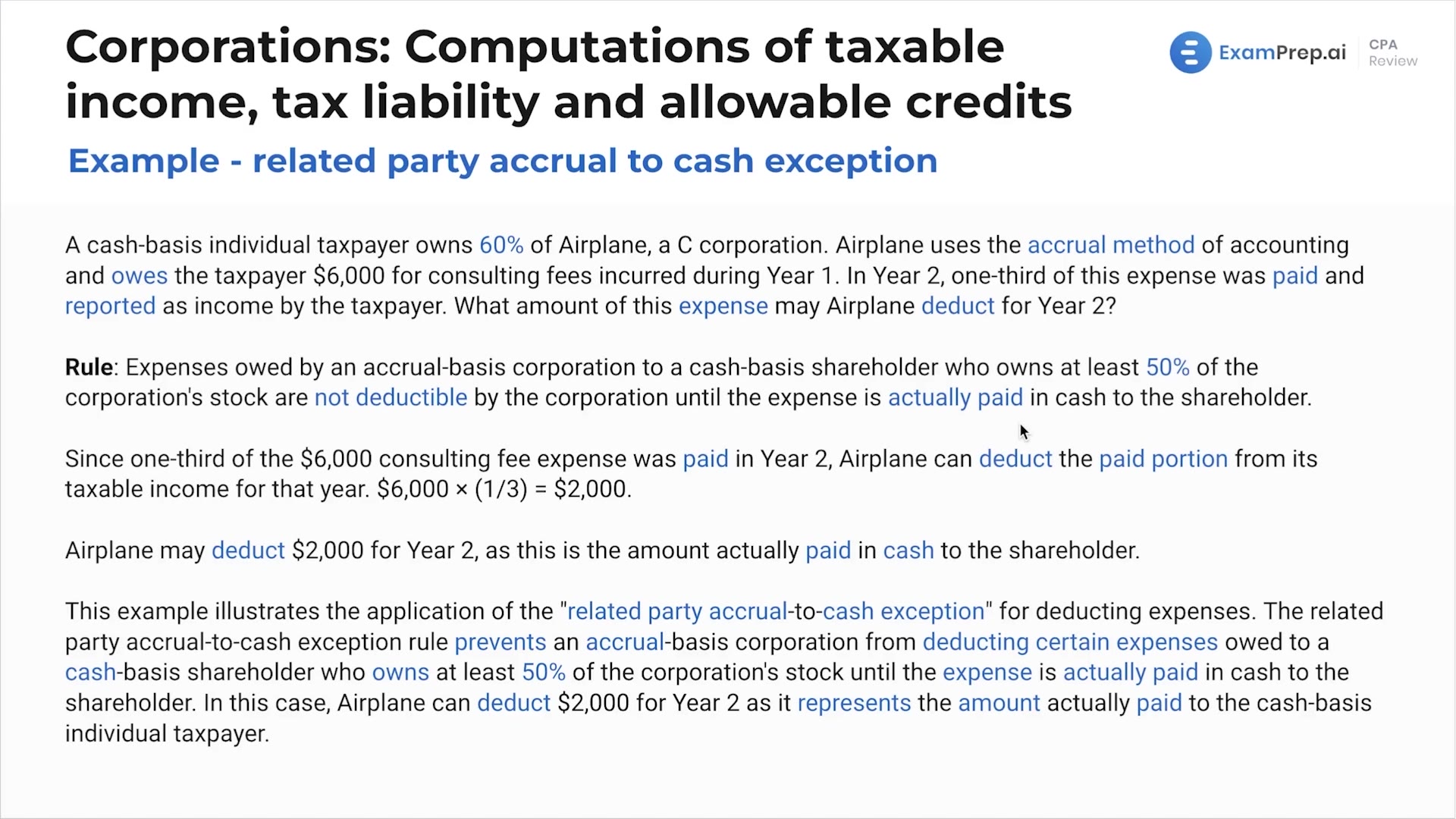

In this lesson, Nick Palazzolo, CPA, takes you through the specifics of the related party accrual to cash exception, using a practical example to illustrate the concept. He expertly navigates the circumstances under which an accrual basis corporation can deduct expenses owed to a related cash basis shareholder. Nick breaks down the rules and provides the rationale to prevent tax manipulation between related entities. Using a clear example involving a consulting fee transaction, he shows how to calculate the deductible amount for the corporation, ensuring an understandable transition from theory to real-world application. Dive into this lesson to gain clarity on how and when a corporation can claim deductions under this special exception.

This video and the rest on this topic are available with any paid plan.

See Pricing