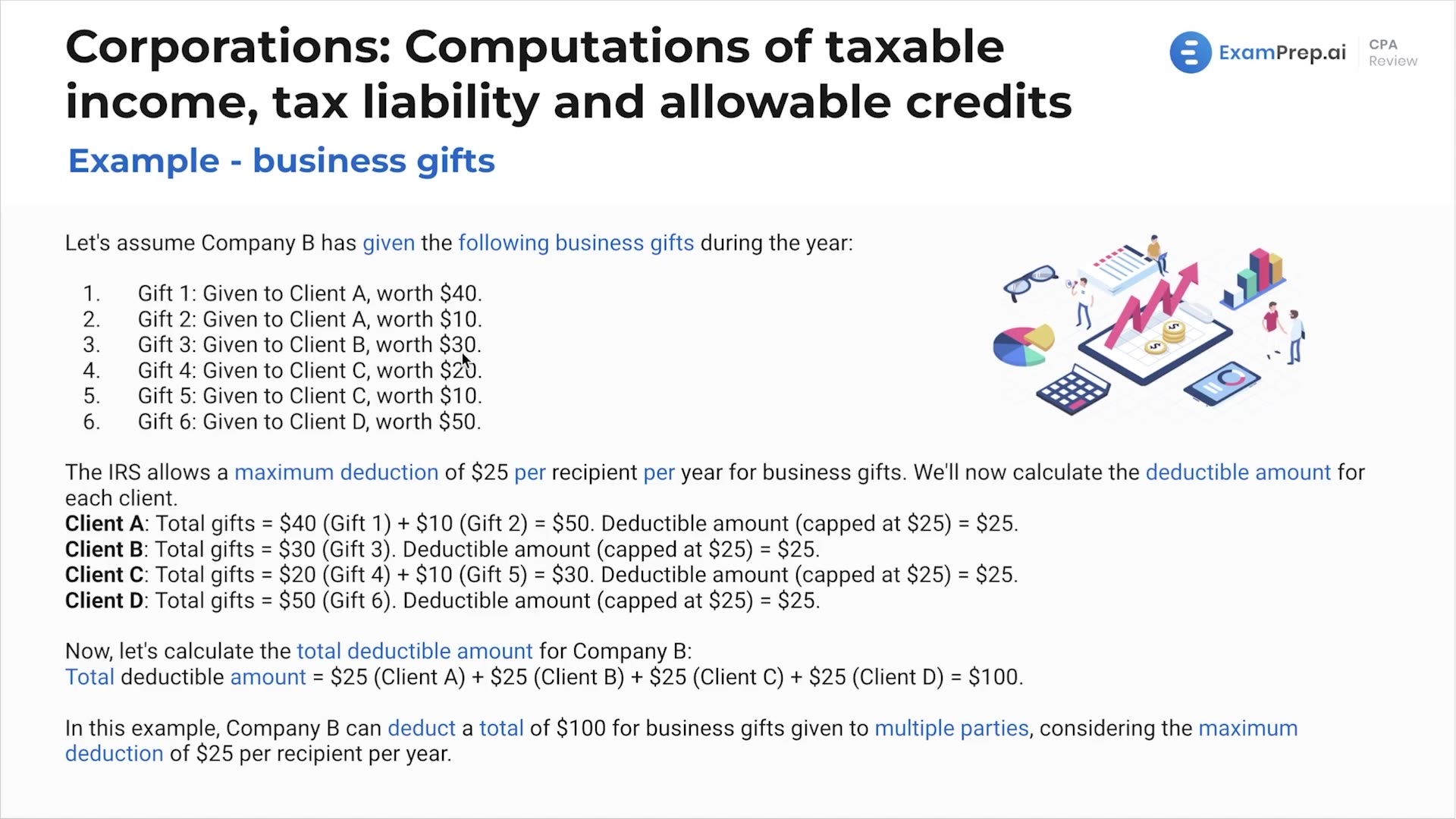

In this lesson, Nick Palazzolo, CPA, elaborates on the intricacies of accounting for business gifts in tax returns. He meticulously breaks down a scenario wherein company B distributes a range of gifts to different clients, clarifying how the IRS rule, which sets a max deduction of $25 per recipient per year, is applied in instances of multiple gifts to singular clients. Through step-by-step calculations, Nick demonstrates the deduction limits in practice, how excess amounts are non-deductible, and how to navigate various gift-giving situations to ensure proper adherence to tax regulations—all with an aim to arm you with the necessary acumen to tackle such questions effortlessly on the CPA exam.

This video and the rest on this topic are available with any paid plan.

See Pricing