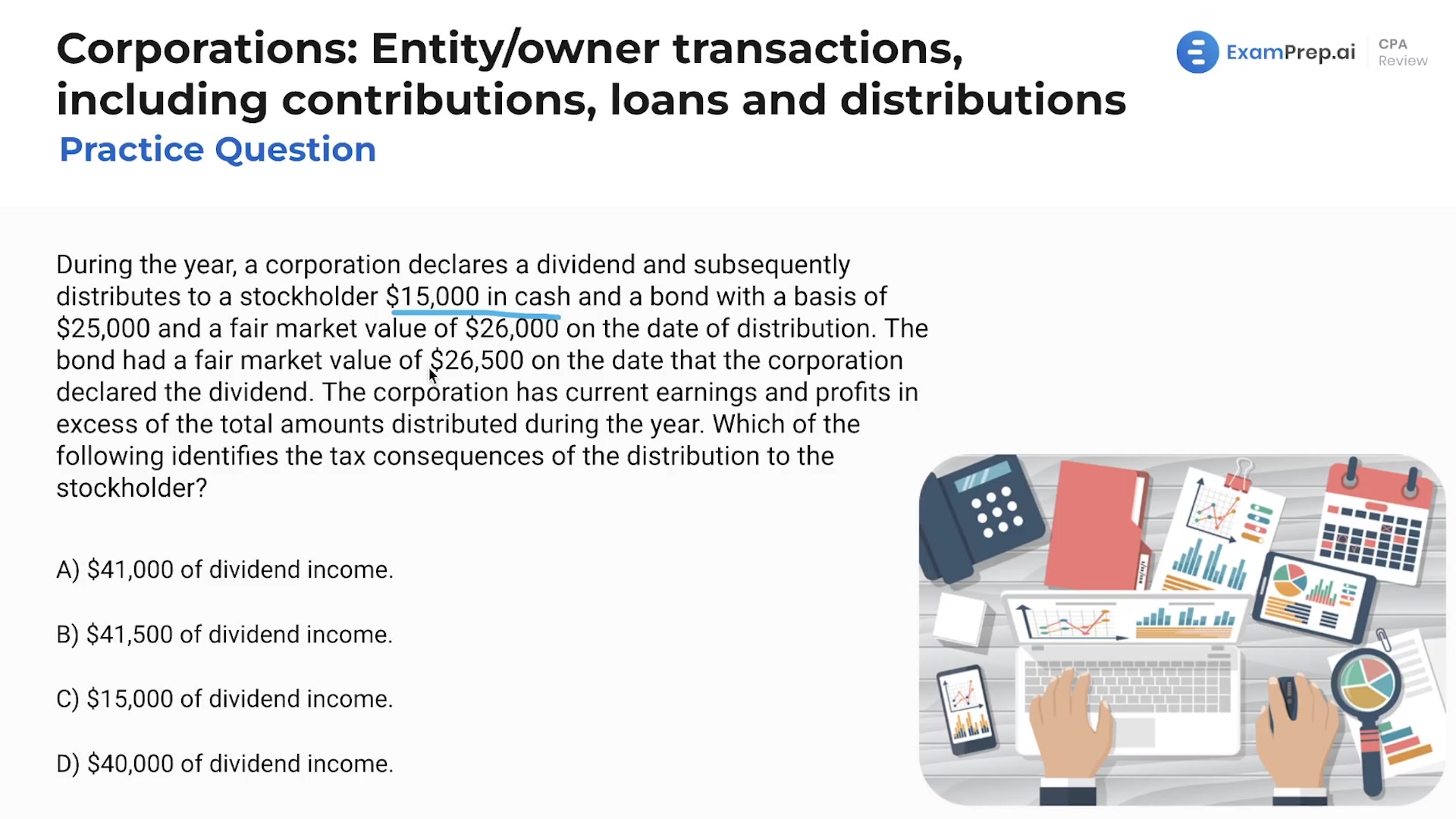

In this lesson, Nick Palazzolo, CPA, helps unravel the complexities of entity/owner transactions, with a focus on corporate distributions and their tax implications. Nick begins by working through a question about the tax consequences of different forms of distribution to shareholders, such as cash and bonds. He clarifies how the value of such distributions is determined for tax purposes, emphasizing the practical aspects of what is actually received by the shareholder. Moving on, he tackles a trickier situation involving the distribution of land and the intricacies of non-recourse liabilities, showing how to calculate the corporation's recognized gain in the process. Throughout, Nick's explanations bring clarity to the often-confusing topic of corporate distributions, equipping you with the knowledge to tackle similar questions with confidence.

This video and the rest on this topic are available with any paid plan.

See Pricing