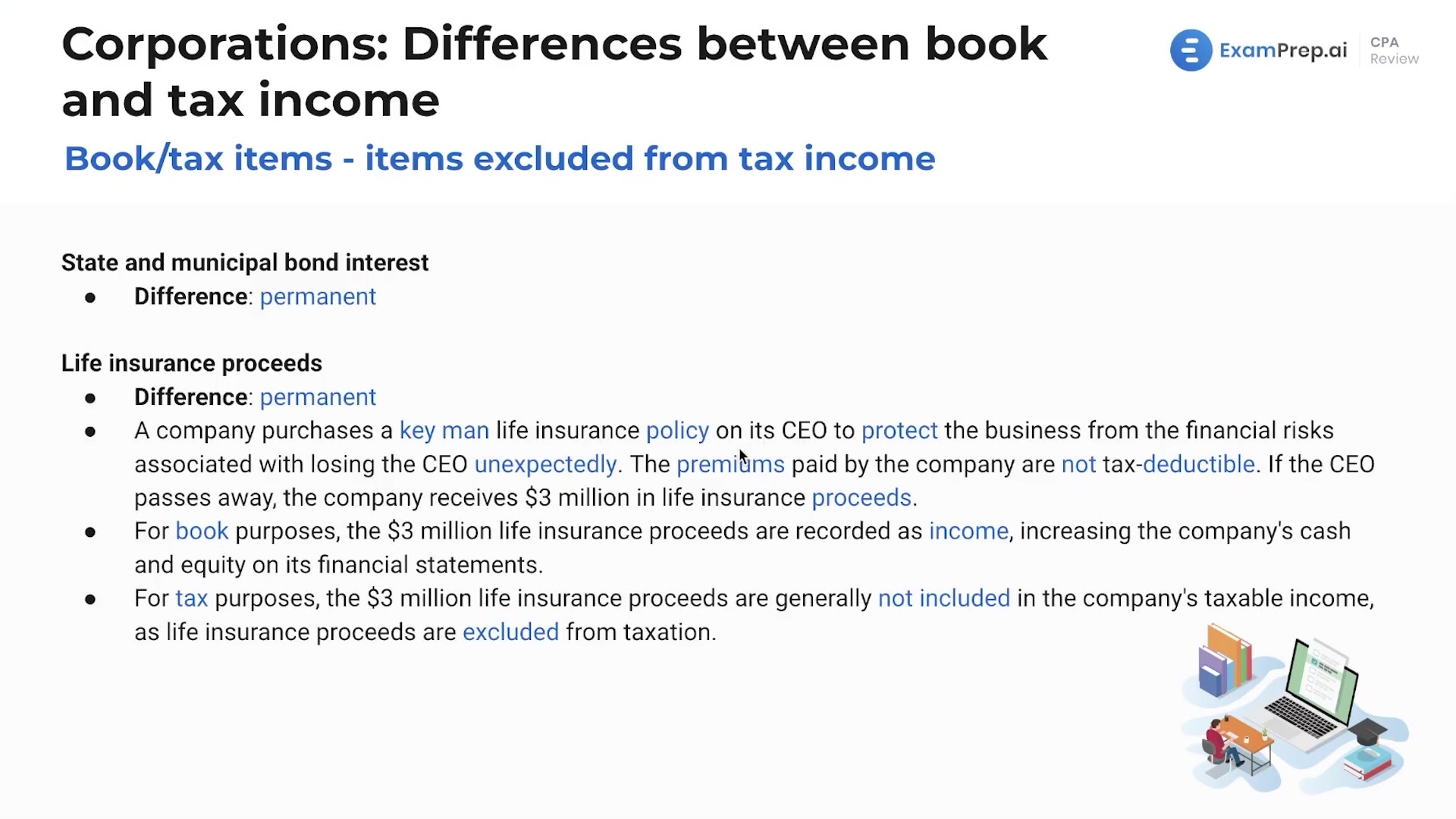

In this lesson, Nick Palazzolo, CPA, breaks down specific types of income that are exempt from being taxed. He zeroes in on the intricacies of state and municipal bond interest, classifying it as a permanent difference to remember. Then he delves into life insurance proceeds, particularly how they impact corporate taxation when a policy is taken on a key executive like a CEO. Nick explains the rationale behind these exemptions, making it easier to grasp why such proceeds are not taxable. By walking through an example of a company receiving a life insurance payout, he clarifies the distinct treatment of such income for book and tax purposes, underscoring the practical implications for a business in the unfortunate event of losing a key person.

This video and the rest on this topic are available with any paid plan.

See Pricing