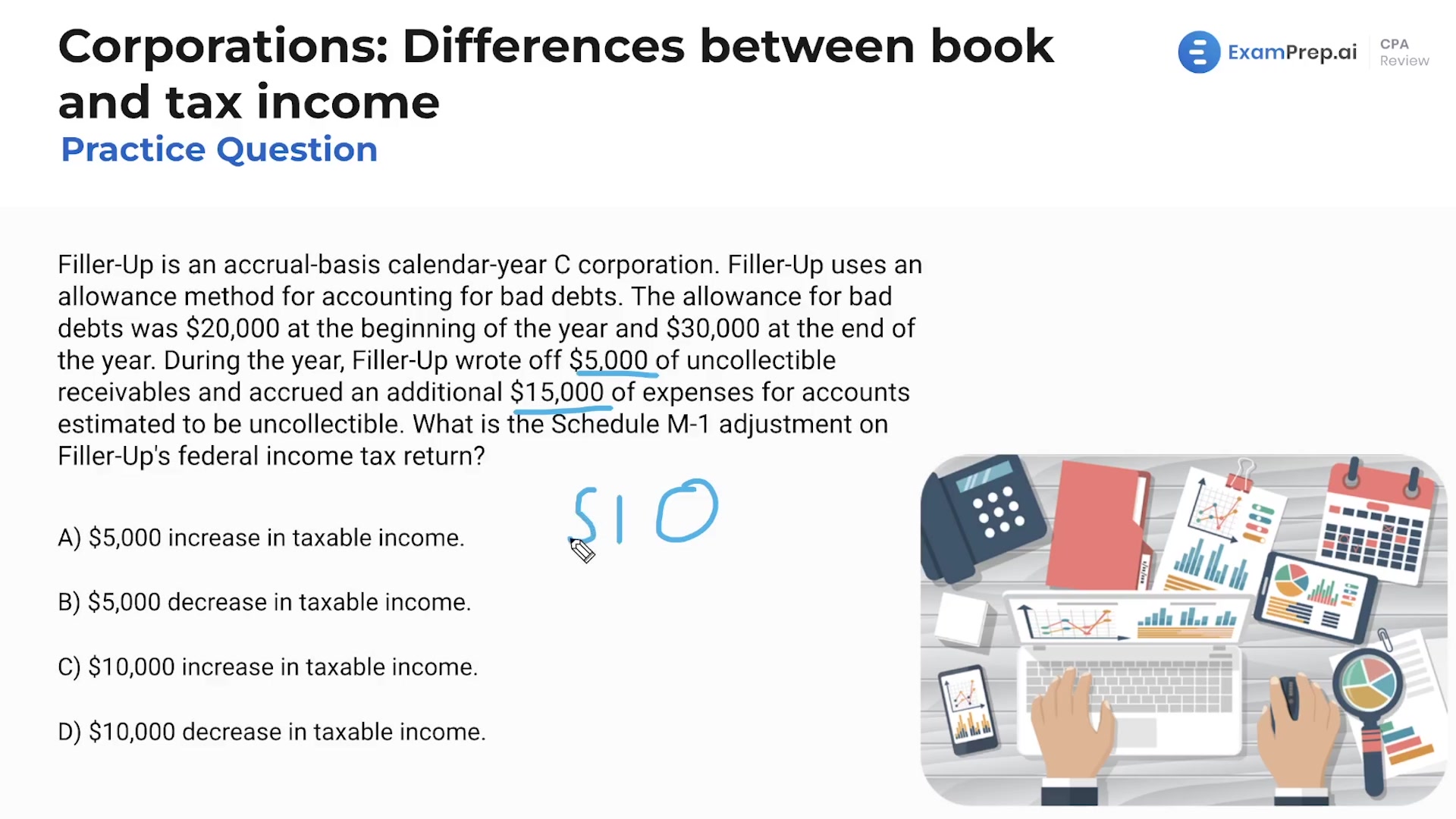

In this lesson, Nick Palazzolo, CPA, unfolds the complexities of reconciling book and tax income, specifically through the lens of Schedule M1 adjustments for a C Corporation. He methodically dissects multiple choice questions by highlighting the differences between the allowance method used in accrual accounting and the direct write-off method required for tax purposes. Nick diligently guides viewers through the intricacies of identifying permanent and temporary differences in this context, ensuring that the nuances of bad debt expense recognition are thoroughly understood. Furthermore, Nick leverages a logical approach to tackle tricky questions about the type of disclosure required on Schedule M3, demonstrating how to navigate temporary differences and understand their impact on taxable income.

This video and the rest on this topic are available with any paid plan.

See Pricing