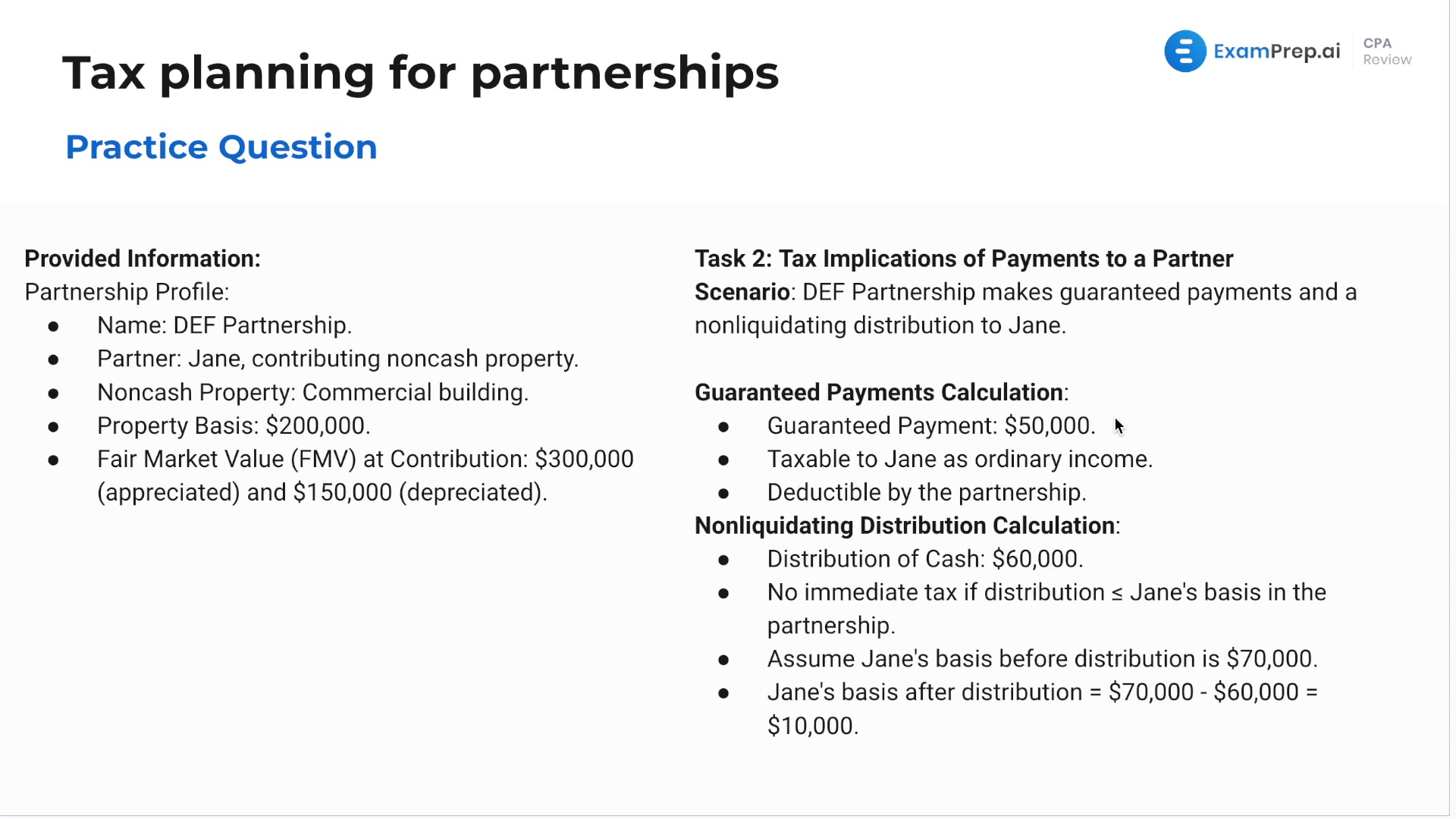

Tax Planning for Partnerships involves strategizing to optimize the tax obligations of entities structured as partnerships by leveraging various tax laws and provisions. This includes considering the timing of income recognition, the allocation of taxable income and deductions among partners, and the selection of accounting methods that align with the partnership's business objectives while maintaining compliance with tax regulations.

This video and the rest on this topic are available with any paid plan.

See Pricing