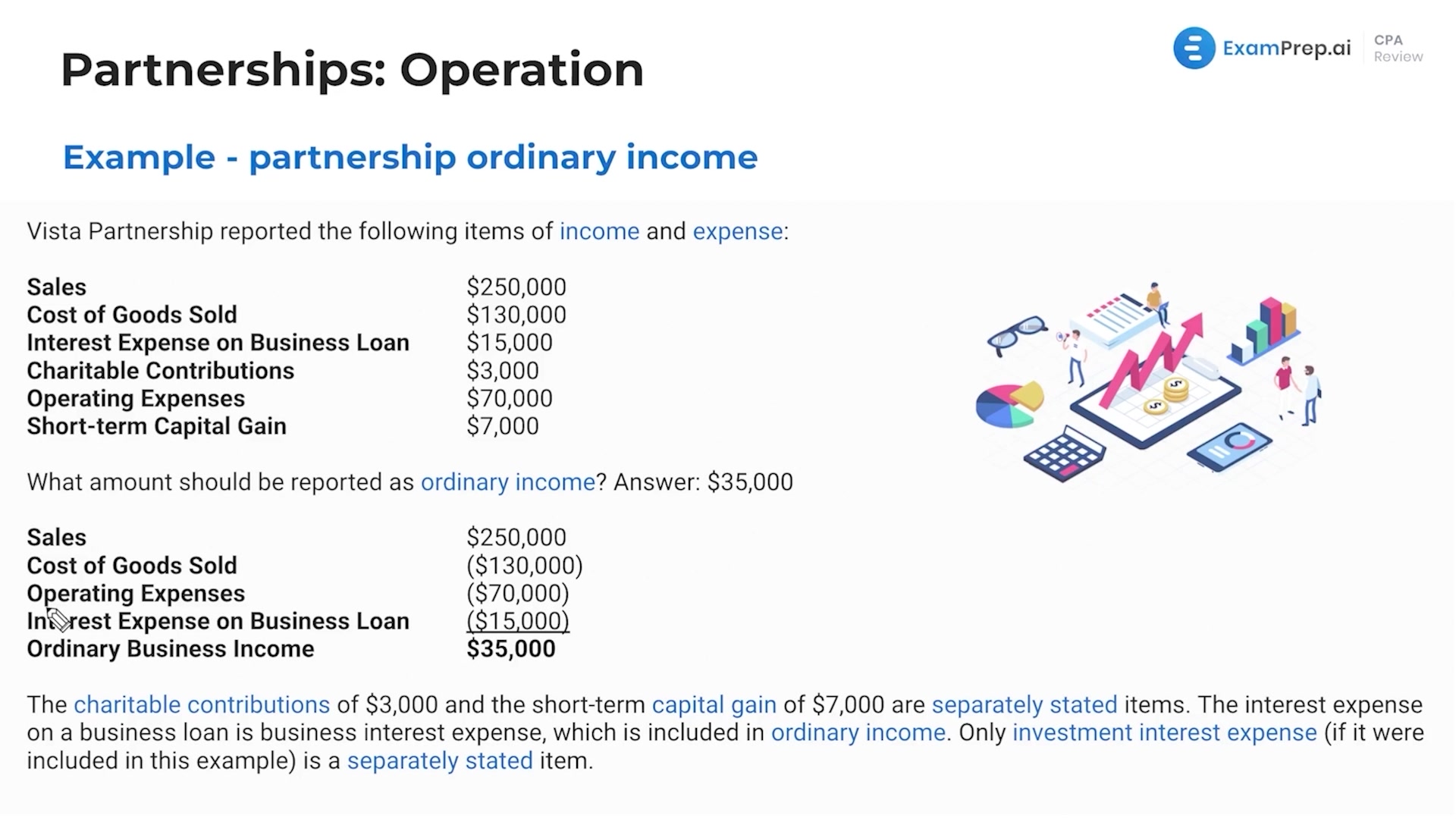

In this lesson, follow Nick Palazzolo, CPA, as he dives into the complexities of partnership taxation with a variety of scenarios honing in on practical examples. Nick starts by breaking down the loss limitations based on a partner's at-risk basis, illustrating how losses beyond this limit will be carried forward. He simplifies the nuances of capital gains taxation for partners, the restrictions on offsetting passive activity losses, and the significance of a partner's adjusted basis over market value. Then Nick transitions to a discussion on how partners are taxed on undistributed income, showcasing how distributions and shares of partnership income are reported for tax purposes. He expertly navigates through examples involving deductible losses, at-risk basis, and the intricacies of non-separately and separately stated items on tax forms. Furthermore, Nick elucidates the treatment of guaranteed payments and their impact on ordinary income and a partner's basis. Throughout the lesson, Nick keeps the pace energetic with clear, concise explanations, making complex tax concepts accessible and engaging.

This video and the rest on this topic are available with any paid plan.

See Pricing