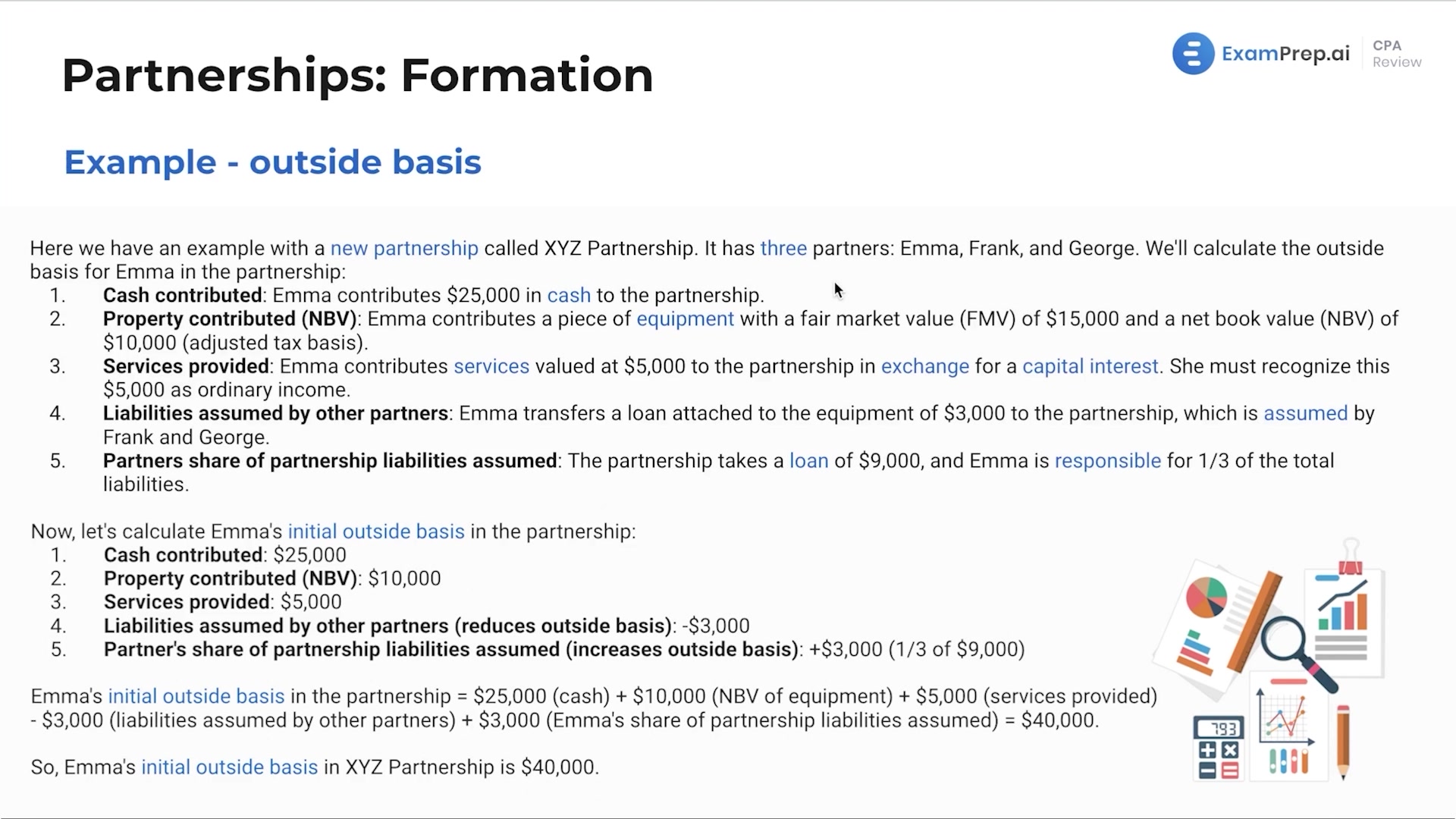

In this lesson, break down the intricacies of outside and inside basis in the context of partnership taxation. Nick Palazzolo, CPA, clarifies these complex concepts by differentiating between a partner's tax basis in their partnership interest (outside basis) and a partnership's tax basis in its assets (inside basis). With practical examples and formula breakdowns, this explanation sheds light on the calculations for initial outside basis for a partner and inside basis for a partnership. Nick's candid approach simplifies the impacts of capital contributions, distributions, and shared liabilities on the basis calculations and helps demystify the tax implications for various partnership transactions. Using the XYZ partnership example, this lesson effectively demonstrates how to calculate a partner's initial outside basis and the partnership's inside basis, considering all contributing factors including cash, equipment, services, and liabilities.

This video and the rest on this topic are available with any paid plan.

See Pricing