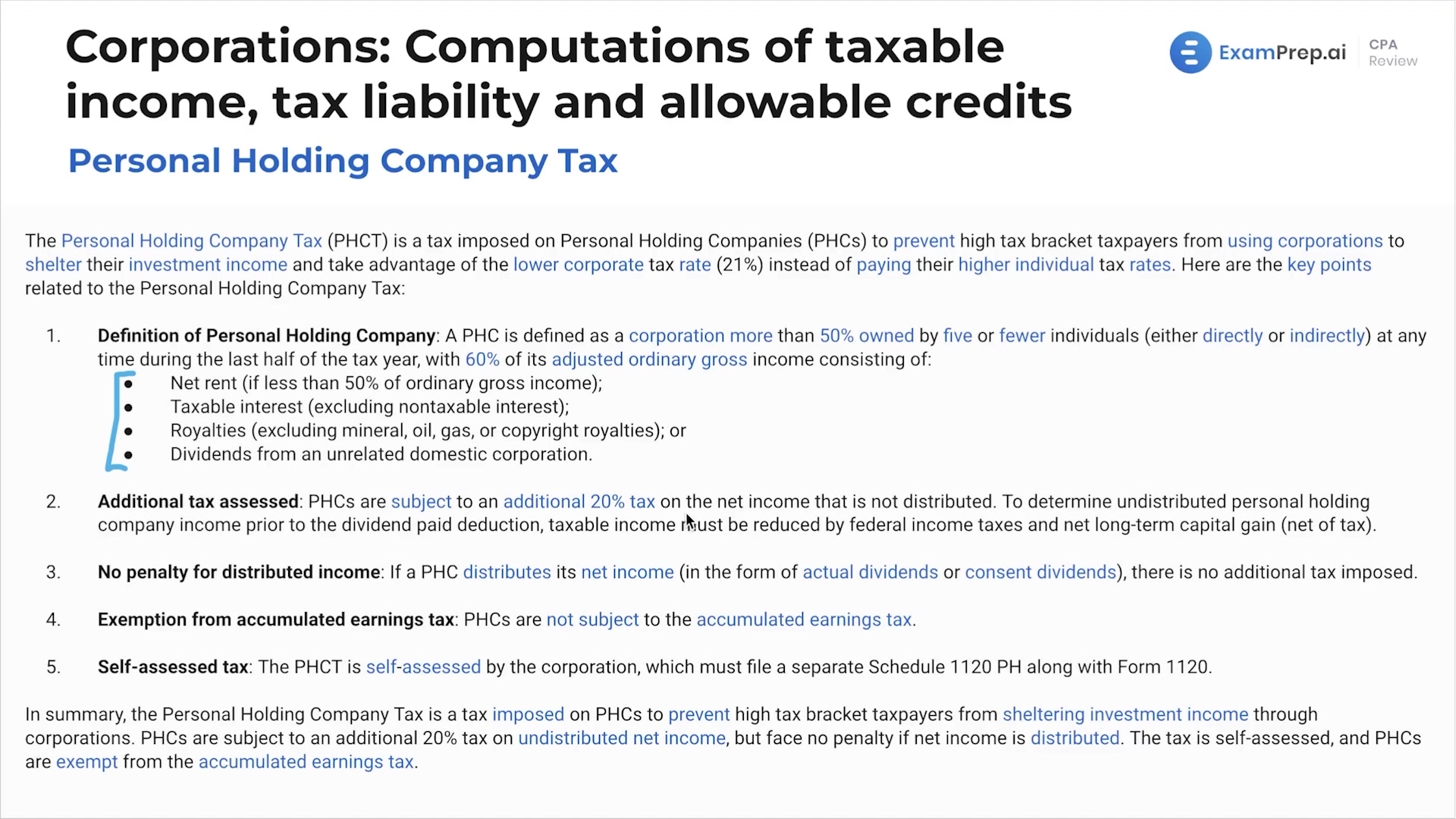

In this lesson, delve into the intricacies of the personal holding company (PHC) tax with Nick Palazzolo, CPA, who lays out the framework for understanding how the IRS regulates shell companies designed to shelter investment income. Nick breaks down the definition of a PHC, illustrating the ownership and income criteria that bring a corporation under this designation. He articulately explains how the tax is applied, including the additional 20% tax on undistributed net income and the exceptions that exist. Using practical examples, Nick expounds on how actual and consent dividends affect the tax calculation, and the implications for businesses with regard to the accumulated earnings tax. With relatable examples, this lesson makes navigating the complexities of PHC tax more approachable, clearly explaining the steps corporations might take to comply with or strategize around these tax regulations.

This video and the rest on this topic are available with any paid plan.

See Pricing