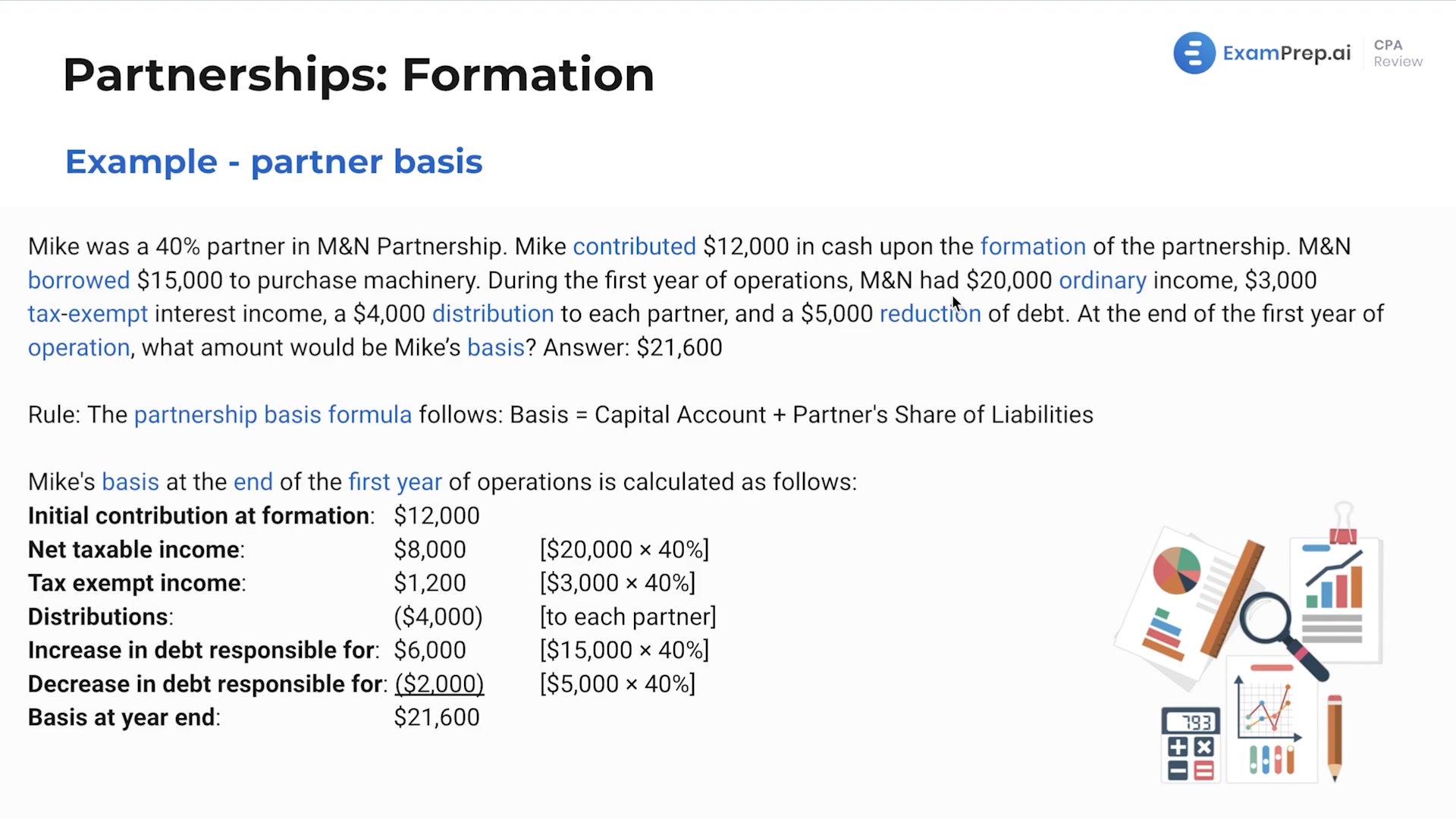

In this lesson, Nick Palazzolo, CPA, dives into the intricacies of partnership tax basics through various illustrative questions. He begins by dissecting what constitutes a partner's initial basis in a partnership by examining contributions of cash and property, introducing terms like adjusted basis and liability allocation. He further elaborates on how basis fluctuates with changes in liabilities and ownership percentage, using examples to make sense of these complex transactions. Then, Nick navigates the convolutions of built-in gains or losses when a partner contributes property to the partnership, and how gains are allocated upon sale, reflecting the allocations both to the contributing partner and others. Lastly, he challenges you with a scenario involving the sale of stock to a partnership, emphasizing the differences between realizing and recognizing losses and understanding the caps on capital loss deductions. This lesson provides not just answers but fosters a deeper comprehension on how different factors affect a partner's basis, crucial for wrangling partnership taxation challenges.

This video and the rest on this topic are available with any paid plan.

See Pricing