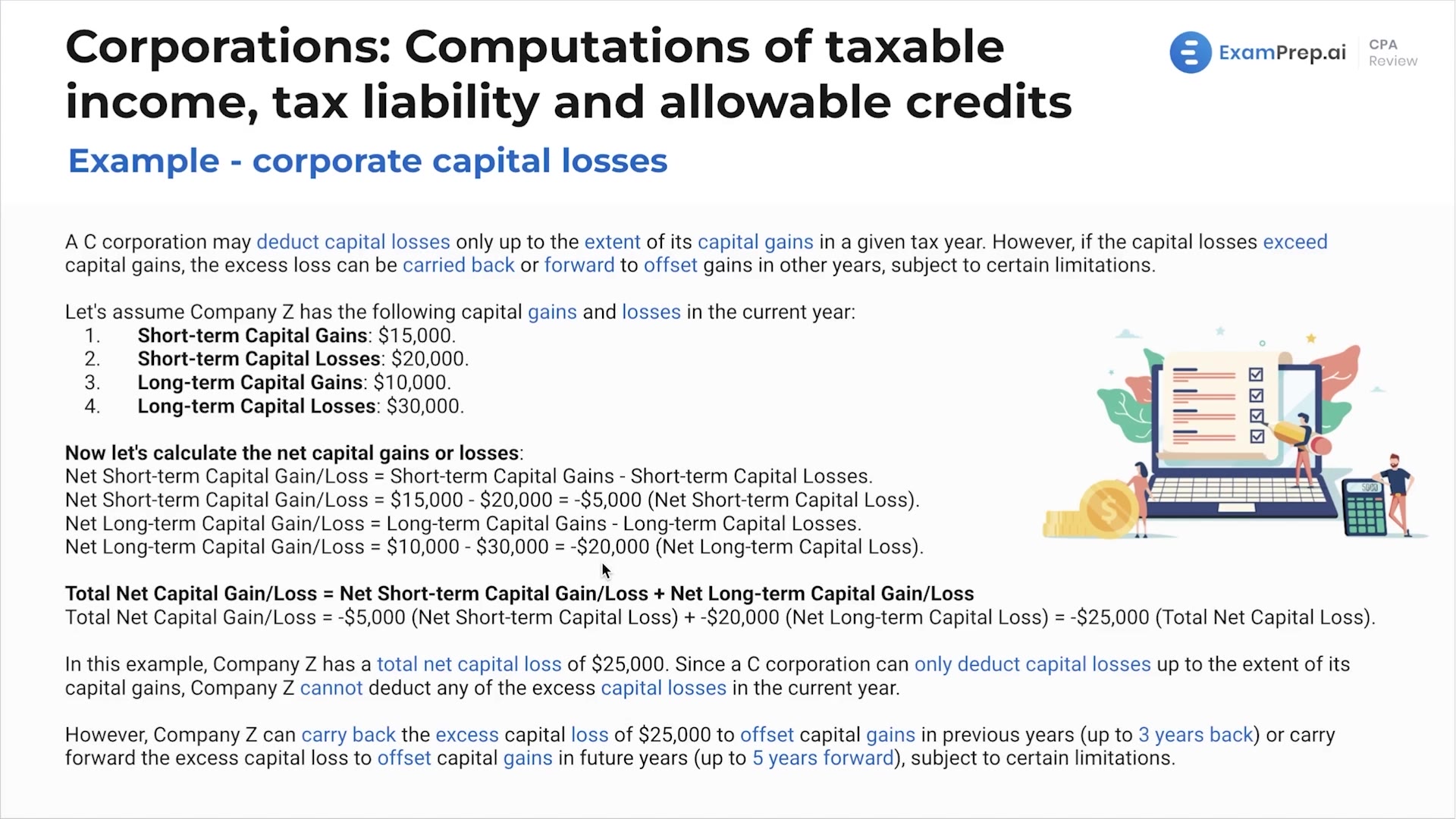

In this lesson, Nick Palazzolo, CPA, breaks down the intricacies of handling corporate capital losses for C corporations. He explains that while these entities can deduct capital losses only to the extent of their capital gains, there's an option to carry excess losses back three years or forward five years. With Nick's characteristic love for learning through examples, a detailed walkthrough provides clarity on how to net short-term and long-term gains and losses, ultimately demonstrating how to calculate and apply total net capital losses when they exceed capital gains for the year. This application of rules provides practical insights into how C corporations can strategically manage capital losses while adhering to IRS limitations.

This video and the rest on this topic are available with any paid plan.

See Pricing