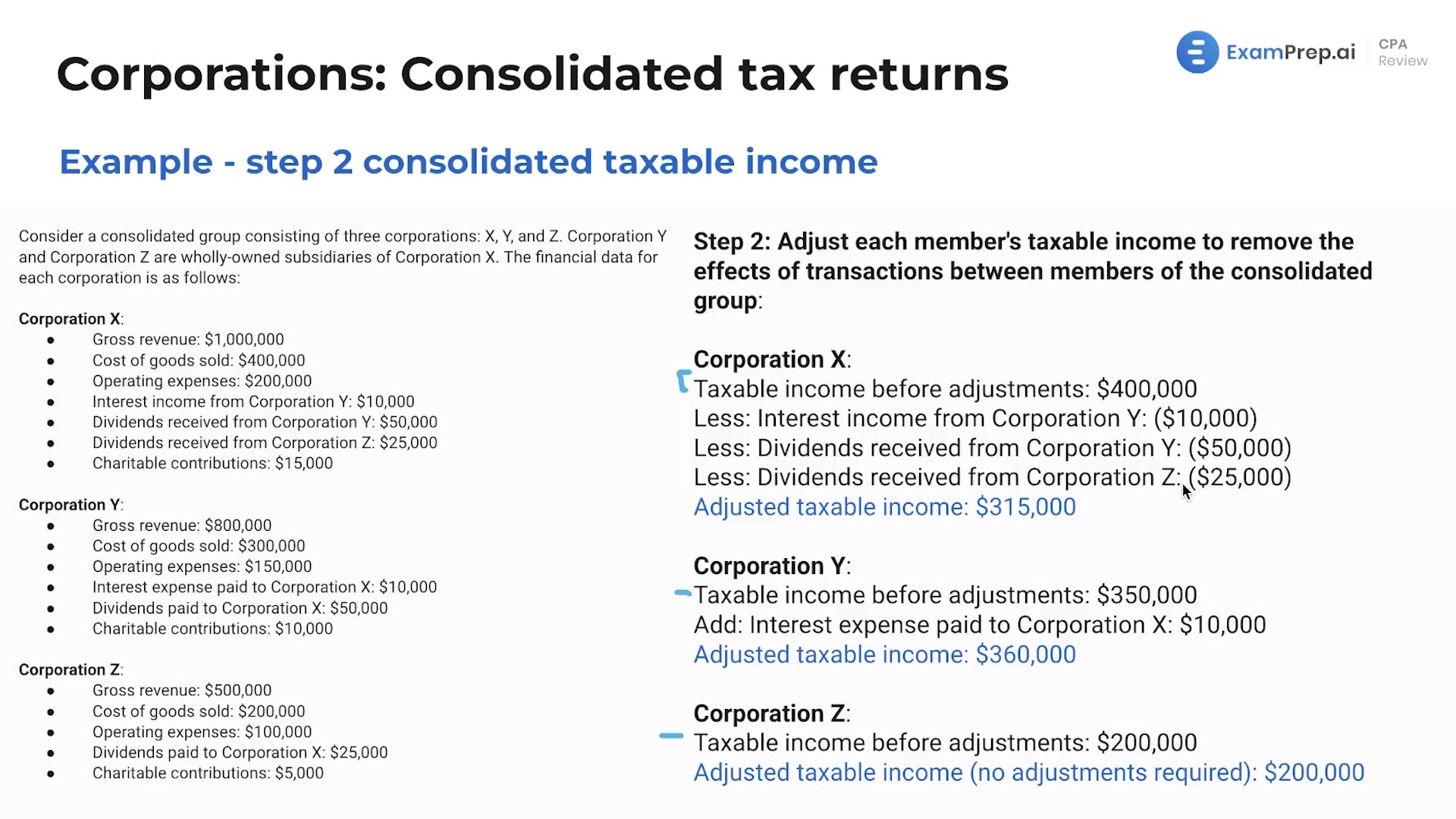

In this lesson, Nick Palazzolo, CPA, unpacks the intricacies of calculating consolidated taxable income—a fundamental concept for corporations with multiple entities. Dive deep into the step-by-step process used to adjust and combine the taxable incomes of individual group members to arrive at consolidated figures. Nick diligently works through practical examples, ensuring that the complex operations such as eliminating intercompany transactions, deferring gains and losses, and incorporating specific adjustments at the consolidated level become clear. By the end of this walkthrough, Nick's thorough explanation equips you with a strong foundation to tackle similar scenarios, which could emerge as simulation questions or multiple-choice queries on the exam.

This video and the rest on this topic are available with any paid plan.

See Pricing