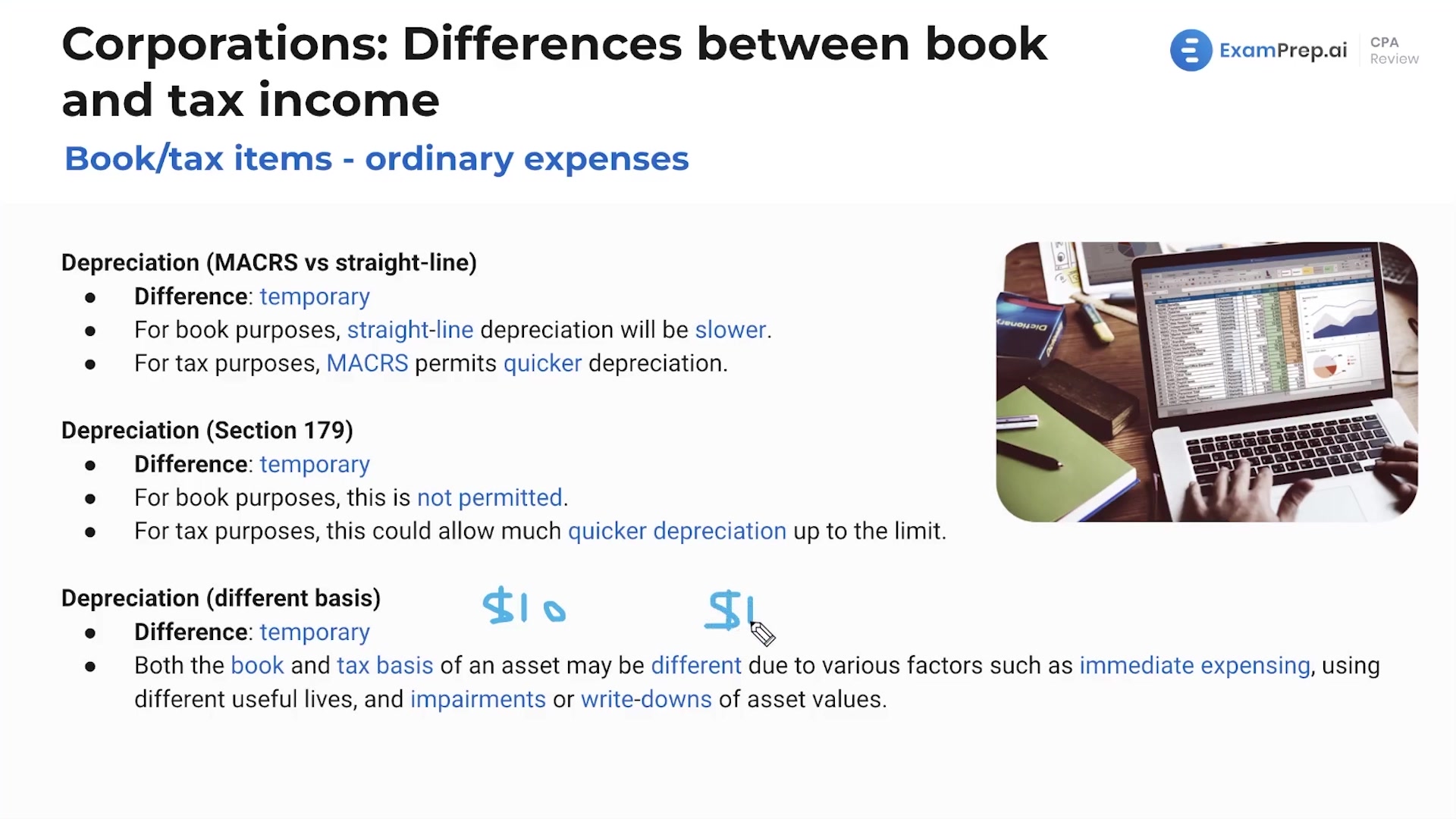

In this lesson, explore the nuances of ordinary expenses with Nick Palazzolo, CPA, as the focus is on differentiating between book and tax treatments. Nick demystifies how certain costs such as amortization of startup and organizational expenses, bad debt, and charitable contributions can yield temporary or permanent differences in financial reporting. He delves into the specifics of methods for bad debt expenses, limitations on tax deductions for charitable giving, and the contrasting approaches to depreciation for book purposes versus tax purposes. Furthermore, Nick sheds light on other significant topics like franchise fees, Goodwill, meals, officer compensation, and state taxes, emphasizing the implications each has on taxable income and how they might play out in exam scenarios – highlighting areas to watch out for to avoid common pitfalls.

This video and the rest on this topic are available with any paid plan.

See Pricing