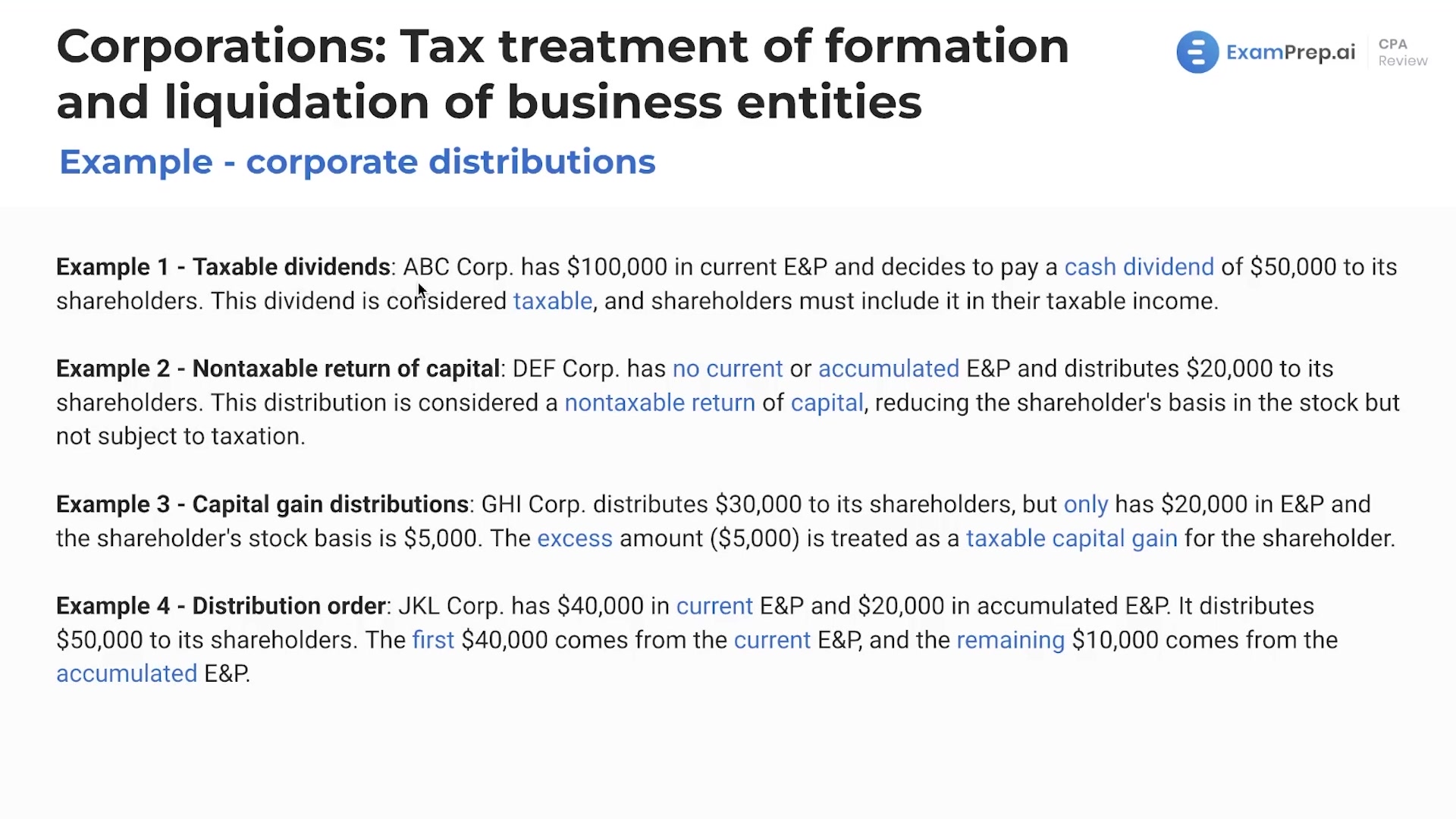

In this lesson, Nick Palazzolo, CPA, tackles the intricacies of corporate distributions, laying the groundwork for a deeper dive in future sessions. He presents the various classifications of distributions, from taxable dividends sourced from a corporation's earnings and profits, to non-taxable returns of capital which hinge on a shareholder's basis in their stock. Nick sheds light on how distributions devoid of available earnings and profits can transform into capital gains—a point that illustrates the importance of understanding the order of distributions. He employs an accessible bucket analogy to distill the flow of corporate distributions and their tax implications. The lesson is packed with illustrative examples, drawing a comprehensive picture of potential scenarios, including cash dividends, property distributions, and stock dividends, making sure that every piece of information is well-absorbed and retained.

This video and the rest on this topic are available with any paid plan.

See Pricing