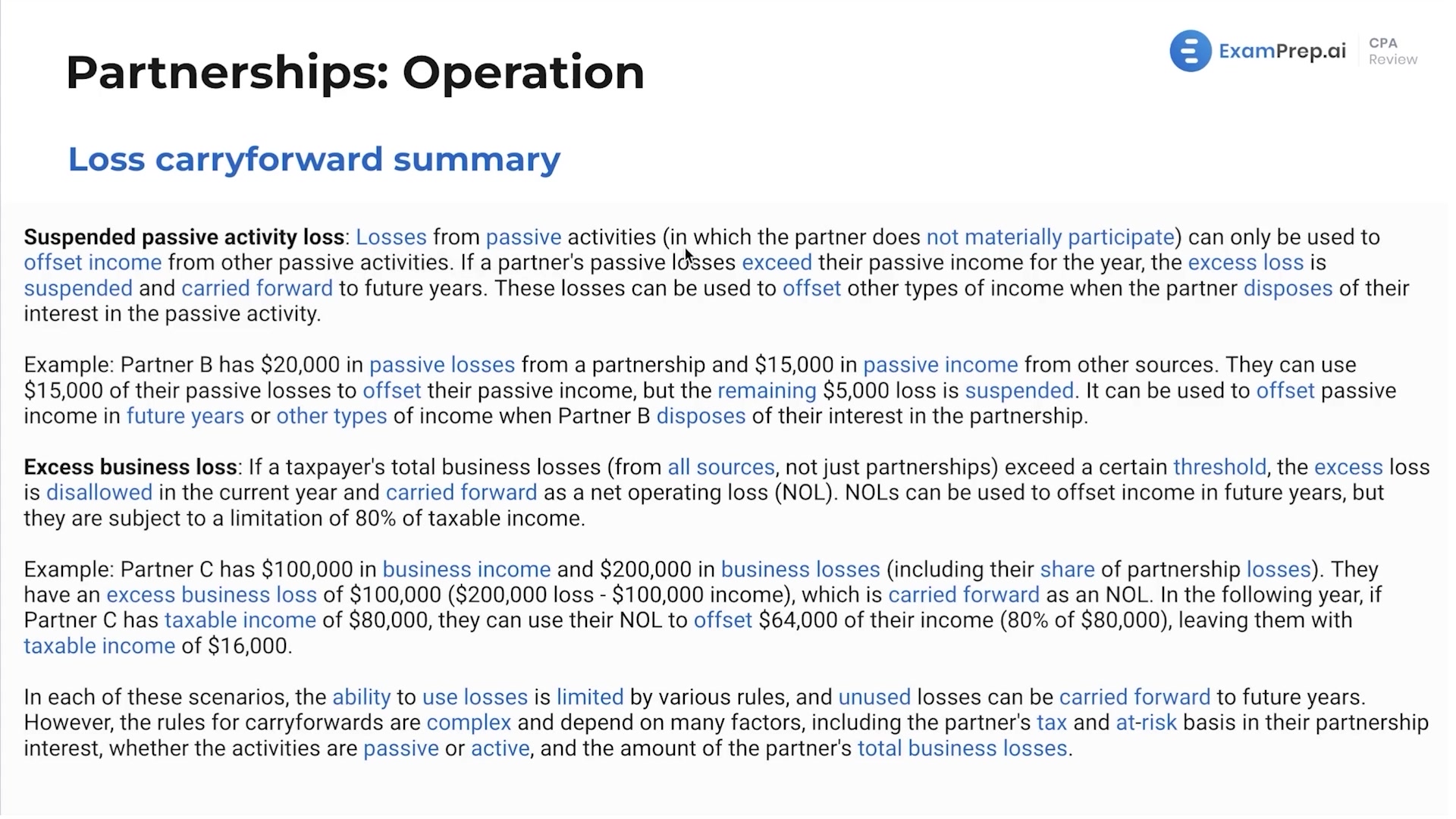

In this lesson, Nick Palazzolo, CPA, delves into the details of loss carryforwards, articulating the intricacies of navigating through suspended losses due to insufficient tax and at-risk basis in the context of partnerships. He provides clear examples to illustrate how partners may deduct losses based on their tax basis and the impacts of various loss limitations, including suspended passive activity losses which can offset other types of income upon disposition of a partnership interest. Nick further explores the nuances of excess business loss and its carryforward as a net operating loss (NOL), stressing the importance of understanding the complex interplay of the rules governing the use of such losses in future years. Throughout the lesson, Nick encourages perseverance and readiness for the taxing scenarios that the CPA exam may present.

This video and the rest on this topic are available with any paid plan.

See Pricing