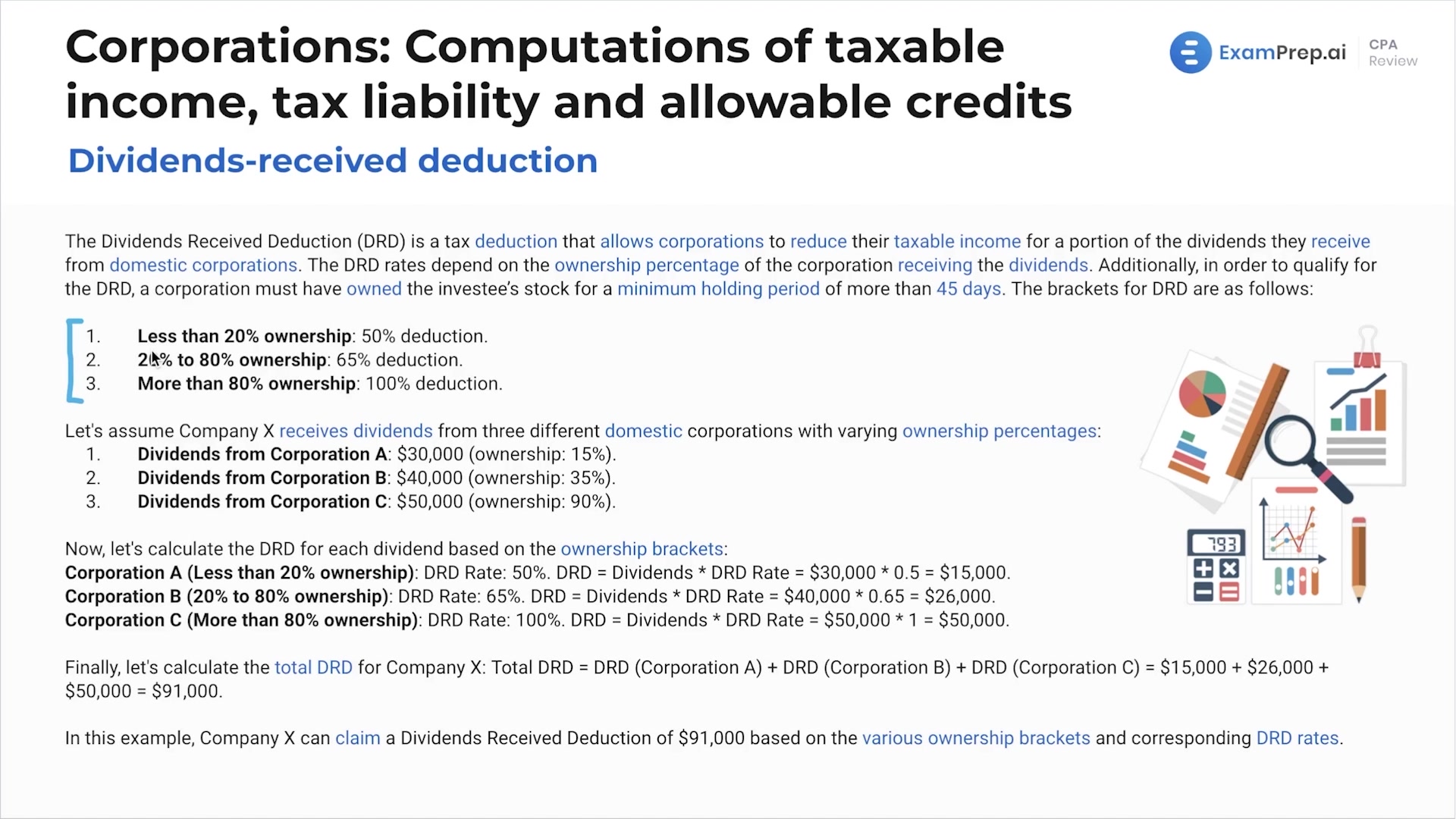

In this lesson, Nick breezes through the intricacies of charitable contributions and the dividends received deduction (DRD), key concepts in U.S. federal tax law crucial for C corporations. He clarifies the limitations and carryforward provisions related to charitable contributions, making sure to unravel the nuances through practical examples. As for the DRD, Nick dives deep into the varying deduction rates based on corporate ownership percentages, illustrating the computation through engaging scenarios. He demonstrates how these deductions affect a corporation's taxable income, emphasizing the importance of distinguishing between the actual deduction amount and the adjusted taxable income post-DRD. With a keen focus on preparing for real-world application, Nick reinforces the relevance of mastering these concepts for exam success, handholding through complex calculations with the ease and confidence of an expert guide.

This video and the rest on this topic are available with any paid plan.

See Pricing