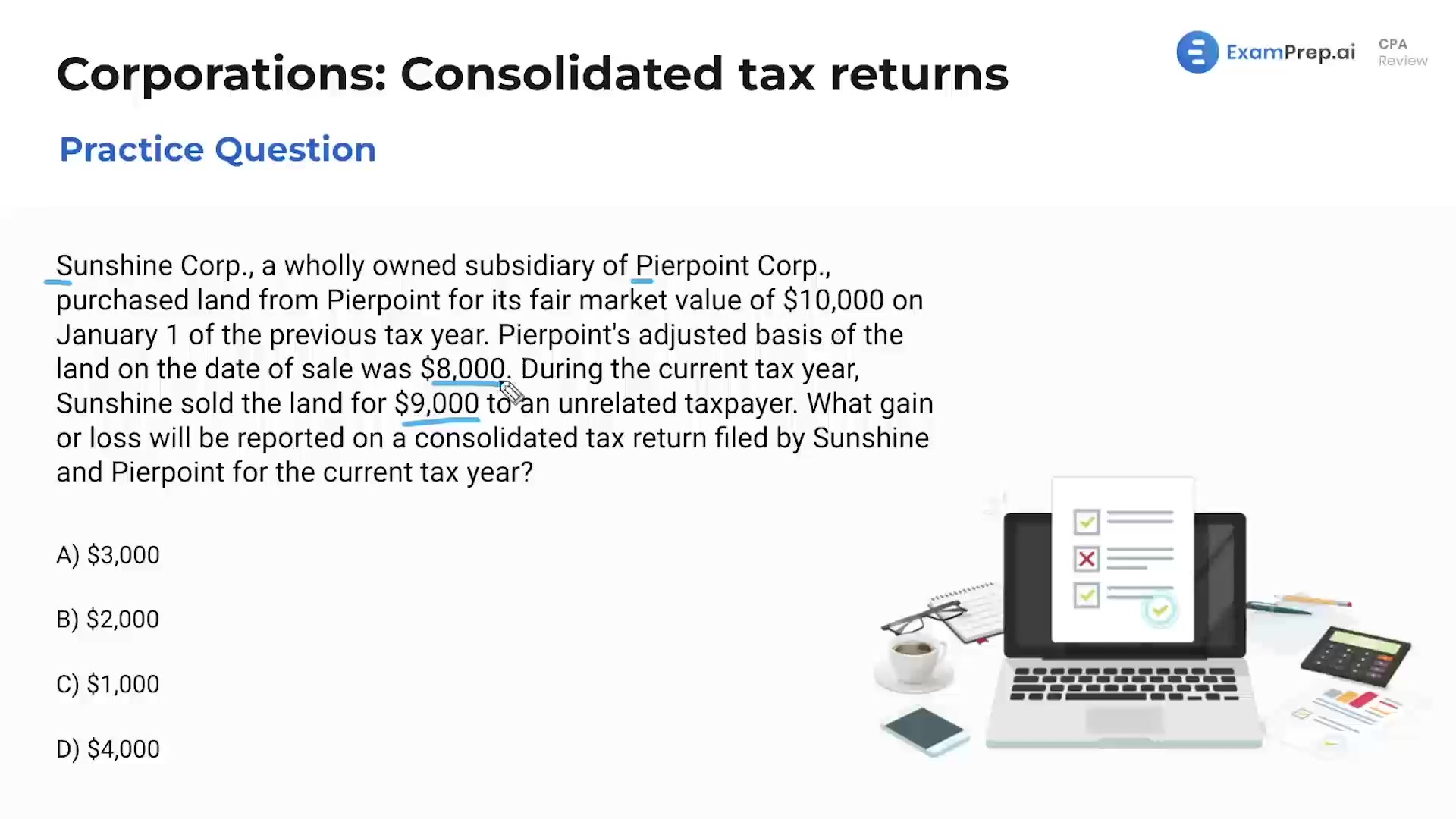

In this lesson, Nick Palazzolo, CPA, dives into the nitty-gritty of consolidated tax returns, starting with a complex multiple-choice question that deals with the recognition of gain or loss on a consolidated return when involving parent-subsidiary transactions. He breaks down the nuances of basis adjustments in related party transactions, highlighting the implications for tax recognition when assets are sold to unrelated taxpayers. Nick then walks through a series of statements about elections to file consolidated tax returns, debunking common misconceptions and providing a clear-cut explanation of intercompany gains elimination and liability sharing among group members. Engaging with common exam question pitfalls, Nick ensures that the intricacies of consolidated tax filings are made clear, leaving no stone unturned in preparing for these types of questions.

This video and the rest on this topic are available with any paid plan.

See Pricing