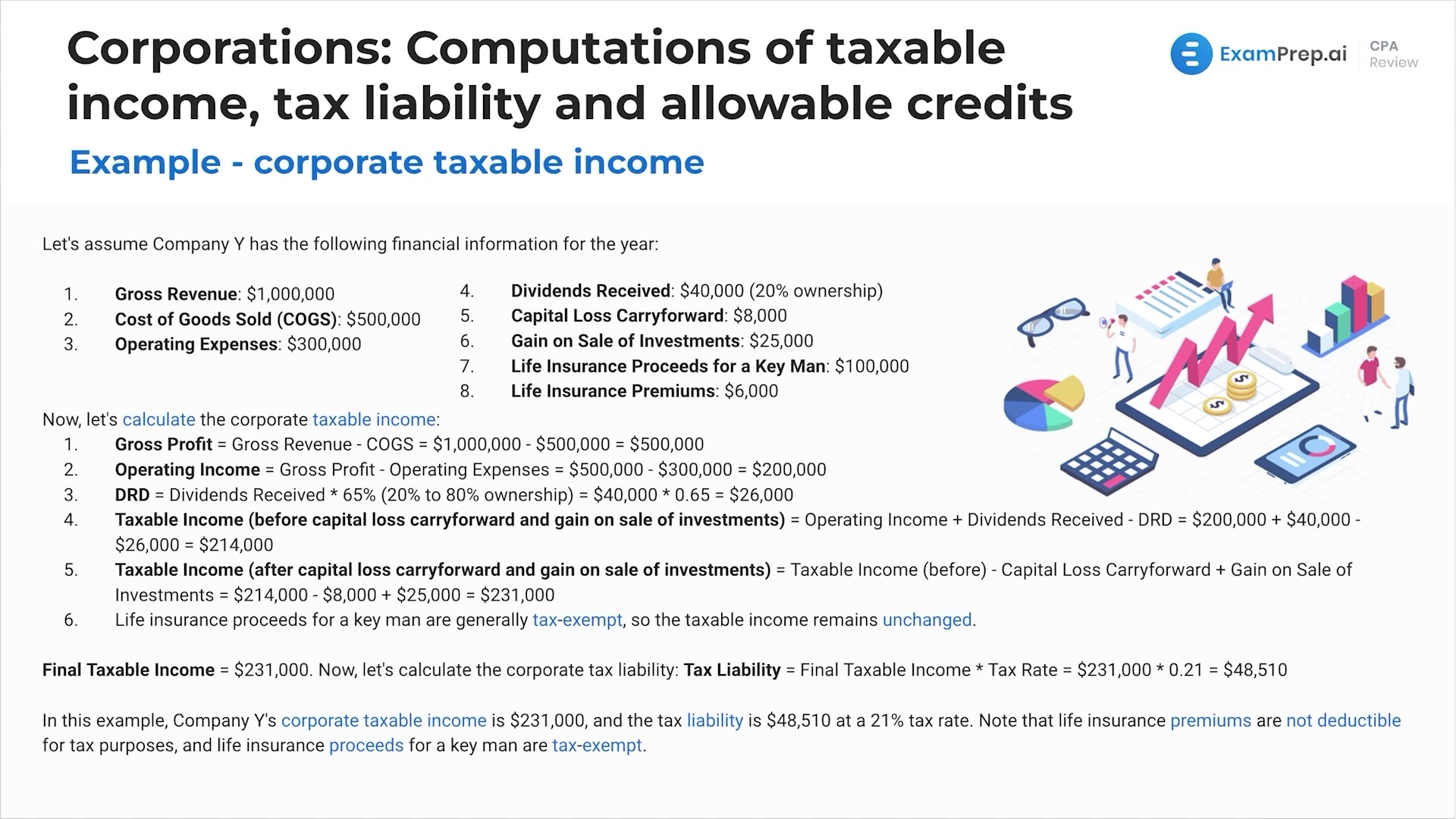

Dive deep into the intricacies of corporate taxable income with Nick Palazzolo, CPA, as he walks through a comprehensive example involving company Y. Beginning with the basics such as gross profit and operating income, Nick meticulously moves through the various stages of calculating taxable income, highlighting the treatment of dividends received deduction (DRD) based on percentage ownership. He further elaborates on the importance of sequence in accounting for capital losses and gains on the sale of investments. Nick also clarifies the tax treatment of life insurance proceeds related to key personnel, ultimately leading to a clear understanding of how to compute the corporate tax liability. Equipped with practical insights and a step-by-step approach, this lesson is tailored to demystify the process of determining corporate tax obligations.

This video and the rest on this topic are available with any paid plan.

See Pricing