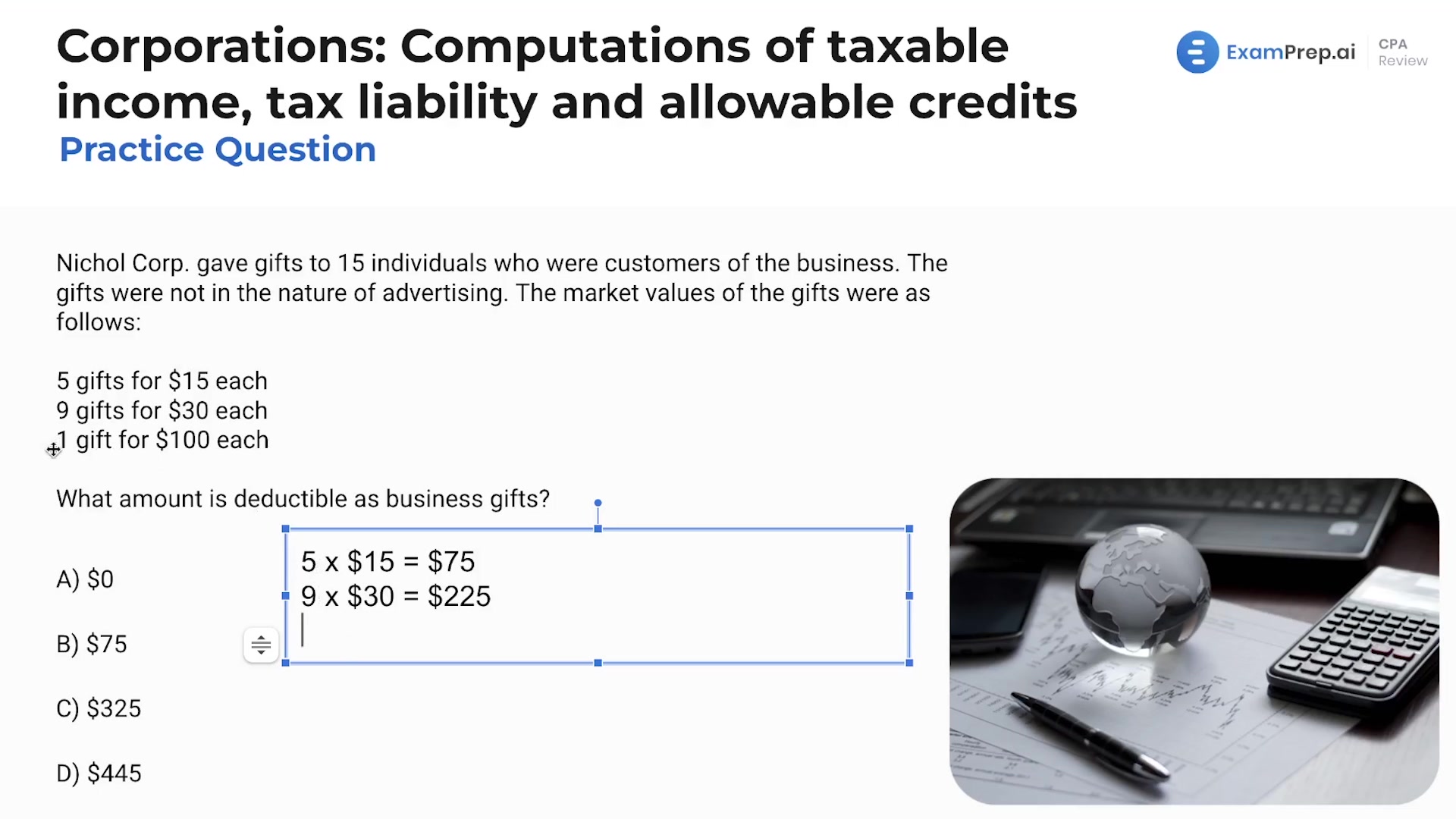

In this lesson, Nick Palazzolo, CPA, delves into the intricacies of calculating a corporation's taxable income, tax liability, and the various credits that can be applied. Using practical multiple-choice questions, he explains the limits on the deductibility of business gifts, highlighting the IRS rule of a maximum $25 deduction per recipient per year. He breaks down examples to discuss how to choose the lesser value between actual cost and the IRS limit. He also clarifies the calculation of the maximum allowable deduction for charitable contributions, underlining the importance of understanding the 10% rule based on income before specific deductions. Throughout the lesson, Nick emphasizes attention to detail, such as regarding the timing of deductions and distractor information, ensuring a thorough grasp of these critical concepts for accurate computation on corporate taxes.

This video and the rest on this topic are available with any paid plan.

See Pricing