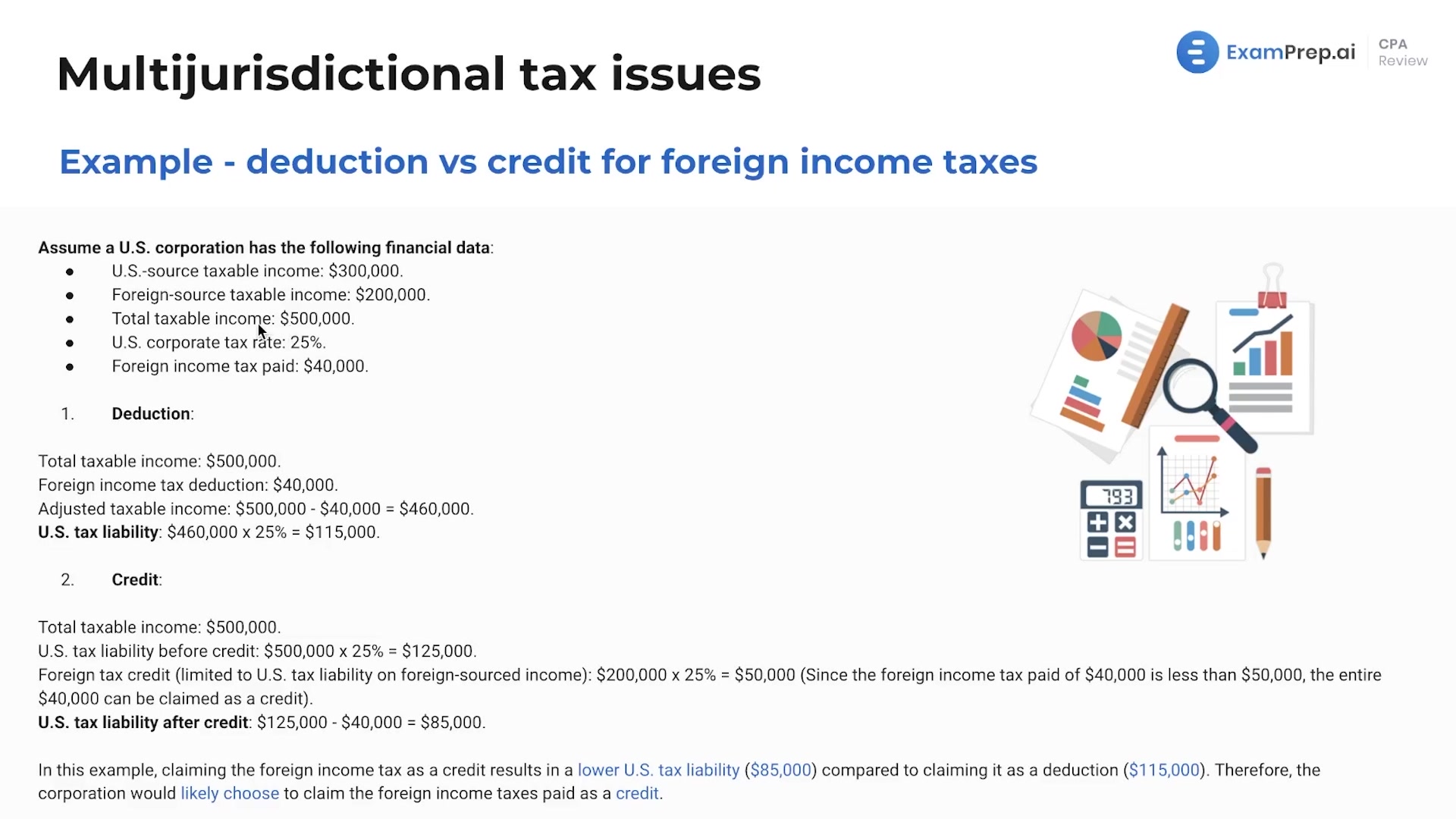

In this lesson, gain insight into the intricacies of corporate foreign income taxes with Nick Palazzolo, CPA. Understand the critical decision-making involved when a U.S. corporation taps into foreign markets and encounters the complexity of taxation by both the U.S. and foreign governments. Explore the options available for these corporations to mitigate double taxation: choosing to claim foreign income taxes paid as either a deduction or a credit. Nick breaks down the benefits of each option with clear examples, clarifying how deductions can reduce taxable income and how credits can decrease the tax liability dollar for dollar. He walks through an example calculation to demonstrate the potential tax savings, elucidating why corporations often find the credit option more favorable in reducing the overall tax burden.

This video and the rest on this topic are available with any paid plan.

See Pricing