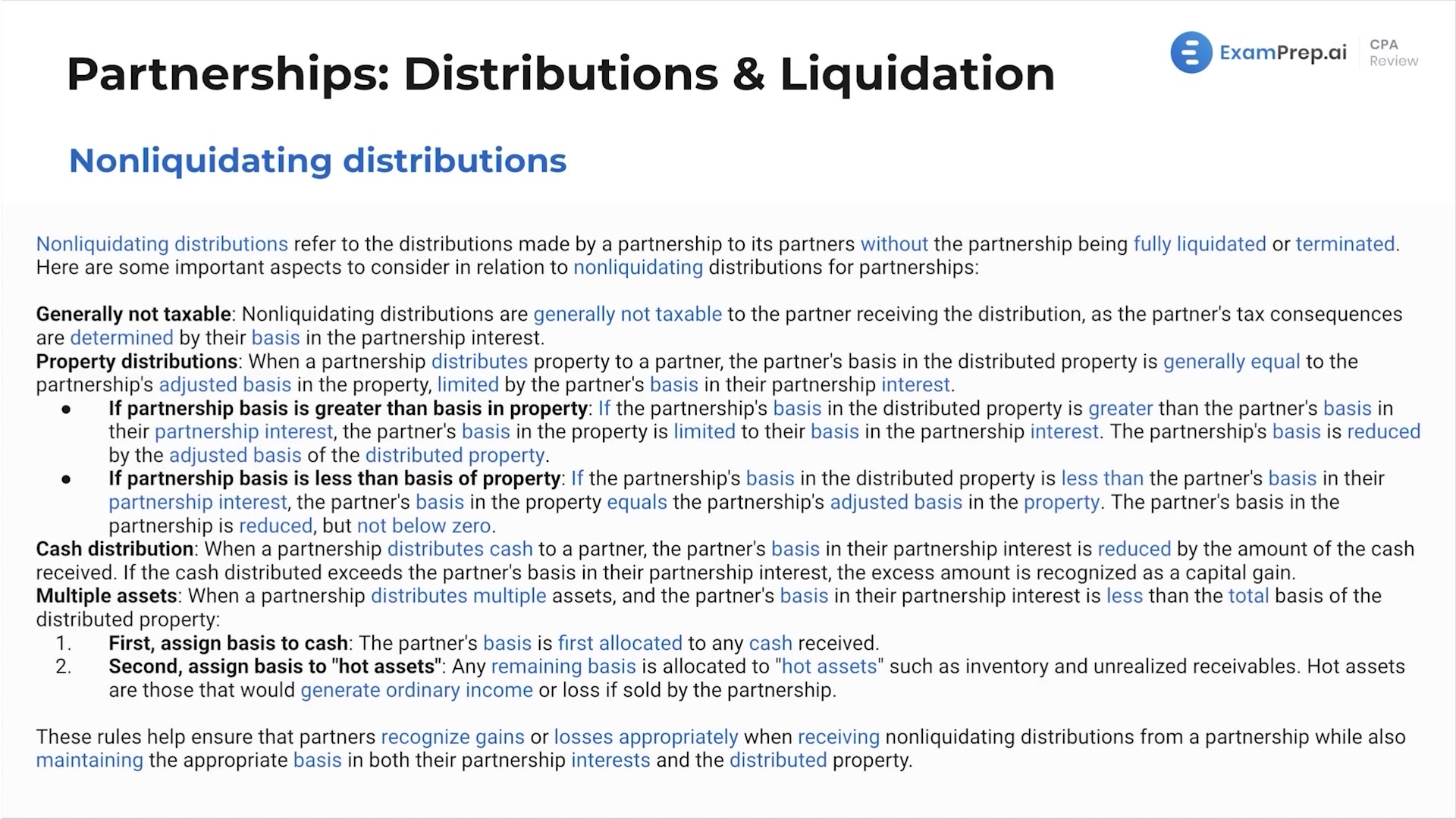

In this lesson, Nick Palazzolo, CPA, delves into the nuances of non-liquidating distributions within partnership taxation, shedding light on when and how these distributions affect a partner's tax position. He clarifies that while generally non-taxable, these distributions result in deferred gains and losses, leading to basis adjustments in the distributed assets. Nick meticulously outlines the rules governing the basis calculations for property distributions, including the limitations and reductions of the partner's interest. Furthermore, through straightforward examples, he dissects the treatment of cash distributions and the tax implications of receiving assets other than cash from the partnership. The lesson rounds up with an essential recap, offering a condensed overview to solidify the key points discussed, which serves as a vital tool for retaining the complex information presented.

This video and the rest on this topic are available with any paid plan.

See Pricing