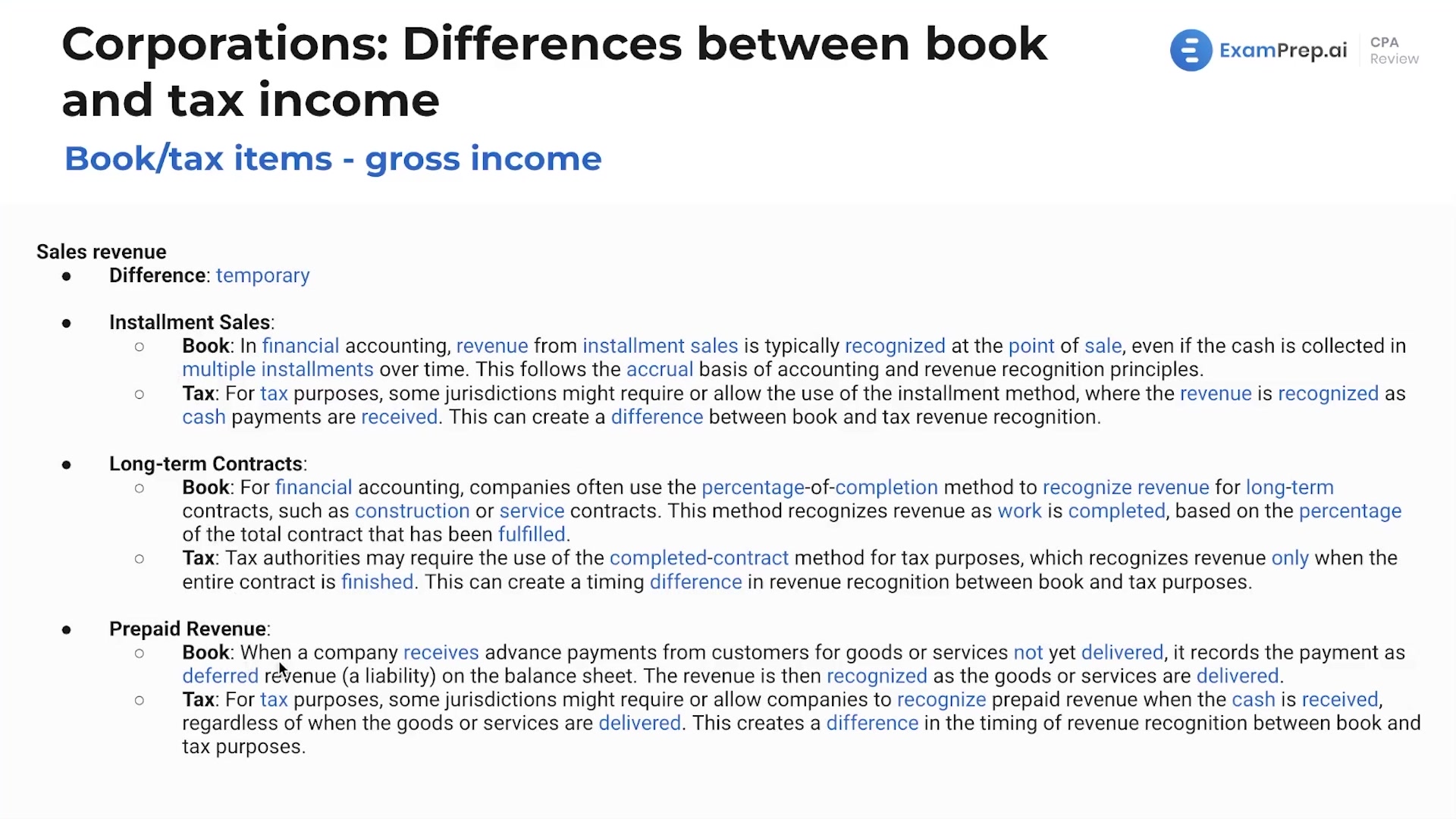

In this lesson, Nick Palazzolo, CPA, dives deep into the intricacies of gross income and its implications on book vs. tax differences, an area that often presents challenges due to its complexity. With an engaging walkthrough, Nick clarifies how common items like sales revenue, installment sales, long-term contracts, prepaid revenue, and dividend income can create temporary or permanent differences when it comes to financial and tax reporting. By providing clear examples, he crafts an understanding of how these revenues are recognized differently in the books and on tax returns, highlighting the importance of timing and the dividend received deduction (DRD). Throughout, Nick employs practical thinking and encourages drawing on prior financial knowledge to grasp the nuance of these differences and their eventual convergence in both bookkeeping and taxation scenarios.

This video and the rest on this topic are available with any paid plan.

See Pricing