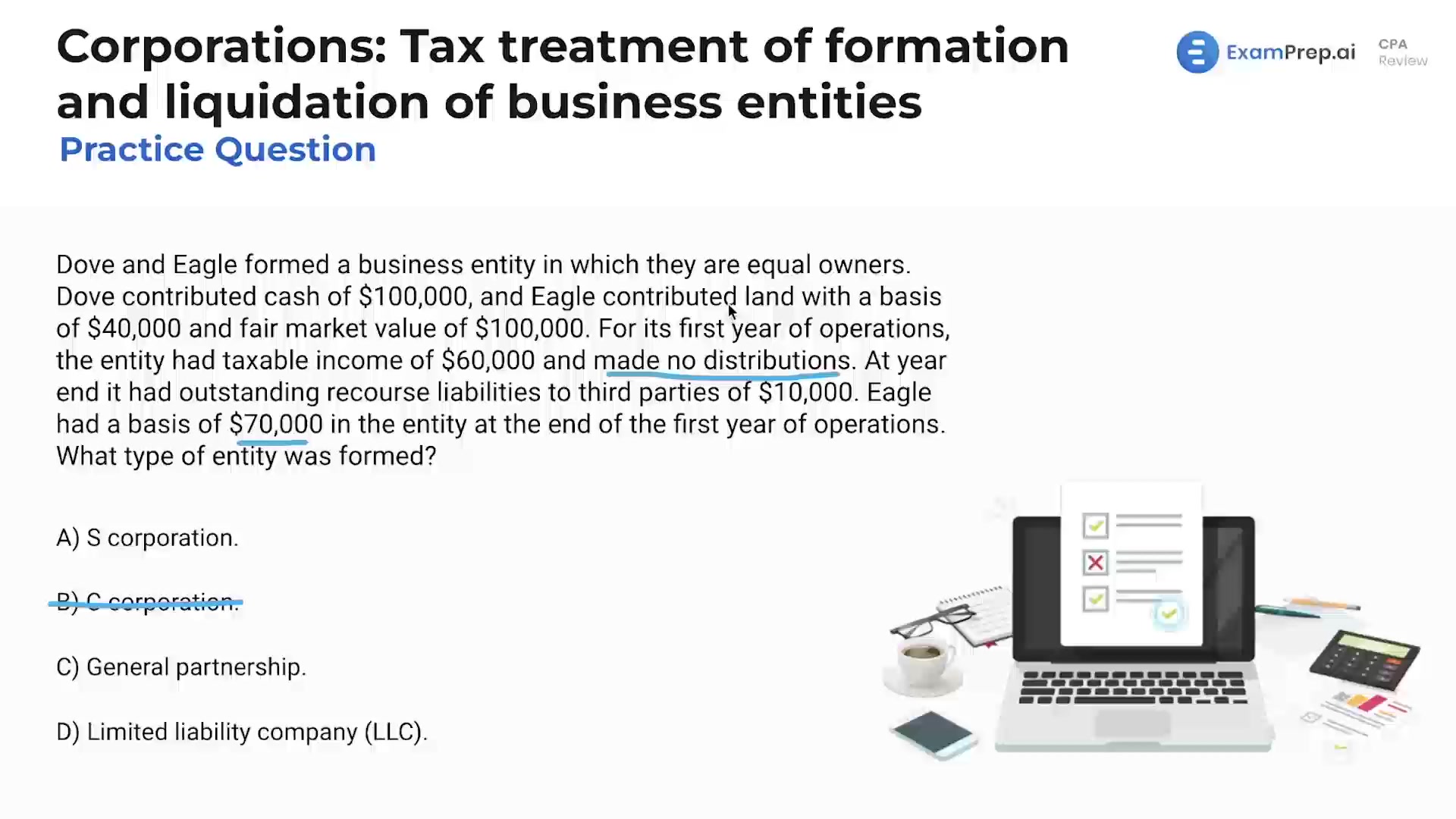

In this lesson, Nick Palazzolo, CPA, dives deep into the taxation nuances associated with various business entities through a series of practice multiple-choice questions focused on corporations' formation and liquidation scenarios. He methodically deconstructs each question, assisting with the decision-making process by eliminating implausible options and justifying the selection of the correct entity type based on specific situations presented. With detailed explanations, Nick breaks down the intricacies of basis adjustments in C-corps and S-corps, and the impact of income, contributions, and distributions for each entity type. This approach not only reinforces the technical knowledge but also hones critical thinking skills beneficial for tackling similar questions on the exam.

This video and the rest on this topic are available with any paid plan.

See Pricing